Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 1 Apr, 2022

By Steve Piper

Natural gas and coal prices escalated during 2H 2021

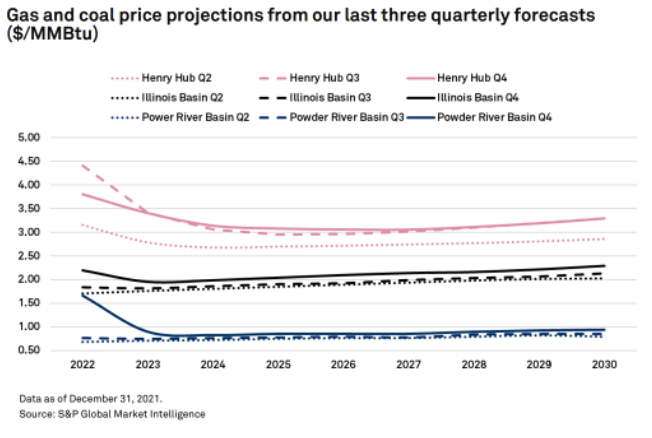

The energy market turmoil in the EU has translated to U.S. domestic markets in terms of increased LNG demand and stronger export coal pricing. The impact is well-illustrated by the difference observed across our last three quarterly projections. We expect natural gas prices to be 14% higher in the midterm as we compare our Q2 against Q4 forecasts. For coal prices, our midterm projections for Powder River Basin and Illinois Basin are expected to be 8% higher as we compare our Q3 against Q4 forecasts.

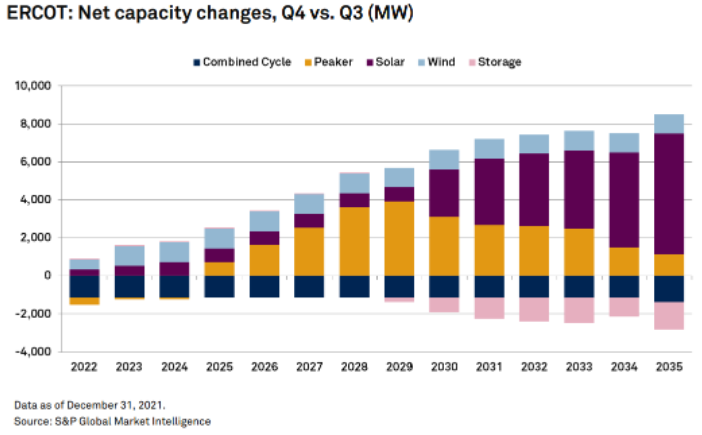

Higher fossil prices stoke green energy build

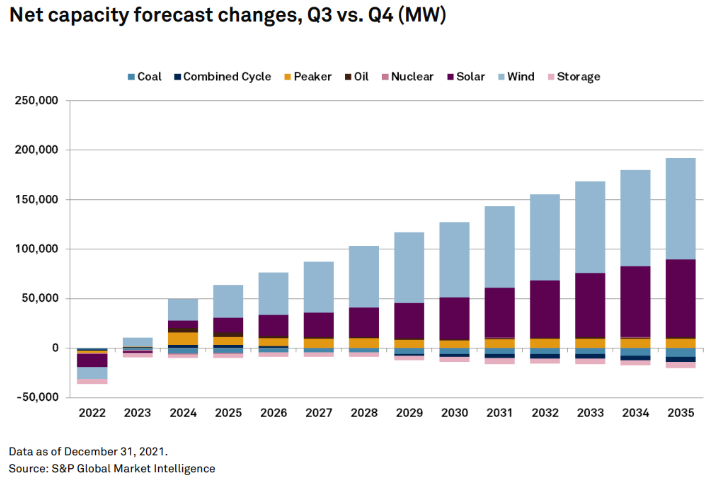

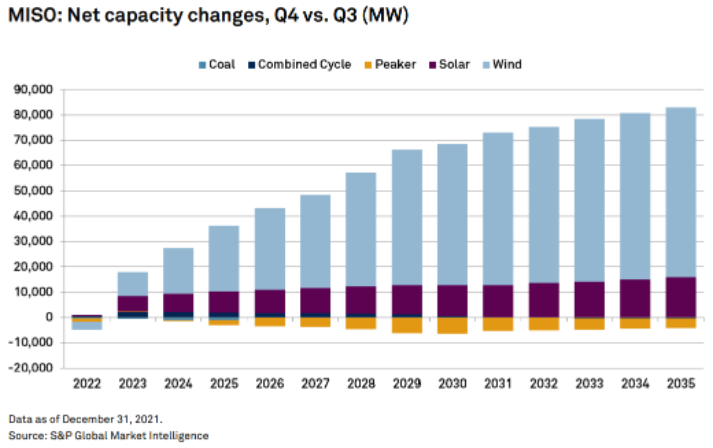

Driven by higher fossil prices, our Q4'21 forecast has increased wind and solar capacity projections since our Q3'21 forecast. We project an increase of 102 GW wind capacity by 2035, mainly in MISO and WECC. Similarly, solar capacity is projected to increase 78 GW by 2035 and is evenly distributed across the US markets. On the other hand, the battery storage outlook has slightly been reduced by 6 GW. The modeled impact of higher fossil prices reduces off/on-peak arbitrage in some markets where renewables have not penetrated substantially and undercuts a small portion of battery storage build.

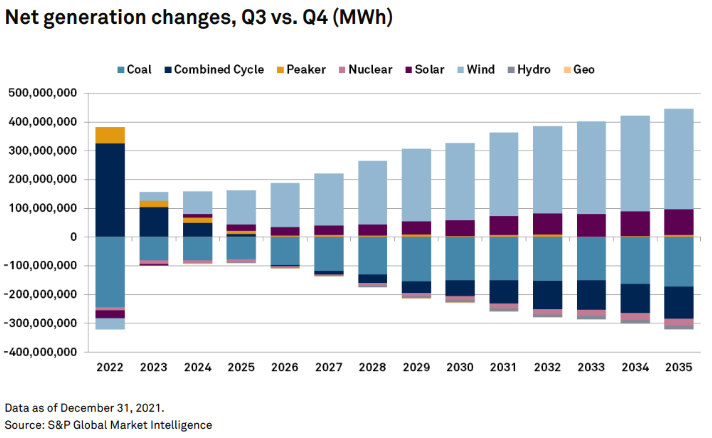

Fossil generation displaced, but not necessarily retired

Higher coal prices in Q4 have reversed our gas-tocoal generation forecast for 2022. Natural gas price is expected to perform better and coal price will start to decline. By 2025, both baseload coal and gas are expected to be displaced by expanding wind and solar generation.

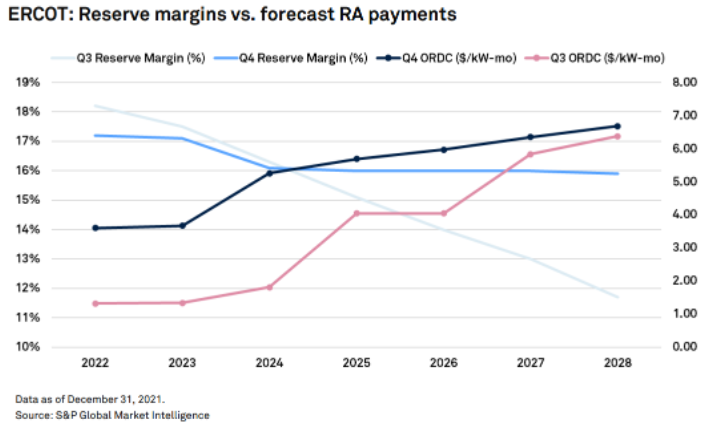

ERCOT – Scarcity changes drive a more constructive outlook

Public Utilities Commission of Texas (PUCT) reduced operating reserve demand curve system-wide maximum price from $9,000/MWh to $5,000/MWh in H2'21. The increase in the operating reserve offsets the reduction as the maximum price which puts into effect rose from 2,000MW to 3,000MW and intensifies the frequency of triggering maximum price hours. As such, our Q3 vs. Q4 projection on peaker net margin increased from 12% to 16%. Correspondingly, the forecast payments from Operating Reserve Demand Curve (ORDC) will increase. As we advance, we expect the higher reserve levels to be beneficial to ERCOT's resource adequacy.

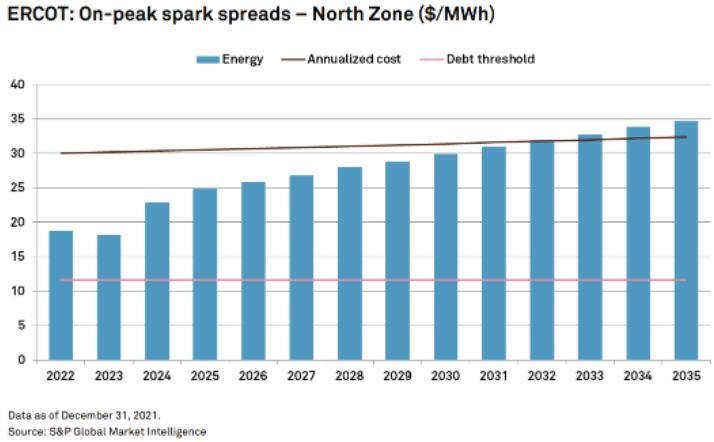

Higher natural gas prices positive for merchant cash flow

Merchants are expected to generate sufficient cash flow to service debt as outright spark spreads improved slightly on an average annual basis in our Q4 forecast. The richer scarcity curve is expected to deliver subpar returns until after the 2030s. Solar capacity additions from late 2020 may be tapering off in the first half of 2021 as the market digests the sheer amount of solar. The battery storage market with huge interconnection queues could be the next wildcard. If a fraction of that battery storage development moves forward, it could dampen the outlook for ORDC payments.

Peaking fossil and green generation get economic boost

ERCOT gas combustion turbines and green generation had an economic boost in our Q4 forecast. The continuing solar build-out during 2021 prominently defers about a gigawatt of combined cycle that we previously expected. The boost in favor of gas peaking and improvement in peaker net margins defer the economic case for battery storage. While we have a fairly conservative view of storage in this market, the storage queue exceeded 40GW. If solar penetration continues to grow, storage can grow as well.

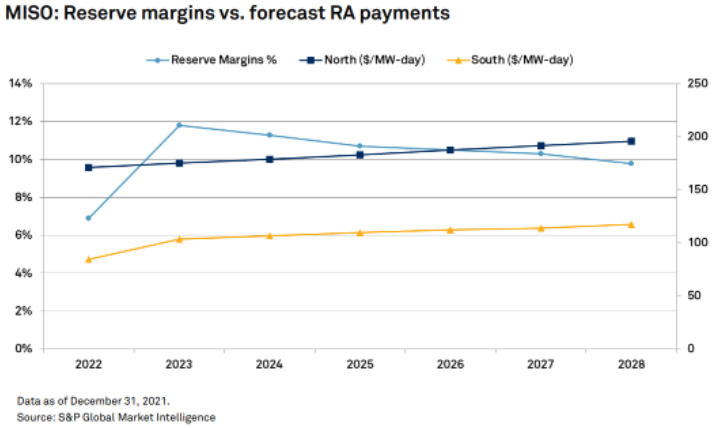

Midwest ISO (MISO) – Tight reserve margins appear imminent

Our MISO forecasts suggest that capacity pricing will move to market-clearing levels as early as the summer of 2022. MISO North zones are retiring coal faster than the ramp-up of green resources. There is a limited transfer capability from south to north to backfill reserve shortages. Our forecast for capacity pricing reflects revenue requirements for new regulated peaking capacity and suggests that utility surpluses need to wane and create more supportive pricing in MISO. The queue for storage and solar hybrid market exceeds 12GW; suggests an opportunity to serve those markets.

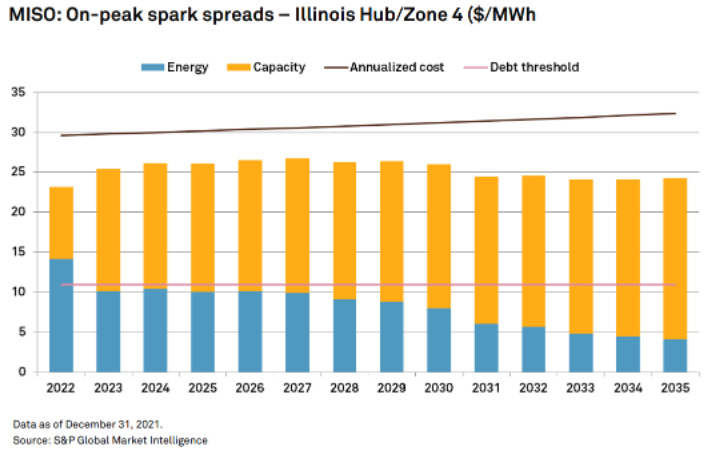

Higher natural gas prices positive for merchant cash flow

The higher natural gas prices will enhance MISO merchants' cash flow and debt-serving ability as outright spark spreads increase. The green expansion in MISO North zones will cause a rapid decline in spark spreads over time. This change is motivated by the updated Illinois RPS, which should start in the Midwest's medium to long-term wind and solar markets. The Michigan RPS will also contribute additional wind capacity to MISO. Wind energy will become economically viable on a stand-alone basis as fossil prices appreciate in the Midwest coal and Western Coal Powder River Basin.

Elevated coal and gas prices unleashes a flood of new wind

Our forecast indicates how structurally higher coal and gas could drive a new wave of wind investments. Illinois' Renewable Portfolio Standard (RPS) accounts for roughly a third of our forecast activity, with surplus generation mainly moving east to displace coal and gas generation in PJM. The State of Louisiana is also starting to explore offshore wind leases to potentially ramp up that renewables market. Please note that the anecdotal reports of higher capital costs for wind and solar are not factored into this release.

Learn how we can help quantify the value of energy transition with our analysis on the US power markets outlook and electricity prices forecasts. Request a demo here.

Like our Energy content? Subscribe to receive our latest research insights.

Research

Webinar