Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 Apr, 2021

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence’s TMT offering.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

Limited movement brought about by the COVID-19 pandemic propelled e-wallet adoption to greater heights in 2020, bringing Southeast Asia's underbanked population a step closer to financial inclusion. Convenience and safety through online transactions, coupled with bonus cashback and multiple top-up options, have positioned e-wallets favorably for recurring monthly payments such as multichannel and broadband services.

Users making online transactions rose in 2020 when physical contact was discouraged due to the pandemic. In the Philippines, both bank and non-bank e-money issuers saw about 4.1 million new digital account sign-ups from March 17 to April 30, 2020, during the height of stringent lockdown measures in the country. As of September 2020, there were 37.5 million e-money accounts in the Philippines, up by 28% from 29.4 million at year-end 2019.

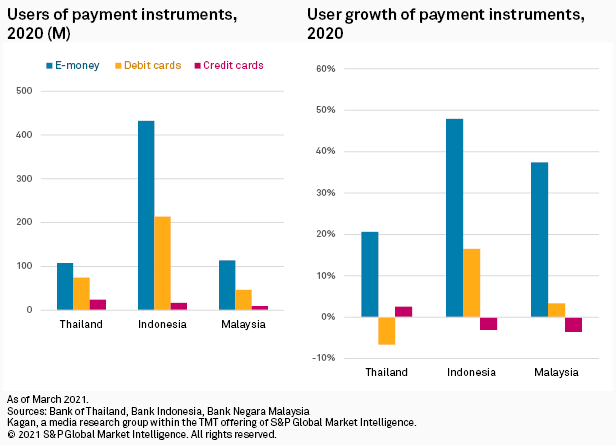

In 2020, there were more e-money accounts than credit and debit cards combined in Thailand, Malaysia and Indonesia. While e-money accounts experienced double-digit user growth across the three markets, debit cards contracted by 6.7% in Thailand, and credit cards saw a 3.1% and 3.5% decline in Indonesia and Malaysia, respectively.

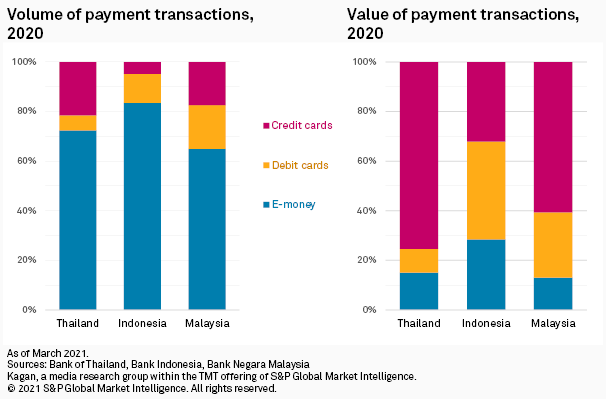

Among the three payment instruments, about 65% to 85% of transactions in Thailand, Indonesia and Malaysia were e-money transactions in 2020. Despite the bulk of transactions gravitating toward the use of e-money, users still made larger payments using their credit and debit cards. This could mean that users rely on e-money for more frequent but smaller purchases, while credit and debit cardholders reserve their cards for bigger spending.

The e-money landscape in Singapore follows the same trend. As of June 2020, the Monetary Authority of Singapore, or MAS, recorded 1.06 billion payments via e-money transactions versus 549 million credit and debit card transactions combined. The amount spent using card instruments, however, reached S$42.54 billion versus S$912 million from e-money transactions.

While there is extensive adoption of e-money in Southeast Asia, other payment methods are still widely used. Singapore had 5.5 million principal cardholders and 1.1 million supplementary cardholders as of December 2020, according to MAS. The combined number of cardholders exceeds Singapore's estimated population of 5.7 million.

In Thailand, interbank and in-house funds transfer remains the most-used payment method among online payments. Data from the Bank of Thailand showed that interbank and in-house funds transfer accounted for about 73% of total e-payment transactions in 2020, while payments via e-money only accounted for 16%, followed by card payments at 6%.

Southeast Asia unicorns with regional e-wallet services

Five Southeast Asian unicorns with regional presence in ride-hailing, e-commerce and gaming went beyond their initial business functions and introduced e-wallet features to their services. Shopee Ltd., Lazada South East Asia Pte. Ltd., GrabTaxi Holdings Pte. Ltd. and PT Aplikasi Karya Anak Bangsa, better known as Gojek, integrated e-wallets within their respective apps, while Razer Pay — owned by technology company Razer Inc. — and AirPay launched as stand-alone apps. E-commerce businesses greatly benefitted from the surge of online shopping during the pandemic, while ride-hailing services shifted focus to food deliveries.

Multichannel and broadband payments through e-wallets

Home to diversified economies, Southeast Asia is becoming the breeding ground of emerging financial technologies catering to various customer needs. Local non-bank e-wallets are not only providing intense competition to regional tech companies but have also expanded their features to facilitate bill payments and prepaid top-ups for leading multichannel and broadband providers. Most non-bank e-wallets only require a mobile number and proof of identification to sign up, making e-wallets accessible to a majority of the population.

Global Multichannel is a service of Kagan, a group within S&P Global Market Intelligence's TMT offering. Clients may access the full article along with the list of e-wallets that support multichannel and broadband payments in Southeast Asia by clicking here.