S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Jul, 2024

This paper builds on our previous analysis on the transshipment of Western-made components to Russia to further establish trade dependencies between different markets with Russia and deliver a case study on shipment data relating to Turkey. The common high-priority items (CHPIs) list will be mapped to reported statistical/customs data, as well as the bill of lading data, for a statistical analysis.

Analysis

Evolution

Although statistical trade data has not been released by the Federal Customs Service of Russia since the start of the war (last series to be published was January 2022), mirror trade can be used to gain an idea of Russia trade dependency in the last two years.

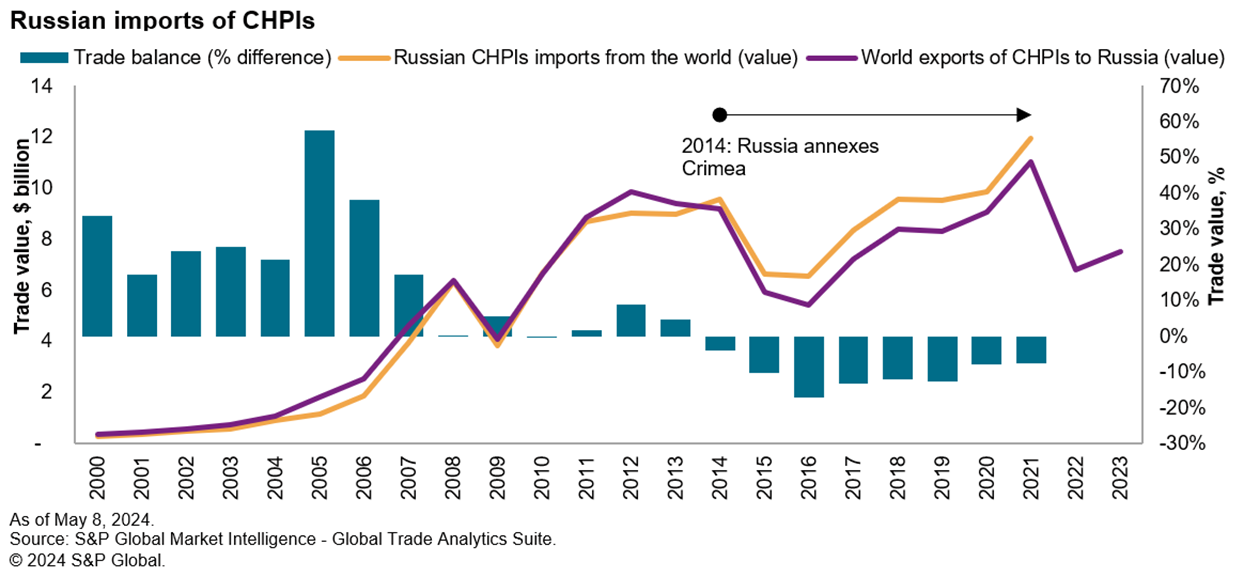

Trade of CHPIs has increased considerably over the years, often with visible ramp-up periods prior to periods of military conflict, such as prior to the annexation of Crimea in 2014 and subsequently in the years leading up to the invasion of Ukraine in 2022.

Comparing imports to exports show that these are fairly in line in terms of trade balance. Data up until 2014 show exports declarations of CHPIs being marginally similar in terms of growth/decline, as well as some visible differences in terms of import/export trade balance, with Russian import figures showing a surplus in contrast to the deficit of reported available export/reexport data to Russia.

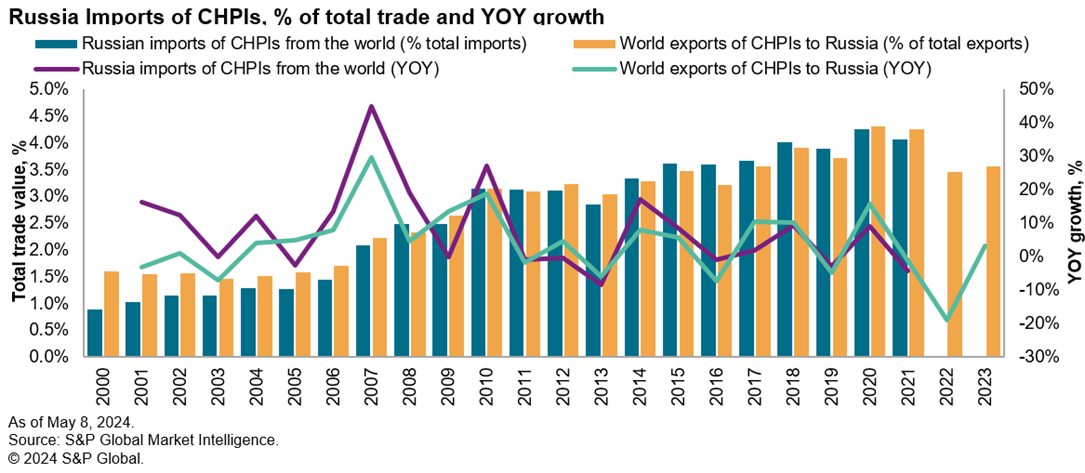

The share of CHPIs in contrast to total trade also fundamentally changed over the years, up 8% year over year between 2000 and 2021, while exports/reexports to Russia grew 5% year over year, with year-over-year evolution also appearing to go through 3-4-year cycles of growth and decline, visible on both reported trade and mirror trade.

Reviewing the available periods prior to the war showed the ramp-up in import of critical items for military equipment, with trade value up 21% in 2021 compared with 2020 and accounted for 4.3% of total trade imported by Russia during that year. Meanwhile, mirror trade for 2022 sharply declined 38% and accounted for 3.5% of total imports, followed by a slight increase of 10% in 2023.

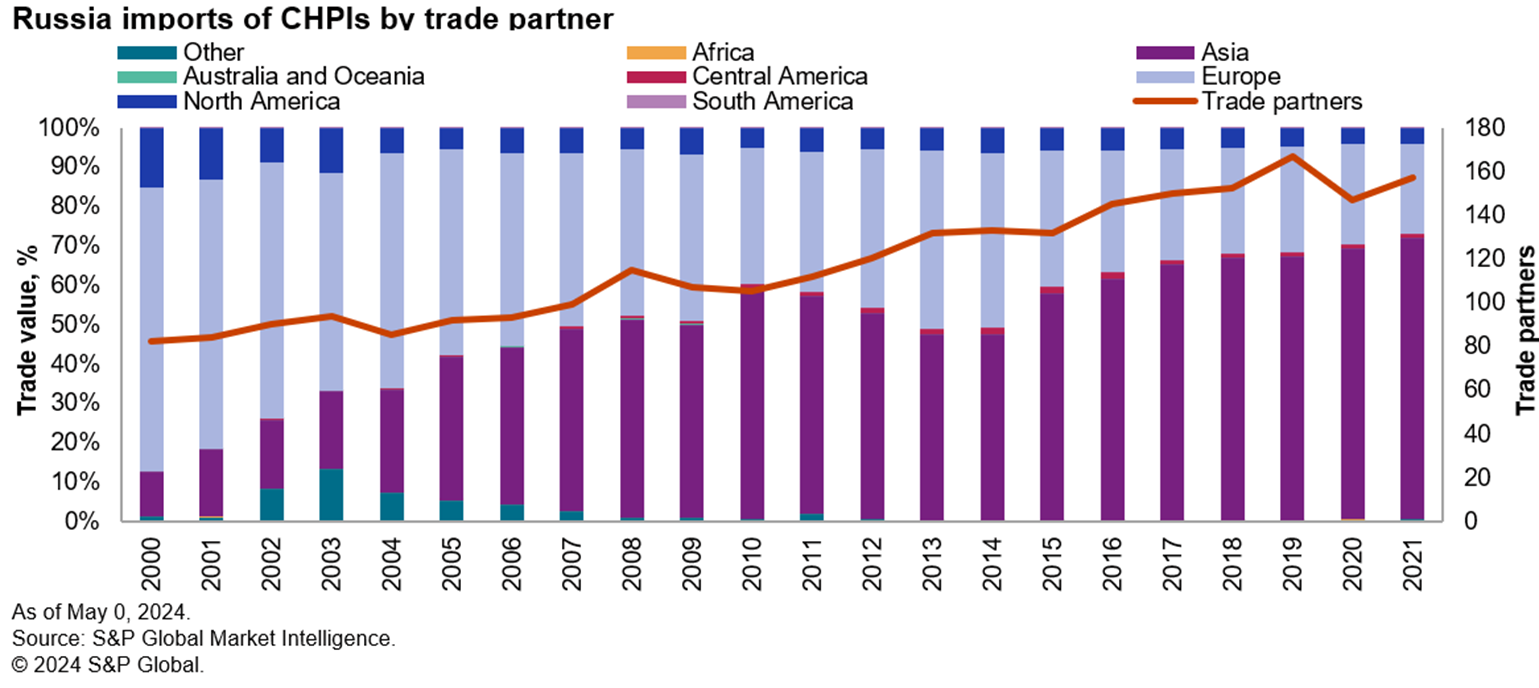

Dependency and origin

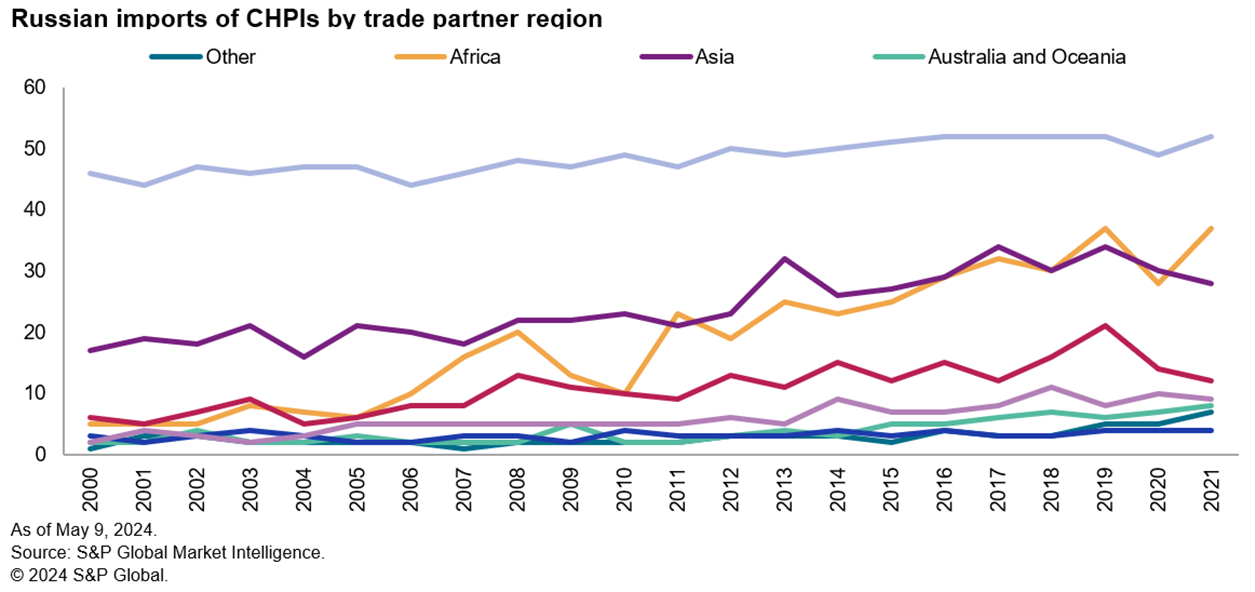

Having established that there has been considerable growth activity in CHPIs in recent years, it is interesting to see how the number of partners contrasts in comparison to this evolution. Imports data since 2000 shows a steady increase in the number of partners that Russia is sourcing from — 82 in 2000, 112 in 2010 and 147 in 2020. This diversification in imports shows shifts from dependencies in Europe to those in Asia. In 2000, 73% of imports of CHPIs originated from Europe and 12% from Asia, but in 2020, 68% of imports came from Asia and 26% from Europe in 2020.

This 91% increase (as shown in the figure above) in unique trade partners during the 20-year period show that the majority of the growth stem from Asia, Africa and Central America. Although some of these partners only represent smaller percentages in the market share, this shows evolution in trade outside of "traditional" partners. Imports from Africa, for instance, which only accounted for 0.01 and five partners in 2000, have grown considerably to account for 0.22% and 37 partners in 2021.

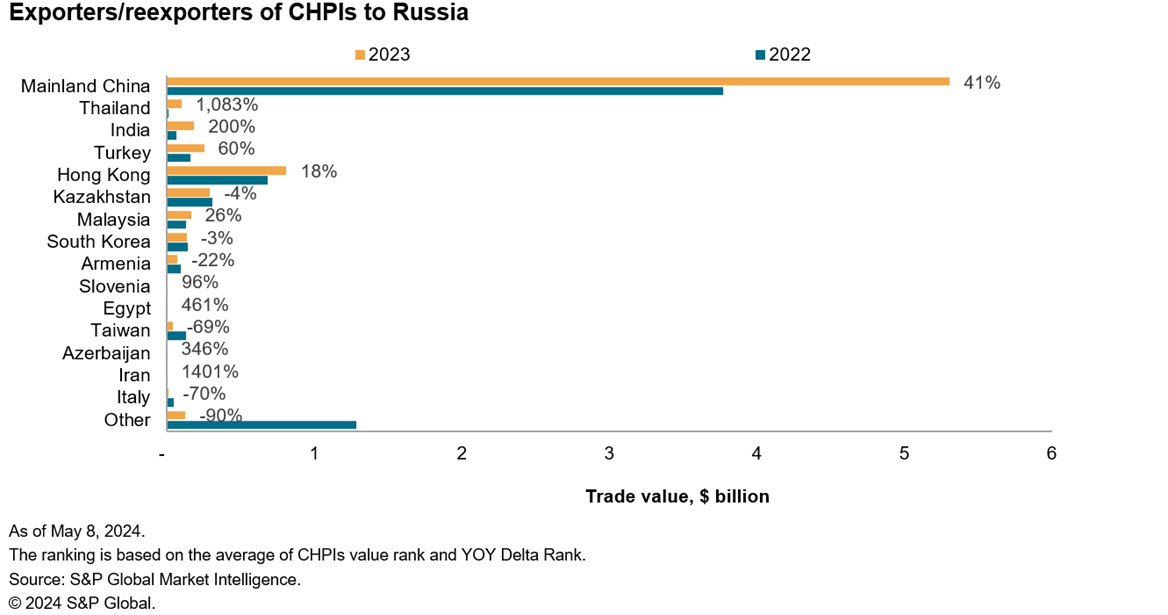

Through mirror reporting, we can better establish some of the trade activities undertaken in the last two years with Russia, highlighting the continuing dependence on mainland China and Hong Kong; trade with mainland China increased 41% during 2022, while trade with Hong Kong was up 18% during the same period. When ranked by year-over-year growth and market share, the three markets that showed considerable export/reexport activity to Russia were Thailand (up 1,083%), India (up 200% and Turkey (up 60%), whereas Kazakhstan's export/reexport to Russia dipped 4%. These six markets accounted for 66% of reported CHPIs export/reexport to Russia in 2023, but now account for 92%.

Click here to download the full complimentary paper where we provide:

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter for the latest insight and opinion on trends shaping the compliance and shipping industry from trusted experts.

BLOG

WHITEPAPER