Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Jun, 2024

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Many traditional loans demand interest repayments one month after the debt has been issued. This is not convenient for companies that face liquidity issues, because they would have almost no time to generate a return on invested funds before a payment has to be made.

With interest rates remaining higher for longer, and amidst a continuing tug-of-war between liquid and illiquid credit markets, payment-in-kind (PIK) interest toggles have become an increasingly prevalent feature of private market loans both in the United States and Europe. [1] This financial arrangement enables borrowers to add accrued interest to a loan’s outstanding balance, effectively increasing the amount that must be repaid at the end of the term. However, this generally comes with a cost premium designed to compensate the lender for no or low amortization, plus the evolving credit risk profile of the borrower over the lifetime of the loan.

Some market commentators have argued that the growing use of PIK represents systemic stress, and that healthy companies should be able to service their debt without interest holidays. Conversely, financial sponsors and private credit lenders that are proponents of such features, see it as a prudent liability management tool that offers borrowers flexibility to ride-out tumultuous periods and navigate sudden base rate changes, whilst continuing along the path of value creation. In the following, we look at a distressed company, and model different scenarios to show how accessing a PIK interest loan may impact creditworthiness through time.

Company A is focusing on owning, developing, and operating midstream energy infrastructure in the United States. It provides natural gas gathering, compression, treating, and processing services, as well as crude oil and produced water gathering and freshwater delivery services. [2]

Over the past 5 years, Company A’s creditworthiness has been quite volatile, due to several distressed exchanges that prompted S&P Global Ratings to downgrade to selective default (SD) and subsequent refinancing activities aimed at repairing its weak balance sheet. [3] The latest refinancing was launched on October 13, 2021, when the company issued a senior secured corporate debenture with a nominal amount of $700 million and an annual coupon of 8.5% maturing in 2026. As a result of this, Company A emerged from default and received from S&P Global Ratings an issuer credit rating of B that it has maintained until today. [4]

Had the company turned to private credit markets and obtained a $700m loan with PIK floating-rate interest, how might its credit risk evolution have differed?

To perform this analysis, we leverage S&P Global Market Intelligence’s Credit Analytics tools and models. The desktop platform includes a quantitative model, RiskGauge™, that combines financial, business and market risk drivers to generate a credit score with optimal accuracy for millions of publicly-listed and privately-held companies, globally, since 2016.[5]

In the following, we leverage the “scoring on-the-fly” capability that enables a user to analyze the credit risk implications of different financial performance scenarios. We restate Company A’s financials in the 2021 – 2023 year-end statements, replacing the debenture with a $700m loan with PIK floating-rate interest. Additional debt issued by the company remains unchanged when restating the financials, and we assume that the hypothetical private credit facility utilises its PIK toggle from issuance and until maturity. We use S&P Global Market Intelligence’s Corporate Yield Curves to estimate the interest rate charged on the loan within this period, adding 300 bps to proxy an illiquidity plus flexibility premium that would be charged by a private lender. [6] We then project the company financials and calculate the credit score change for future years under two scenarios:

S&P Global Market Intelligence’s Economic and Country Risk (ECR) baseline scenario:[6] it assumes growth prospects in North America weaken markedly during 2024 and keep hovering around 1.6% for next years, whilst the base interest rate decreases by 115 bps from 2025 onwards. We adjust the floating interest rate of the loan for future years, assuming a constant shift for all credit scores and within each future year, for the sake of simplicity. We project remaining financials based on the scenario’s gross GDP growth and run them via RiskGauge Desktop.

The Network for Greening the Financial System’s (NGFS) Net Zero 2050 scenario:[7] it assumes an orderly and ambitious energy-transition to reach net zero emissions by 2050, whilst limiting global warming to 1.5°C above pre-industrial levels. In this instance, we leverage S&P Global Market Intelligence’s Climate Credit Analytics to project company financials and assess the credit risk impact up to the end of 2026, to align with the maturity of the hypothetical $700m PIK interest loan.[8]

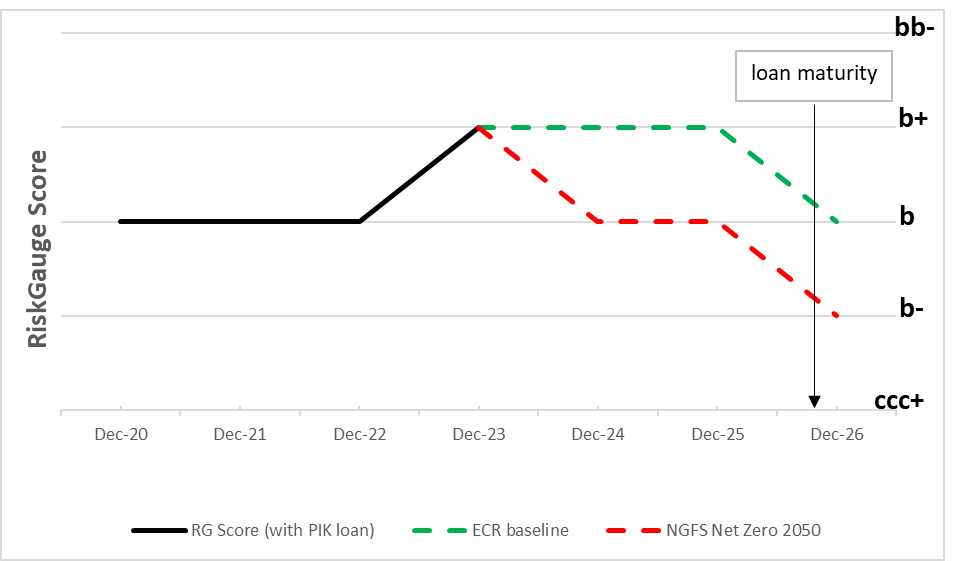

Figure 1 summarizes our findings. The PIK nature of the interest would have made Company A’s refinancing more expensive but enabled it to enjoy more business flexibility and stronger resilience, and – as a result – to improve its overall creditworthiness profile in 2023, as measured by RiskGauge. However, things could turn differently in following years.

In fact, this analysis highlights the importance of running multiple scenarios to understand the financial and credit risk implications on the borrower side in future years, as well as the viability and soundness of the investment opportunity over the loan’s lifetime from the underwriters’ perspective.

Figure 1: RiskGauge score evolution for Company A with a hypothetical $700m PIK Interest loan, under two scenarios.

Source: S&P Global Market Intelligence. For illustrative purposes only (as of May 1st,, 2024).ECR stands for the Economic and Country Risk baseline macro-economic scenario, and NGFS stands for the Network for Greening the Financial System

To conclude, in the right economic circumstances, it makes sense to allow a borrower to take a break from paying down liabilities and to focus on business stability and funding growth. With the realization of a bullish credit story, an obligor can then comfortably refinance and pay down the accumulated and compounded interest they have accrued. Conversely, if the macro-economic conditions deteriorate markedly or market dynamics such as carbon taxation evolve along a net zero pathway, this could place strain on the cost and indeed likelihood of said refinancing. In the absence of significant growth outperformance, the entity may then be unable to make balloon repayment and may default on its debt obligation.

We believe the importance of private credit is set to grow (as an efficient and flexible financing alternative to the traditional banking world) and that it can play a role in sustaining the energy-transition to a greener economy in coming years. If you wish to know more about S&P Global Market Intelligence’s analytical tools, including RiskGauge Desktop, Corporate Yield Curves, ECR macro-economic scenarios, or the Climate Credit Analytics suite of models, click here.

[1] “Private Markets Monthly, December 2023: The Outlook For 2024, According To Eight Experts On Private Markets”, Ruth Yang, S&P Global Ratings (December 18th, 2023).

[2] Source: S&P Capital IQ Platform (as of May 2024).

[3] Source: “Summit Midstream Partners L.P. Rating Lowered To 'SD' From 'CC' On Closing Of Preferred Equity Distressed Exchange”, S&P Global Ratings (April 15th,2021).

[4] Source: Summit Midstream Partners L.P. Upgraded To 'B' From 'SD' On Refinancing, Outlook Stable; New Secured Notes Rated 'BB-', S&P Global Ratings (October 13th, 2021).

[5] Source: S&P Global Market Intelligence (as of May 2024).

[6] Source: S&P Global Market Intelligence, “Economic and country risk macro-economic baseline scenario” (as of December 2023).

[7] We adopt the REMIND v3 scenario. Source: “Climate Scenarios for Central Banks and Supervisors”, Network For Greening the Financial System (June 9th, 2022).

[8] Climate Credit Analytics is a suite of industry-specific models that projects firm full financial statements and credit risk score over pre-defined and user-defined climate-related scenarios. It was developed and keeps evolving in a collaboration between S&P Global Market Intelligence and Oliver Wyman™.