S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 Apr, 2021

By Inna Popesku

Impairment under IFRS 9 is calculated on an expected, rather than incurred, loss basis. Expected Credit Loss (ECL) is a forward-looking measure and is influenced by a variety of factors, including the credit rating of an issuer and macroeconomic conditions.

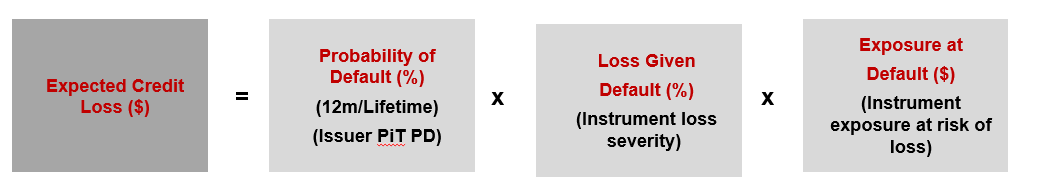

We believe that a sound approach should follow the traditional method of estimating ECL from its base components:

Macroeconomic factors will have an impact on each step of this process. Regional specific considerations include but are not limited to level of (local) regulatory endorsement, Internal capabilities, portfolio characteristics and availability of default data. The spot light falls on availability of historical systematic and macroeconomic data and reliable forecasts for systematic and macroeconomic data. Hence, approach in ECL calculations should take into account the regional considerations and macroeconomic forecast for Latin American and Caribbean Market. In this blog we will look at the key elements to keep in mind when assessing the impact of macroeconomic factors on ECL provisioning calculations.

How can you reflect it as part of the ECL provisioning calculations?

Probability of Default Component

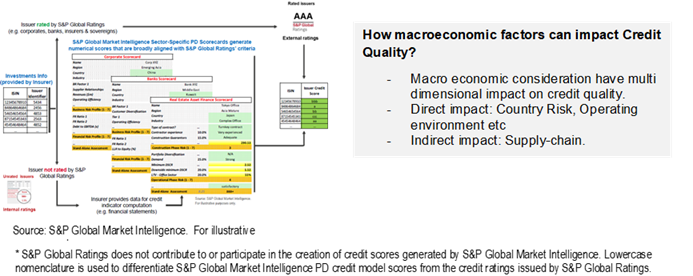

When it comes to the unrated universe there are various options that you can pursue. At S&P Global Market Intelligence we have designed S&P Global Market Intelligence Credit Assessment Scorecards to capture not only the sector specific considerations but also the impact of macroeconomic factors on the credit quality estimates. The credit quality estimates are than mapped to the Through The Cycle PDs.

Point in Time PD

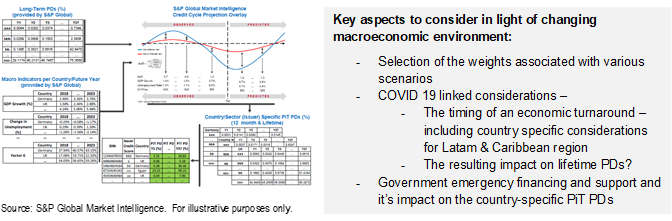

This TTC PD is subsequently adjusted to a Point in Time (PiT) PDs. S&P Global Market Intelligence we have designed our Credit Cycle Projection Overlay to uses macroeconomic and market data, which are country and sector-specific in order to convert from TTC to PIT basis. When considering how macroeconomic factors can impact PiT PD and which elements to consider you should not only consider macroeconomic aspects such as GDP growth, Unemployment rate, Change in Oil prices, Geopolitical tensions – both regional vs global – but also take into account reliability of macroeconomic forecast

Loss Given Default Component

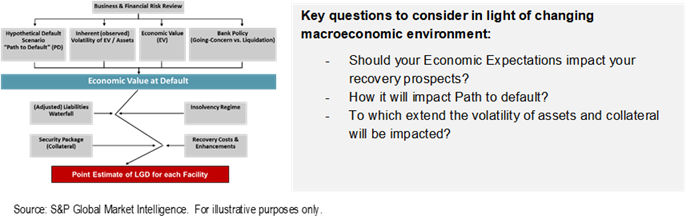

LGD estimation is considered more difficult than the estimation of PD. Many institutions struggle with developing sound methodologies, with most settling on the use of average historical losses as indicators of future expected losses. This simplified approach is not well suited for IFRS 9 purposes as averages, by definition, are not PIT nor supported by empirical evidence. S&P Global Market Intelligence Loss-Given Default (LGD) model allows to following the process of recovery to obtain instrument specific LGD while taking into not only Economic Value at default, Insolvency regime, position in the debt waterfall and recovery package but also reflect economic expectations regarding sector-specific volatiles of Economic Value as part of this process.

Active monitoring of the portfolio including the impact of macroeconomic factors pertinent Latin American and Caribbean Market is the key to accurate IFRS 9 provisioning. Macroeconomic factors will impact from one side Expected Credit Loss equation i.e. Probability of Default and Loss Given Default but also Staging classification. Therefore, when considering a solution for IFRS 9 purposes it is crucial to consider regional specific considerations.

Solution