Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 3 May, 2022

By Sarah Cottle

Today is Tuesday, May 3, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we examine the challenges confronting banks in Europe. As the war in Ukraine drags on, European lenders operating in Russia must either make a hurried and potentially costly exit or stay put and deal with international sanctions and reputational risks. In France, the re-election of President Emmanuel Macron offers a brief respite to lenders, which are facing up to a deteriorating outlook as the war impacts revenues and asset quality. Elsewhere, major Nordic banks aim to press ahead with efforts to reduce exposure to the oil and gas sector even as Norway ramps up fossil fuel production.

Japan's IPO market may see a further slowdown in the second quarter and beyond after market volatility and inflation forced seven companies to shelve proposed listings in February and March, analysts said. Seven of the 10 largest debuts in the first quarter were trading below their IPO prices as of mid-April, according to S&P Global Market Intelligence data.

Russia's invasion of Ukraine is adding stress to the global auto supply chain, threatening to send surging prices for new cars even higher. Sanctions against Russia are impacting energy prices, agricultural goods and raw materials, and the conflict is prompting logistical challenges and production stops related to operations on the western Ukrainian border, according to S&P Global Mobility. Supply shortages will hit auto production for years to come, offering little relief to high prices.

The Big Number

Trending

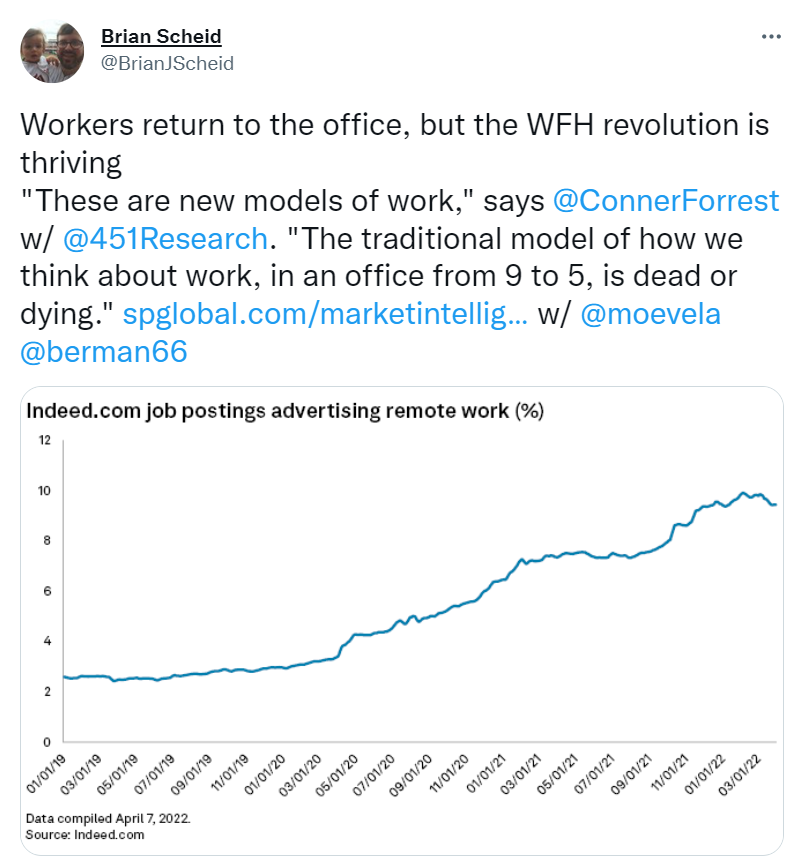

Read more on S&P Global Market Intelligence and @BrianJScheid on Twitter

Navigating Risks and New Realities

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.

Theme