Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 12 Jul, 2022

By Sarah Cottle

Today is Tuesday, July 12, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we take a close look at U.S. stock performance at the half-year mark. The S&P 500 fell 20.6% during the first six months of 2022, its worst start to a year since 1970. Energy stocks were the market's lone bright spot as oil prices rallied, though the sector posted steep losses in June. Utility stocks also fared better than most, and experts foresee substantial price gains in a looming recession due to the industry's stable earnings and dividend growth, and its decreasing sensitivity to interest rates. For the broader market, equity analysts believe that the path forward depends on the Federal Reserve's ability to tame inflation and the severity of a potential economic downturn.

Most of the 20 largest European banks suffered market cap declines in the first half, a period marked by mounting recession fears amid Russia's invasion of Ukraine. Sberbank of Russia, whose operations have collapsed under the weight of crushing international sanctions, saw its market cap fall by more than half. CaixaBank posted the biggest gain in market value as the Spanish bank stands to generate more revenues amid rising interest rates due to its loan book composition.

Initial public offering activity in the technology, media and telecommunications sector has dropped off sharply from its 2021 peak as public markets lose their appeal to companies looking for liquidity in 2022. S&P Global Market Intelligence counted 12 sector IPOs that were completed in the first half, compared to 52 in the year-ago period. IPOs that listed during the boom of 2021 and into 2022 have also struggled to provide returns from their IPO price.

The Big Number

Trending

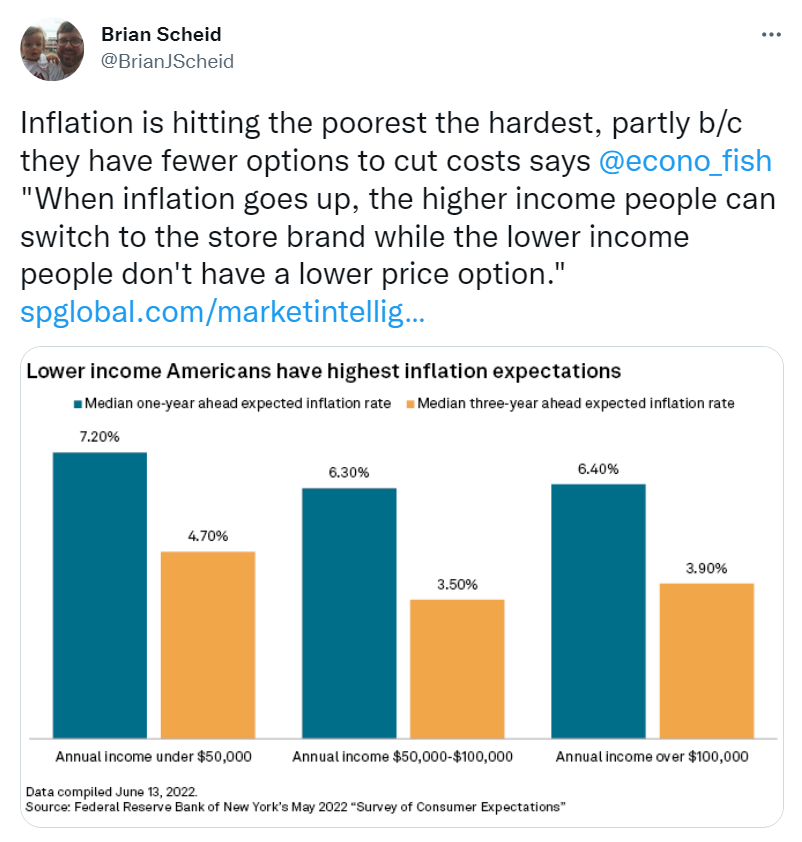

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani

Theme