Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Aug, 2023

By Sarah Cottle

Today is Tuesday, August 15, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we examine the impact and implementation of the US Inflation Reduction Act (IRA) a year since its enactment. The IRA offers tax credits for a range of clean energy resources that will not expire for at least 10 years. The law also created and extended incentives to produce in the US solar panels, wind turbines and other linchpins of the clean energy transition. By the end of 2024, US solar panel production capacity could rise to nearly 48 GW, more than tripling in two years, and jump to nearly 70 GW by the end of 2025, according to announcements tracked by S&P Global Commodity Insights. At least $63 billion in public- and private-sector funds have been committed to invigorating the country's nascent battery supply chain, according to S&P Global Commodity Insights and other public information, unleashing a fast-paced industrialization that aspires to decarbonize the world's largest economy largely from within.

Banks faced a liquidity crunch during the second quarter amid rising Federal Reserve interest rates to quell inflation, worsened by a series of high-profile bank failures early in the year. As a result, US community banks with less than $10 billion in assets posted generally lower year-over-year returns, worse efficiency ratios and slower deposit growth rates in the quarter. Based on S&P Global Market Intelligence estimates, community banks are likely to struggle to grow earnings over the next few years, prompting them to consider mergers to boost returns.

Private equity portfolio companies in the US are on course in 2023 to post the highest number of annual bankruptcy filings since 2010. In the first half, 338 US companies filed for bankruptcy protection, including 54 companies with private equity or venture capital backing, an S&P Global Market Intelligence analysis shows. At the current pace, bankruptcies by private equity portfolio companies are on track to total 108 by the end of 2023, a number that would exceed the 2020 total of 95 such bankruptcies.

The Big Number

Trending

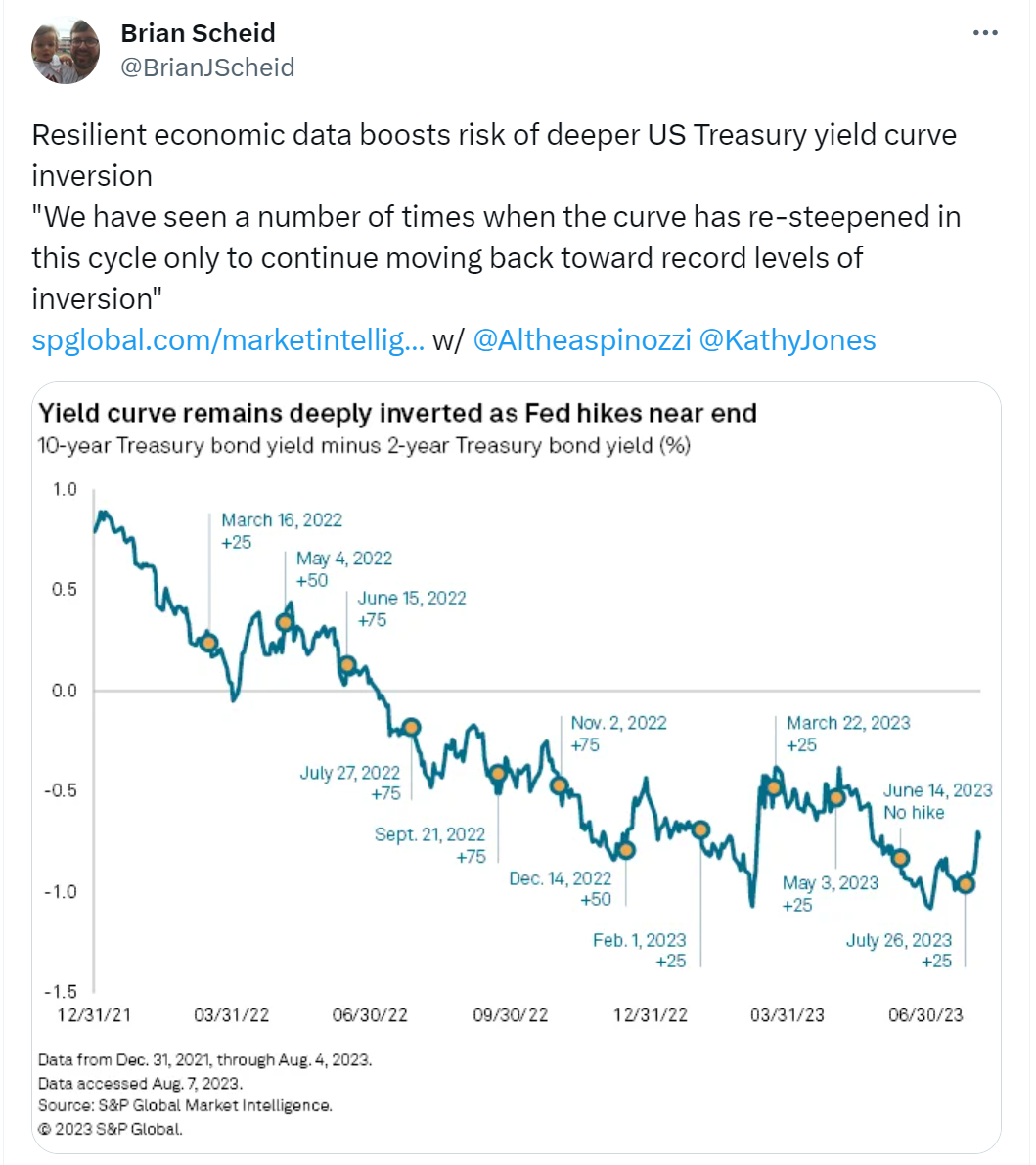

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Deavelle Sauva

Theme