Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Aug, 2023

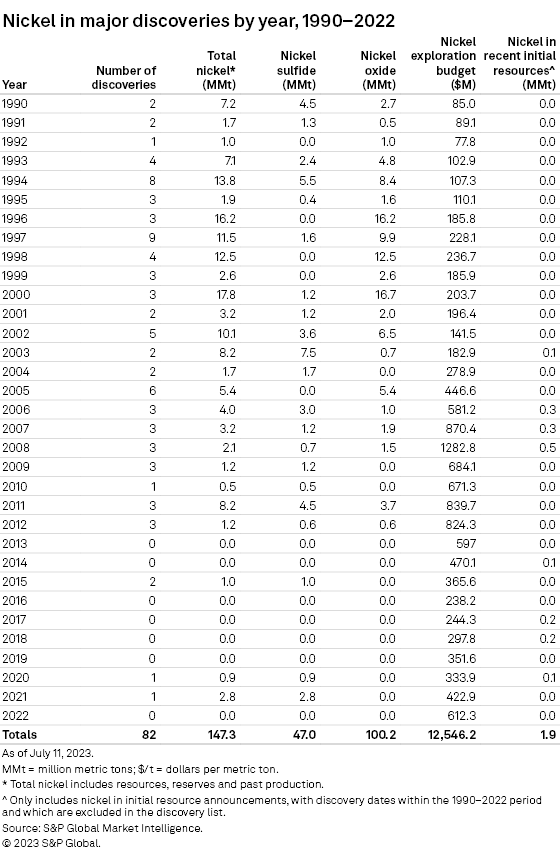

S&P Global Commodity Insights has identified 82 major nickel discoveries made from 1990 to 2022, containing 147 million metric tons of nickel in oxide and sulfide deposits. Only four were discovered in the past decade and account for just 3% of the total nickel discovered — far from the prolific years of the 1990s when almost two-thirds of the nickel discoveries were made.

The discoveries dataset prepared by Commodity Insights includes all deposits containing at least 250,000 metric tons of nickel in reserves, resources and past production. The year of discovery corresponds with the year in which a drill program initially identified mineralization that eventually led to the definition of reserves and resources that meet or surpass our major discovery threshold criteria. As assets increase above our threshold, we assess and add them to the discovery dataset. Likewise, should an asset's total endowment drop below our threshold, we remove it from the list.

Recent nickel discoveries continue to lag historical numbers

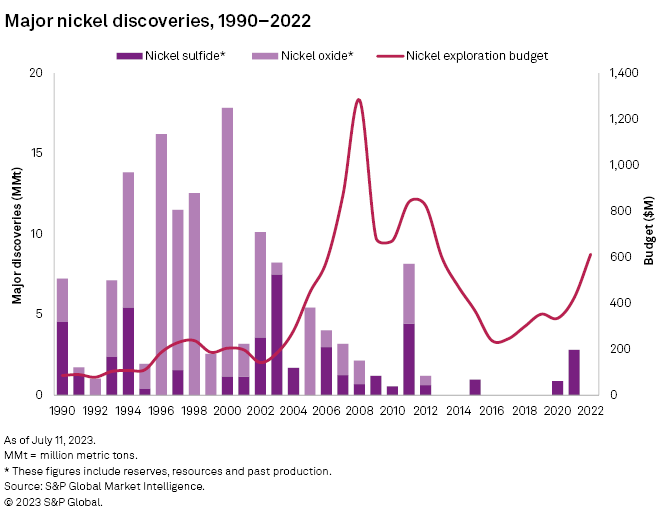

The 1990s and early 2000s were the most prolific years for nickel discoveries, but the total nickel in major discoveries has gradually decreased. With only 10 discoveries since 2011, including the two most recent from 2020 to 2022, major nickel discoveries remained scarce in recent decades. Discovered in 2020 and 2021, respectively, Chalice Mining Ltd.'s Julimar project in Western Australia and Aston Minerals Ltd.'s Sothman Township project in Ontario are the most recent significant discoveries in the record. Discoveries since 2011 totaled 14 million metric tons (MMt), accounting for only 10% of the total discoveries since 1991. One contributing factor was the slump in nickel prices in recent decades. They struggled to recover to the peak of $37,000 per metric ton in 2007 despite spikes in 2011, 2014 and 2019.

The scarcity in recent discoveries can also be attributed to the gradual downtrend of grassroots exploration for nickel since the 1990s. Grassroots exploration's share of nickel budgets peaked in 2004, accounting for $135 million, or half that year's $279 million total. Grassroots spending hit a multidecade low of $64.4 million in 2019, making up just 18% of the nickel total. While allocations have increased over the past few years, it remained well below historical spending. This, combined with the historical performance of the nickel price in the market, resulted in shrinking numbers and contained metal in major nickel discoveries.

Top 10's "most recent" discoveries made 12 years ago

No discovery in the last decade made it to the top 10 largest discoveries in terms of total nickel in reserves, resources and past production. The Weda Bay mine in Indonesia, owned by Tsingshan Holding Group Co. Ltd. (51.3%), Eramet SA (38.7%) and PT Aneka Tambang Tbk (10%), remains the largest discovery in the list with 15.3 MMt of total nickel. In its 2022 annual report, Eramet said it plans to develop the Sonic Bay hydrometallurgical project to produce battery-grade nickel-cobalt from Weda Bay starting in 2026.

The most recent discoveries in the top 10 were the Zebediela late-stage project in South Africa and the Hengjaya mine in Indonesia. Zebediela is TSX Venture Exchange-listed ZEB Nickel Corp.'s sole property, where a drill program is planned for 2023 to determine current mineral resource estimates. The Hengjaya mine switched from producing nickel pig iron to nickel matte in the December quarter of 2022.

Recent discoveries mainly in Africa, Asia-Pacific, US-Canada regions

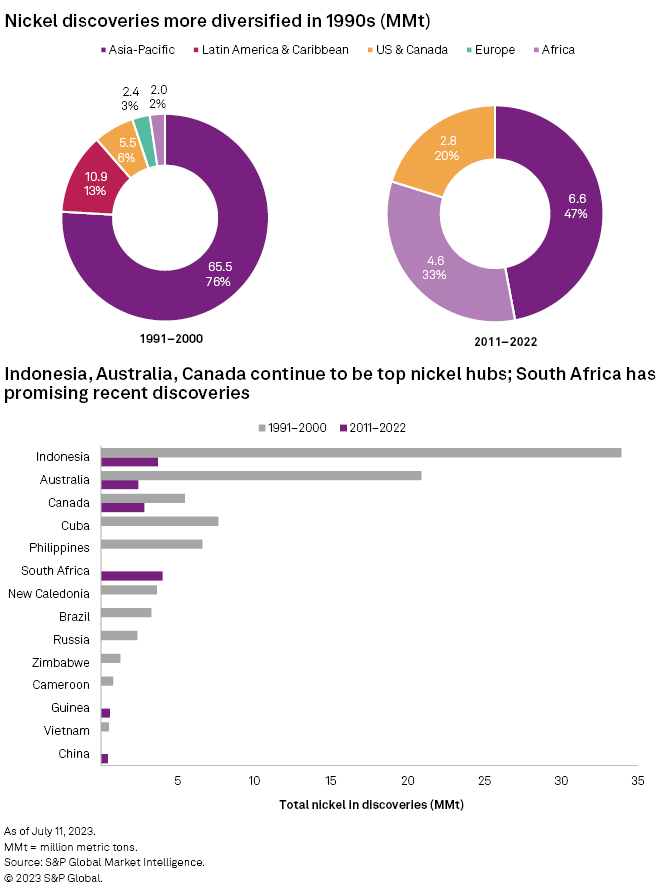

Significant nickel discoveries were more geographically diverse in the 1990s. Although more than three-quarters of the discoveries within the period are in the Asia-Pacific region, the remaining quarter was spread throughout Latin America, US-Canada, Europe and Africa. Most of the nickel deposits discovered then were in Indonesia, Australia and Canada, which were also the top three nickel-exploring countries toward the end of the 1990s.

In the last 12 years, however, as the number of discoveries declined, they became concentrated in a few regions. Asia-Pacific still accounts for the largest share since 2011, but significant discoveries in the Africa region, such as Zebediela, and in the US-Canada region, such as the Sothman Township project, took substantial shares of the total, shrinking Asia-Pacific's share to 47%.

Initial resources insufficient to support significant increase in major discoveries

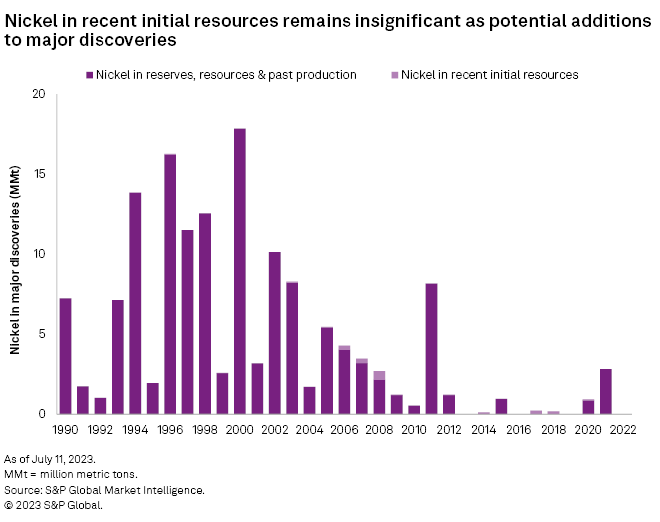

Over the past several years, 32 initial resource announcements containing nickel were made, with the deposits discovered from 1991 to 2022. At the time of announcements, the resources contained 1.9 MMt of nickel but did not meet the threshold to be considered a major discovery. With further exploration, however, these deposits could add to the major nickel discoveries. Of the 32 announcements, eight included nickel exceeding 100,000 metric tons in initial resources at the time of announcement. One such project is Talon Metals Corp.'s (60%) and Rio Tinto's (40%) Tamarack project in Minnesota, which holds 218,000 metric tons of contained nickel, more than doubling its initial resource of 106,000 metric tons of nickel in 2014.

Despite these growths in nickel deposits, the nickel in initial resources on record could prove insufficient to significantly impact the total nickel discoveries in the near term.

Nickel discoveries much needed amid looming supply deficits in medium term

The recent Commodity Briefing Service publication for nickel forecast a supply deficit for the metal in 2027. With the ongoing transition to electric mobility and the global green revolution, the demand for battery metals such as nickel is expected to increase in the medium term. The scarcity of nickel discoveries in recent decades could prove detrimental to this rising demand, especially with the average lead time of nickel mines estimated to be at 17.5 years . While some companies' shift to nickel matte production for battery use could mean more opportunities for projects hosting oxide deposits, nickel's increasing demand will still need to be supported by its substantial quantity in new discoveries.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.