Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 09, 2023

By Chris Rogers

Elevated temperatures globally have increased the use of air conditioning for home and office, raising demand for machinery and maintenance services. Air conditioning manufacturers are reviewing their supply chains, which diverge widely, considering a mixture of cost, risk, regulatory and environmental drivers.

Cooling after a hot spell: Air conditioner supply chain growth slowing

Extremely hot temperatures in the United States are reported to be leading to increased use of air-conditioning systems in both domestic and commercial settings. That's leading to increased demand for both new machines and maintenance parts.

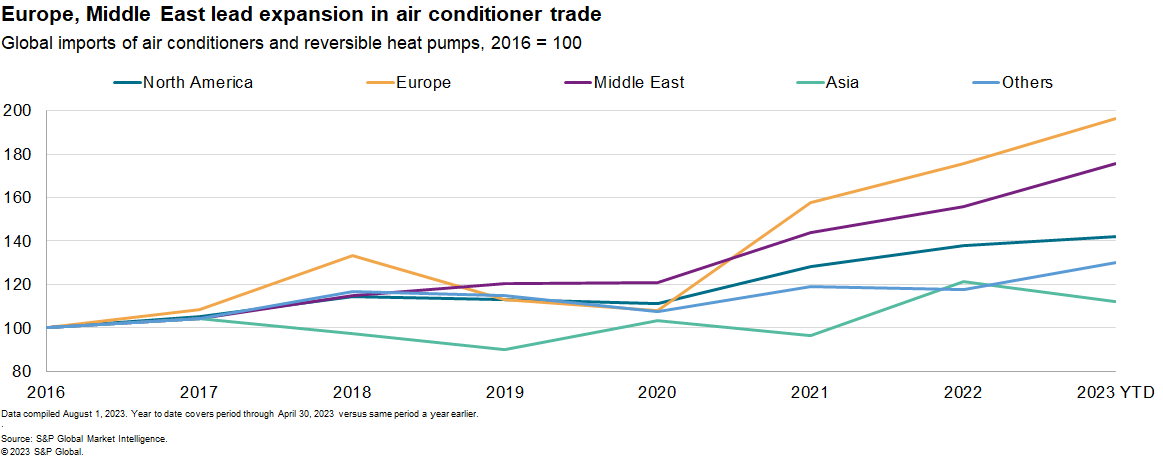

Global exports of air conditioners, reversible heat pumps and parts, climbed 20% higher year over year in 2021 before slowing to an 8% increase in the first four months of 2023, according to S&P Global Market Intelligence data.

The fastest growing market has been the Middle East, with a 26% year-over-year increase in imports in 2022 followed by a 13% rise in the first four months of 2023. Imports into the North American market jumped 46% higher in 2021, slowing to just 3% in 2023.

Fiddling with the controls: Restructuring as supply chains return to normal

As supply chains return to normal, like many other industries including home appliances and kitchenware, the air conditioner manufacturers are turning their attention to long-term sourcing strategies to both reduce long-term costs and to ensure resilience for the next surge in demand.

At the global level, the sourcing of assembled air conditioners has been mostly stable. Mainland China's share of global exports has declined modestly to 47.2% in 2022 from 49.7% in 2017, Market Intelligence data shows.

Different reasons for different sources: Diversity in corporate sourcing

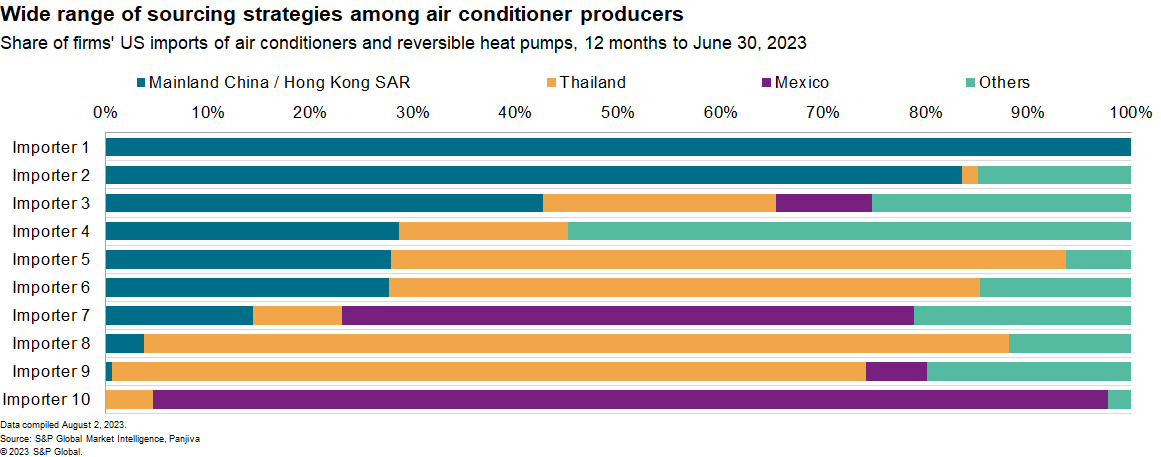

The wide variety of cost, risk and policy drivers of supply chain decision-making has led to a diverse range of sourcing strategies for air conditioning manufacturers.

Analysis of bill-of-lading data for the top 10 importers of air conditioners and reversible heat pumps shows only one firm sources almost entirely from mainland China, with most firms having at least three, or in one case four, supplier countries.

Sourcing decisions will be dynamic over time. The advent of the Inflation Reduction Act may shift sourcing in favor of countries where the United States has a free-trade deal, as we noted in Before the battery and magnet: IRA and mineral supply chains. That may act to the benefit of Mexican suppliers.

Environmental considerations are also on the rise, particularly given the move to more green steel trade deals, such as those being pursued by the United States and the European Union. You can read more about that in our Q3 outlook, Right place, right time: Supply chain outlook for third quarter 2023.

Subscribe to our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.