Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Dec, 2021

By Seth Shafer and Brian Bacon

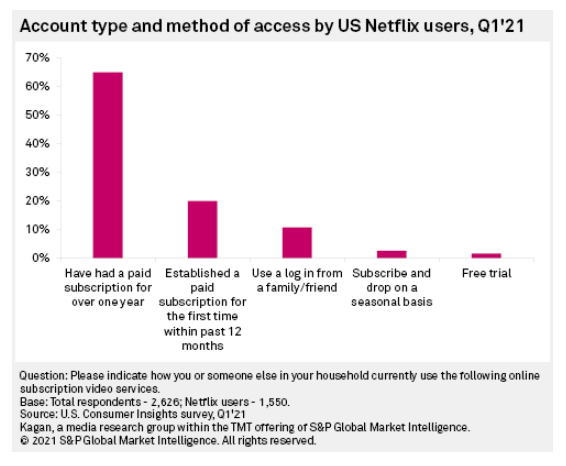

Assessing the true extent and impact of login/password sharing for Netflix and other SVOD operators is challenging, but Kagan Consumer Insights surveys of U.S. internet adults shed some light on admitted login sharers. When asked about account type and method of access, 85% of Netflix users said they were paid subscribers, including 20% that had established a paid subscription within the last 12 months. That left just 11% using a shared login and the remainder seasonal subscribers and free trial users.

The percentage of Netflix users surveyed in the U.S. who acknowledged sharing a login has barely exceeded 10% in each of the last three years, ranging from 13% in 2019 to 12% in 2020 and 11% in 2021.

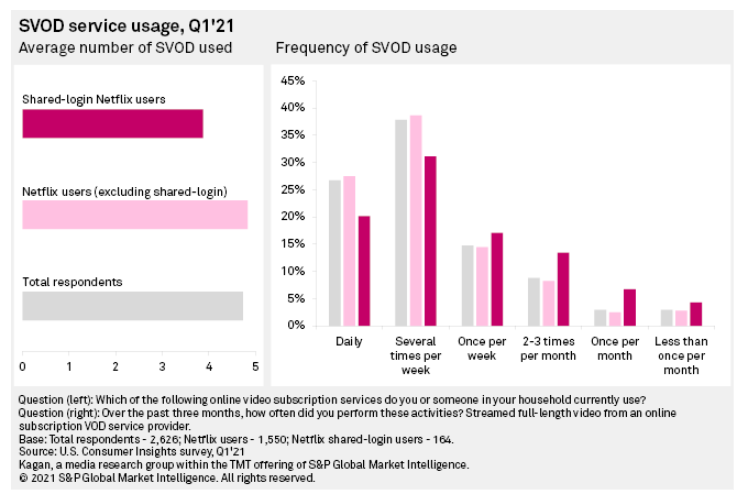

Additional survey data suggests that Netflix login sharers are also generally less avid SVOD consumers overall compared to both Netflix users excluding login sharers and total survey respondents. Login sharers used an average of 3.9 total SVOD services versus nearly 5 services for total respondents and Netflix users minus sharers. Login sharers were also much more likely to turn to SVOD services on a weekly or monthly basis than the more frequent daily/several times per week usage demonstrated by total and nonsharing respondents.

Many Netflix password sharers may be deciding to forgo a paid membership because of entertainment consumption tendencies and not so much out of economic necessity or a desire to thumb a nose at big media giants. Infrequent users may feel that they simply do not use the service enough to justify a paid subscription, making them more inclined to borrow a login from family or friends for the occasional show or movie they would like to watch.

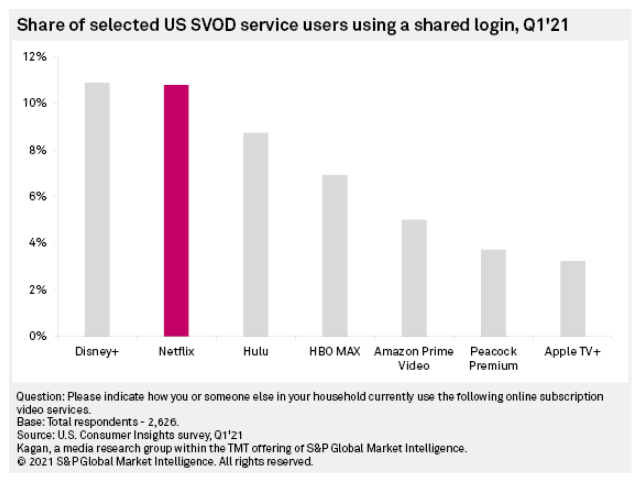

Compared to some of the other big SVOD services, Netflix tied with The Walt Disney Co.'s Disney+ for the largest share of users who indicated using a shared login, both at 11%. Demographic trends among other services for shared login users such as AT&T Inc.'s HBO Max and Amazon.com Inc.'s Prime Video were generally similar to that of Netflix, with sharers typically coming from single adult and multiple adult households with no children.

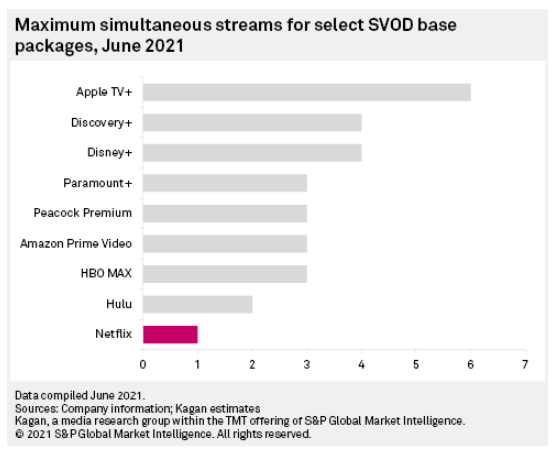

SVOD operators have always faced a dilemma of sorts surrounding how many simultaneous streams they offer per account. More simultaneous streams offer large households flexibility in watching different programming at the same time but may also encourage password sharing across several households, especially among families and friends, despite service terms prohibiting it. Most services have settled on offering an average of three to four simultaneous streams per account, with Apple TV+ (six simultaneous streams) and Netflix (just a single stream for its Basic subscription tier) outliers at each end of the spectrum.

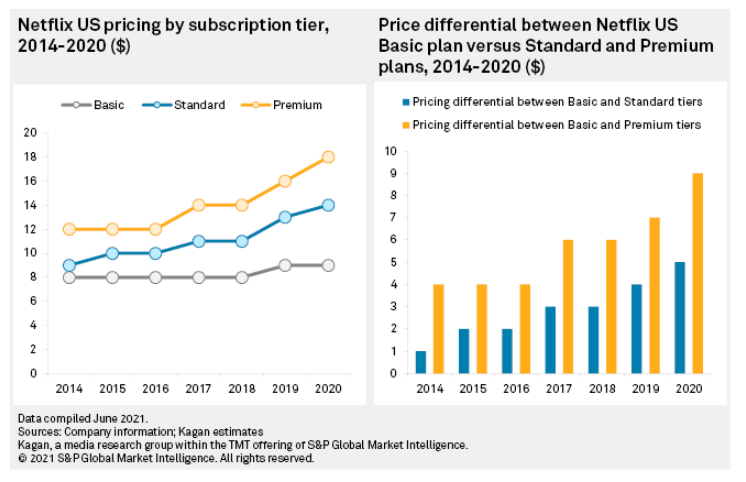

Netflix's strategy to date to mitigate the financial impact of password sharing has been to avoid hard crackdowns and to instead peg additional simultaneous stream availability to higher-priced subscription tiers. While its Standard ($13.99/month) and Premium ($17.99/month) tiers do offer extra features related to downloads and HD/UHD content availability, a key difference from the $8.99/month Basic tier is access to two simultaneous streams for Standard subscribers and four simultaneous streams for Premium members.

Recent price hikes from Netflix in the U.S. have increased the cost of all three tiers while the pricing differential between the Basic and Standard/Premium plans has also increased substantially. In 2014, the Netflix Standard plan was just $1 more expensive than the Basic plan and the Premium tier an extra $4. Fast-forward to 2020 and the Standard plan was $5 more, while the Premium plan cost an additional $9 versus the Basic tier.

To avoid hitting the maximum simultaneous screen limit, frequent Netflix users sharing an account with other households would likely need to upgrade to a Standard or Premium subscription, with the additional revenue generated monetizing some of the "free" access enjoyed by account sharers.

Kagan's Consumer Insights surveys span key markets in the U.S., Europe and Asia Pacific and track consumer behaviors surrounding topics including cord cutting, streaming video, connected devices, gaming and pay TV. Please see the link below to request a demo to learn more about Kagan's Consumer Insights survey results and broader analysis and coverage of the streaming video sector.