Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 Apr, 2022

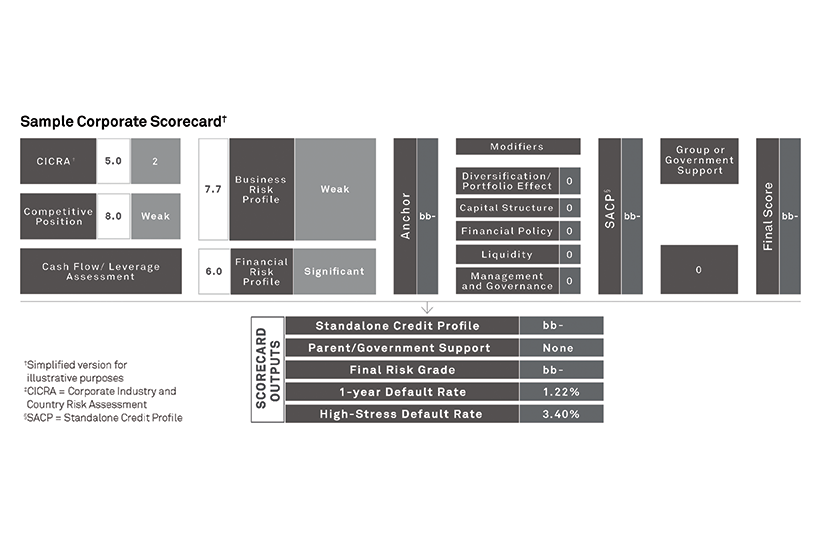

Proactive monitoring of quantitative and qualitative risk factors can help to understand and assess the rising credit risks associated with the new realities of market volatility. The Corporate Credit Assessment Scorecard provides an effective framework to navigate today’s climate, especially for low default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

But how will the creditworthiness of the unrated universe be impacted by such volatility?

There are four primary areas where our Corporate Scorecard can reflect the spillover effects of market volatility on credit risk.

In response to the COVID-19 pandemic, central banks and governments have deployed unprecedentedly large fiscal and monetary policy packages to help workers and companies bridge the gap to recovery. Today, the expectation of specific, extraordinary support provided by governments to certain government-related entities (GREs) is considered with the use of the GRE overlay provided along with the Corporate Scorecard.

With credit markets constantly evolving, how do you effectively manage risk?

Products & Offerings