S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Case Study — 9 Sep, 2024

By Paul Vinzani

Highlights

The Client: Investment banks and asset managers

Internal Users: Technology and data science teams

Investment banks and asset managers need to use multiple credit rating agencies (CRAs) in their business practices. Security master and infrastructure development have created outsized costs and continue to become more complex as data requirements increase. To map fixed income holdings via a common data layer can take multiple development streams and time-consuming processes to validate that a security is appropriately assigned across a common identifier (ID). Data must then be adequately maintained to ensure overall quality. As the associated datasets linked with a security or issuer increases, the need to streamline the linking process does, as well.

The technology and data science teams at investment banks and asset managers have been searching for a simplified approach. As a provider of S&P Global Ratings, S&P Global Market Intelligence ("Market Intelligence") was aware of the need for data that can be easily ingested and mapped to a company's existing databases. In response, specialists at Market Intelligence developed a consolidated ratings feed so that ratings across providers can be delivered via a common ID and delivery channel.

Pain Points

Investment banks and asset managers deal with many data providers that deliver information via disparate IDs and delivery channels. It is an enormous challenge to link and maintain these data items calling for:

Teams have turned to Market Intelligence to discuss possible solutions.

With increased data needs, finding solutions for easy implementation and mapping across ID’s is paramount for investment banks and asset managers to keep data management costs down while ensuring quality across security masters.

Potential benefits of a single feed solution

The Solution

Specialists from Market Intelligence acknowledged that firms receive credit ratings data from individual CRAs in separate formats and packages, with no unified method to consolidate this information. As a result, subscribers lack a comprehensive view of the ratings assigned to an issuer or issue by various agencies, making it difficult to have all relevant data in one place for thorough analysis.

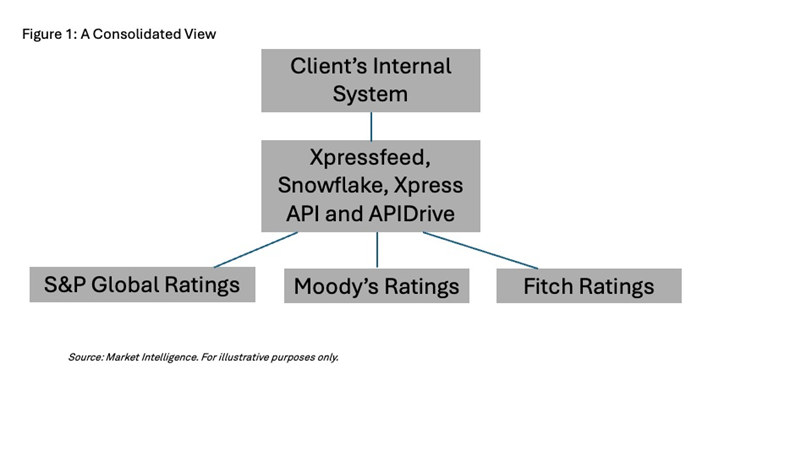

As a result, Market Intelligence developed a unified offering to deliver current and historical ratings from S&P Global Ratings, Moody’s and Fitch via a range of options, including XpressfeedTM, cloud-based Snowflake, Xpress API and APIDrive that comprise a powerful suite of data delivery solutions.

This enhancement enables users to streamline the ingestion and analysis of credit data, facilitating comprehensive risk assessments and reporting without the need to process and query multiple data feeds. It includes:

As shown in Figure 1, this streamlined workflow significantly enhances efficiency by providing a holistic view of credit ratings in one place, facilitating better-informed credit risk assessments and decision-making.

This solution provides technology and data science teams with:

|

Current and historical credit ratings from all three CRAs via multiple delivery channels

|

Xpressfeed is S&P Global's powerful data feed management solution that delivers data in packages that are zipped and posted to a secure location accessible via FTP or Xpressfeed Web Service so users can customize it and receive only the data they need. Cloud-based Solutions: [e.g. Snowflake] enables users to get live, ready-to-query datasets that are always up-to-date and don't require transformation before use. XpressAPI let users pick and choose the data they need without hosting a database. Secure web services can be leveraged to dynamically access datasets or interact directly with the web services via REST/JSON. |

|

Assistance to quickly implement data delivery |

Detailed User Guides provide helpful instructions on how to access the credit ratings via multiple delivery options and perform different queries. |

Key Benefits

Technology and data science teams at investment banks and asset managers can now:

Click here for more information on the solution mentioned in this Case Study.

Theme

Products & Offerings