Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 26 Nov, 2021

By Giorgio Baldassarri and Kieran Shand

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

S&P Global Ratings’ issuer credit ratings (ICRs) assess a firm’s willingness or ability to repay its debt on time and in full. They are based on criteria that include both quantitative[1] and qualitative considerations,[2] and are subject to a committee review. S&P Global Ratings provides further directional information (e.g., a Credit Outlook and CreditWatch) on the future potential change of some ICRs,[3] but any credit rating can be updated at any point in time, with critical implications for both asset managers and credit risk managers:

In this paper, we show how a statistical model developed by S&P Global Market Intelligence can be used to generate early warning signals of a potential credit risk deterioration/improvement that may trigger a portfolio rebalancing.

At S&P Global Market Intelligence, we have developed a quantitative model that is trained on S&P Global Ratings’ corporates’ stand-alone credit profiles (SACPs):[5] CreditModel™ Corporates 3.0 (CM3.0). CM3.0 generates a credit score[6] that aims to statistically match the SACP for rated companies, and can also be used for unrated companies above a certain revenue threshold. CM3.0 credit scores are expressed on the same scale as S&P Global Ratings, but in lowercase nomenclature to distinguish them from actual S&P Global Ratings’ credit ratings.

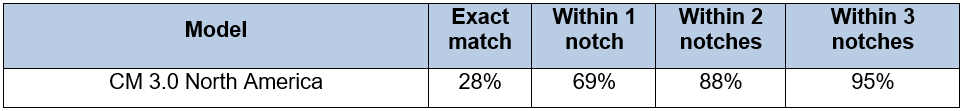

A further overlay adjusts the CM3.0 score by including parental and government support considerations, when present, enabling the model outputs to statistically match S&P Global Ratings’ ICRs in 28% of the cases, as shown in Table 1 for rated non-financial corporates domiciled in North America.[7] As expected for a statistical model, the ratings agreement is not perfect (i.e., for 100% of the cases), because ICRs include qualitative aspects that cannot be exactly quantified. In any event, CM3.0 retains a great performance within one, two and three notches.

Table 1: Performance of CM3.0 North America, adjusted with parental and government support.

Source: S&P Global Market Intelligence as of December 31st, 2018. For illustrative purposes only.

Interestingly, we notice a fraction of outliers whose CM3.0 adjusted score is three or more notches different from the actual ICR (circa 12%). This group seems to defeat any technical attempt to improve the model performance. Two questions naturally arise:

Our Findings

Figure 1 depicts the historical frequency of ICR changes for companies where the adjusted CM3.0 score deviates by x notches from S&P Global Ratings’ ICR at time t. For example, the bar corresponding to +1 refers to companies whose CM3.0 score is one notch better than the ICR score at time t, and that were upgraded (green), downgraded (red) or remained the same within a one-year (left panel) or within a five-year (right panel) time horizon from time t. The dataset includes corporates domiciled in the U.S. and Canada, rated between 2010 and 2021.

Figure 1: Percentage of rating downgrades, upgrades, no change.

Source: S&P Global Market Intelligence as of October 1st, 2021. For illustrative purposes only

As the notch difference widens, the historical odds of an ICR change within the specified time horizon increases. As can be seen from Figure 1, the outliers (companies with a difference of three notches and above) are particularly suitable for surveillance purposes, since the statistical odds of an upgrade (notch difference of +three and above) or a downgrade (notch difference of -three and below) are close to 80%.

Table 2 shows the percentage of ratings with an Outlook/CreditWatch prior to their change, for a positive or negative notch difference in Figure 1.

Table 2: Outlook/CreditWatch for ratings that moved towards CM3.0 score.

Source: S&P Global Market Intelligence as of October 1st, 2021. For illustrative purposes only.

Source: S&P Global Market Intelligence as of October 1st, 2021. For illustrative purposes only.

Approximately half of all ratings that were upgraded (downgraded) within one year from recording a positive (negative) notch difference initially had an S&P Global Ratings’ Outlook/CreditWatch.[8] Equally interesting, circa 2% (7%) of ratings with an initial positive (negative) view were actually downgraded (upgraded).

Thus, statistical outliers could be employed to automate the generation of directional signals of potential creditworthiness improvement or deterioration, beyond existing CreditWatch and Outlooks.

These findings remain valid also for a five-year time horizon, despite the volatility linked to a longer time horizon and the smaller number of observations that smooths the effect.

The stability or change of a credit rating is important for risk management and investment purposes. In this paper, we show how a quantitative model built to statistically match S&P Global Ratings’ ICRs can be used to automate risk surveillance or identify potential investment opportunities by appropriately leveraging the natural existence of mathematical outliers generated by the model.

Our empirical analysis on historical data suggests that a significant divergence between a modelled score and actual ICR is accompanied by higher odds of a rating change, beyond the Outlook or CreditWatch flag sometimes provided by S&P Global Ratings. As is obvious, these signals are statistical in nature and cannot predict rating moves in a deterministic fashion.

In a follow-up analysis, we will explore how/if the same approach can be leveraged for stock portfolio selection and finding excess returns over a certain benchmark, since rating moves are known for their impact on equity prices.

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research, and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations, and assess credit risk. Investment professionals, government agencies, corporations, and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks, and analytics in the global capital and commodity markets, offering ESG solutions, deep data, and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

[1] E.g., a firm’s financial ratios, macroeconomic scenario projections, etc.

[2] E.g., country risk, industry risk, competitiveness, peer-comparative analysis, quality of management, etc.

[3] As a rule of thumb, there is a one in three chance of a rating downgrade/upgrade over the next six to 24 months, for companies with a negative/positive outlook. There is a one in two chance of a downgrade/upgrade for companies with a negative/positive CreditWatch over the next three months. See, for example, “Guide to Credit Rating Essentials”, S&P Global Ratings (2019), available here.

[4] Investment grade includes any rating better than BB+.

[5] A corporate SACP refers to an issuer credit rating prior to any parental or government support considerations.

[6] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[7] Assessed on a training sample containing 2,801 unique companies, rated between 2003 and 2017.

[8] Initially, i.e., at the date when the difference between the statistical score and ICR was recorded.

Location

Products & Offerings