Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 25 Aug, 2022

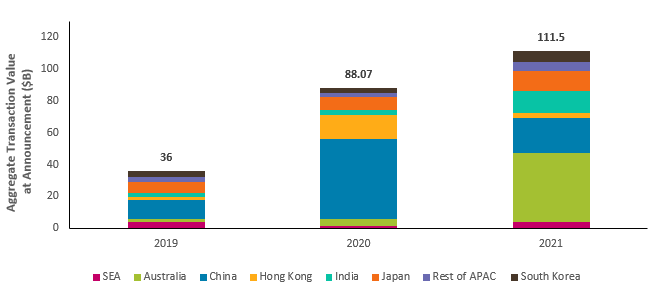

The Asia Pacific Technology M&A market has exploded over the last few years, nearly tripling 2019’s deal value total to over $111 billion in 2021, based on data gathered by S&P Global Market Intelligence. This is exclusively accounting for the Information Technology, Financial Technology, and Payment sectors.

Specifically, Artificial Intelligence (A.I.), Cloud Data Services, and Network Security are major emerging technologies targeted by acquirers in Asia Pacific markets.

In this report, we take a closer look at some of the top 10 largest deals between 2019 and the second quarter of 2022, and cover the macro-level trends related to these technologies.

APAC Tech M&A Deals in Major Territories

The deal growth between 2019 and the second quarter of 2022 was led by Chinese acquisitions with an aggregate of $91.4 billion in deals over the three-and-a-half-year period. Australia and Japan came in second and third place, respectively contributing $52.5 billion and $29.7 billion in tech M&A deal value to the APAC region.

Figure 1: APAC Tech M&A Deals in Major Territories

Source: S&P Global Market Intelligence. Data compiled Jul 6, 2022. This analysis is limited to Asia Pacific transactions within the information technology, financial technology, and payments sectors, as defined by S&P Global Market Intelligence between Jan 1, 2019 and June 30, 2022. Excludes terminated deals and deals without value disclosed at the announcement date. Industries are classified according to S&P Global Market Intelligence. SEA: South-East Asia; Rest of APAC: Macau, New Zealand, North Korea, Pakistan, Samoa, Sri Lanka, Taiwan. The chart is for illustrative purposes only.

Since COVID-19 struck, personal and business interactions have been driven further into the digital world. More companies are leveraging cloud-based technology to enable their employees to work from home and ensure business continuity. According to a survey conducted by 451 Research, the technology research group within S&P Global Market Intelligence, the COVID-19 pandemic has accelerated the pace of business investments in software to improve customer experience. Companies of all sizes are pushing to modernize their technology and reorient their leadership structure to manage more digital and data-driven workflows.

In a tech M&A-focused webinar held in February this year, experts from 451 Research came together to explore the drivers behind the surge in global M&A activity in 2021. Technology played a vital role during the past two years of the pandemic, where massive disruption increased demand and opened up more use cases. As a result, vendors had to expand their portfolios. From a corporate strategy perspective, it was much faster for vendors to buy things rather than build things to meet these new use cases, according to Brenon Daly, Research Director, Financials at 451 Research who spoke at the webinar.

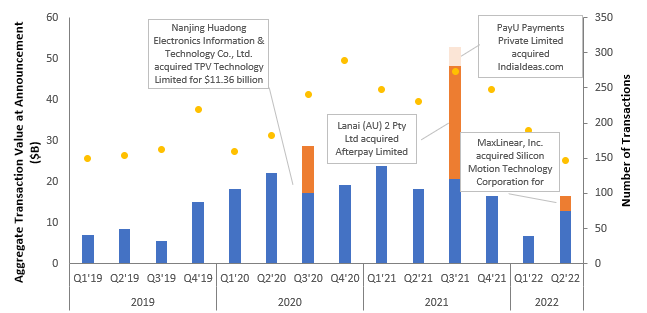

Ten Largest Deals

FinTech deals littered the largest transactions over the past three and a half years. Lanai (AU) 2 Pty Ltd., a subsidiary of Block Inc., acquired payment solutions provider, Afterpay Limited, for $27.4 billion. This transaction alone contributed more than half of the aggregate transaction value announced in the third quarter. According to 451 Research, this deal catapults the buyer into one of the most prominent positions in buy-now-pay-later (BNPL) while also opening opportunities on many fronts, such as linking its merchant and consumer businesses, broadening its (limited) global reach, and augmenting its financial services arm. The BNPL market is experiencing explosive growth against a backdrop of increasing competition, commoditization, and regulatory scrutiny.

Another transaction related to payment solutions in the same quarter of 2021 was PayU Payments Private Limited’s acquisition of IndiaIdeas.com Limited. This deal was worth $4.7 billion. According to the merger press release, the combined business will be able to meet the changing payments needs of digital consumers, merchants, and Government enterprises in India and offer state-of-the-art technology to even more of the excluded sections of society, while adhering to the regulatory environment in the country and delivering robust consumer protection. According to S&P Global Market Intelligence’s 2021 India Mobile Payments Market Report, this deal comes amid growing competition from fast-growing, well-funded younger startups and large e-commerce merchants’ efforts to cut down their dependence on external gateways.

The largest deal in 2020 came from Nanjing Huadong Electronics Information & Technology Co., Ltd.’s 51% stake acquisition in TPV Technology Limited for $11.36 billion, announced in September 2020. TPV Technology Limited, headquartered in Hong Kong, designs, manufactures, and sells computer monitors, flat TV products, and other display products.

Other sectors that contributed to the largest deals in the same period were Internet Software and Services, with $22.2 billion, and Semiconductors, with $9.2 billion worth of deals respectively. The largest deal in the Internet Software and Services sector was the $7.99 billion acquisition of online classifieds platform 58.com Inc. by a group of investors including General Atlantic Service Co. LP, General Atlantic Singapore Fund Pte. Ltd., Warburg Pincus Asia LLC, Ocean Link, Huang River Investment Ltd., Ohio River Investment Ltd., and THL E Ltd.

The only 2022 deal that made it to the 10 largest deals was MaxLinear, Inc.’s acquisition of Silicon Motion Technology Corporation in May worth $3.58 billion. According to 451 Research, the result of this combination will be a $2 billion-plus, profitable business that places MaxLinear among the top 10 fabless semiconductor firms, extending its broadband, connectivity, and infrastructure products with NAND flash controllers for solid-state devices developed by Silicon Motion. Potential synergies span the computer, networking, and storage domains.

Figure 2: 10 Largest Tech M&A Deals in the Asia Pacific Announced Between 2019 and 2022

(Ranked by deal value at announcement)

|

Buyer |

Target |

Target Country/ |

Announcement Date |

Transaction |

Deal Value at Announcement ($B) |

|---|---|---|---|---|---|

|

Lanai (AU) 2 Pty Ltd |

Afterpay Limited |

Australia |

8/1/2021 |

Payment Processors |

27.44 |

|

Nanjing Huadong Electronics Information & Technology Co., Ltd. |

TPV Technology Limited |

Hong Kong |

9/4/2020 |

Technology Hardware, Storage, and Peripherals |

11.36 |

|

Investor Group1 |

58.com Inc. |

China |

4/2/2020 |

Internet Software and Services |

7.99 |

|

LINE Corporation |

Z Holdings Corporation |

Japan |

1/20/2021 |

Internet Software and Services |

7.12 |

|

TCL Technology Group Corporation |

Tianjin Zhonghuan Electronic Information Group Co., Ltd. |

China |

6/24/2020 |

Semiconductors |

5.64 |

|

Hitachi, Ltd. |

Hitachi High-Technologies Corporation |

Japan |

1/31/2020 |

Electronic Equipment and Instruments |

4.88 |

|

PayU Payments Private Limited |

IndiaIdeas.com Limited |

India |

8/31/2021 |

Payment Service Providers and Gateways |

4.71 |

|

Baidu, Inc. |

Domestic Video-Based Entertainment Live Streaming Business of JOYY Inc |

China |

11/16/2020 |

Internet Software and Services |

3.60 |

|

MaxLinear, Inc. |

Silicon Motion Technology Corporation |

Hong Kong |

5/5/2022 |

Semiconductors |

3.58 |

|

Investor Group2 |

LINE Corporation |

Japan |

11/18/2019 |

Internet Software and Services |

3.52 |

Source: S&P Global Market Intelligence. Data compiled Jul 6, 2022. This analysis is limited to Asia Pacific transactions within the information technology, financial technology, and payments sectors, as defined by S&P Global Market Intelligence between Jan 1, 2019, and June 30, 2022. Excludes terminated deals and deals without value disclosed at the announcement date. Industries are classified according to S&P Global Market Intelligence. The table is for illustrative purposes only.

Figure 3: Aggregate Tech M&A Transaction Value in APAC, Q3'21 was Highest on Record

Source: S&P Global Market Intelligence. Data compiled Jul 6, 2022. This analysis is limited to Asia Pacific transactions within the information technology, financial technology, and payments sectors, as defined by S&P Global Market Intelligence between Jan 1, 2019, and June 30, 2022. Excludes terminated deals and deals without value disclosed at the announcement date. Industries are classified according to S&P Global Market Intelligence. The chart is for illustrative purposes only.

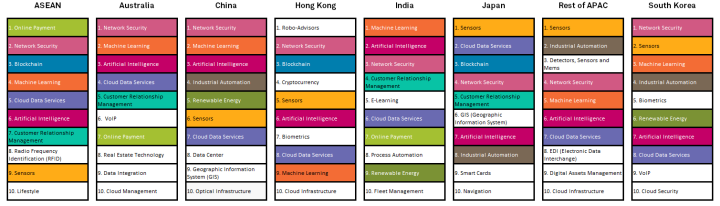

Top 10 Emerging Technology Targets in Major Territories Since 2019

Analysis of Asia Pacific technology M&A transactions gathered by S&P Global Market Intelligence between 2019 and second quarter 2022 reveals that Artificial Intelligence (A.I.), Cloud Data Services and Network Security are major emerging technologies targeted by acquirers in Asia Pacific markets.

Figure 4: Top 10 Emerging Technology Targets in Major Territories Since 2019

Source: S&P Global Market Intelligence. Data compiled Jul 6, 2022. This analysis is limited to Asia Pacific transactions within the information technology, financial technology, and payments sectors, as defined by S&P Global Market Intelligence between Jan 1, 2019, and June 30, 2022. Excludes terminated deals and deals without value disclosed at the announcement date. Industries are classified according to S&P Global Market Intelligence. The table is for illustrative purposes only.

When it comes to digital transformation, cloud services is a growth segment. The market is expected to see healthy growth, nearly doubling in size from $34 billion in 2020 to $67 billion by 2025. This is according to 451 Research senior research analyst, Agatha Poon, who presented her research at a webinar event, "Envisioning Digital Reinvention: How Would Asia Pacific Progress?" last December. Agatha further elaborated that cloud revenues are highly concentrated in a handful of markets and the top 3 include China, Australia, and Japan.

Local governments in the region are rather agnostic about the development of different digital technologies. However, A.I., or more specifically Machine Learning (M.L.), appears to resonate in various markets. Besides China, Japan and South Korea are strong supporters of these technologies with the government putting aside funding for A.I.-related research, said Agatha.

To highlight some key development trends in emerging ASEAN and South-East Asian economies, there are pockets of opportunities in key vertical segments like retail and financial services, which are partly driven by trends like open banking and the fintech boom. Although banking and financial institutions in South-East Asia have always been cautious about adopting emerging technologies such as cloud computing, M.L., and A.I. for security and compliance reasons, they cannot afford to ignore this trend as digital technologies inspire new business models and uncover untapped markets. Agatha Poon’s research report on Open Banking in ASEAN highlights that the COVID-19 pandemic has been an opportunity for companies that are willing to transform their business models with new-age technologies and digital offerings. “A.I. and M.L. are going to be key areas with a lot of investment because we are living in this data-driven world where we get both structured and unstructured data.”, said Agatha in her closing remarks at the above-mentioned webinar.

As technology became the key enabler for sustaining business across the globe during the pandemic, security inevitably rose to the fore as a concern. There was substantial investment in enablers such as digital workspaces, virtual conferencing and collaboration, and customer experience for booming online retail. According to a survey conducted by 451 Research, Information Security (InfoSec) technology is an increasing priority for large enterprise businesses. In addition, 451 Research’s 2021 Tech M&A Outlook: Information Security report, further stated that securing remote work at an enterprise scale became one of the more urgent projects during the 2020 pandemic. This Increased focus on the providers and technologies that could support these projects, spurring a substantial number of acquisitions.

One-stop intelligence. Nonstop results.

In an intensely competitive and unpredictable marketplace, it’s not enough to respond to the status quo.

Our trusted solutions, data, and expertise drive multiple workflows across your organization, so you can enhance decision making and accelerate growth. See how your company can set the pace. Learn more at spglobal.com/SetthePace.

Products & Offerings