Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 4 May, 2021

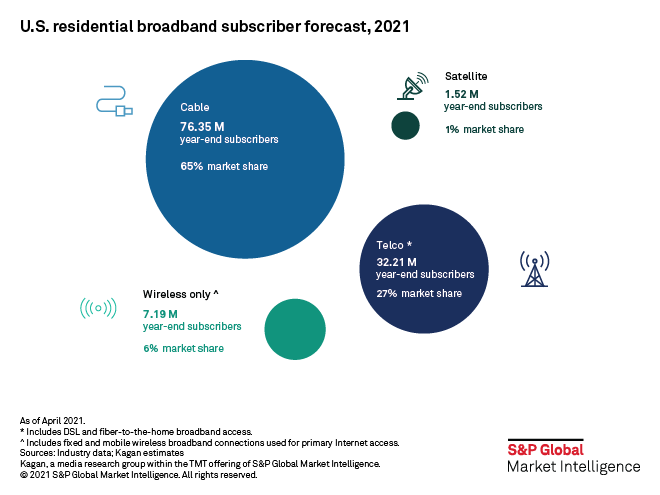

U.S. broadband providers are carrying considerable momentum out of the pandemic despite increased competition and impending service maturity with penetrations nearing 90% of occupied households, according to the updated forecast from Kagan, a research unit of S&P Global Market Intelligence.

Shifting work and school patterns fueled 5.5 million new customers in 2020 and promise unflattering year-over-year comparisons, but the prospects for growth remain upbeat. An emphasis on remote work as many companies discuss turning makeshift office closures into permanent situations along with enduring digital lifestyle changes suggest increased room for growth in the five-year outlook.

Cable operators face the biggest challenge, a result of dominant market share. The telcos are redoubling their fiber investments, including extending fiber-to-the-home, or FTTH, for wireline services and to support 5G offerings with an increasing focus on fixed wireless services for home broadband. Moreover, the satellite segment is also set for an infusion from Starlink that promises to generate ample buzz, if not a meaningful share shift.

We expect cable to feel pressure, but the industry's track record supports a staunch defense while wireless services should produce inroads, particularly in underserved areas. However, the subscriber segment most ripe for disruption is legacy DSL, which puts the telcos in a position of losing wireline share even as FTTH footprints grow.

Location

Segment