Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 1 Jun, 2022

By Milan Ringol

Worldwide smartphone shipments declined an estimated 1.8% year over year in the fourth quarter of 2021, mostly from continued component shortages and pandemic-related disruptions. Shipments for the total year, however, still grew an estimated 5.2% as factory shutdowns in 2021 were not as frequent or as severe as in 2020 while consumer demand remained robust.

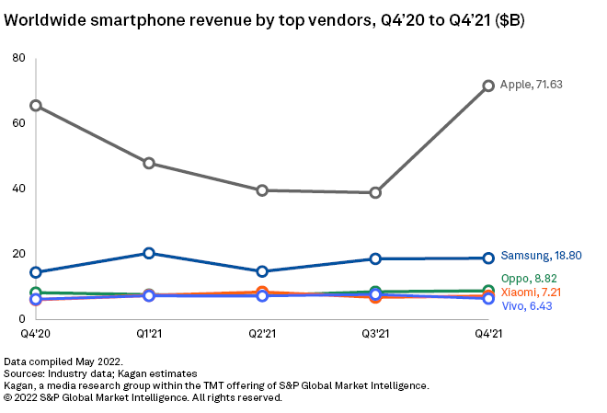

The persistent imbalance between supply and demand for electronic components, including semiconductors, affected most industries in 2021, and the smartphone market was not immune. With the supply of many key parts needed in the manufacture of smartphones — from display drivers to power management chips — still constrained, average selling prices were driven up an estimated 11.8% as manufacturers adjusted their product mixes to include a greater proportion of high-margin products. Ultimately, the smartphone market ended 2021 with an estimated 1.35 billion units shipped as well as a 17.7% jump in estimated total revenue at $424 billion.

While Samsung ceded the top spot for shipments to Apple in the fourth quarter, it maintained the lead for full year 2021, shipping an estimated 270.0 million units, up 5.1% over 2020. A growing share of the flagship S-series and ultra-premium Z-series foldables among its total shipments, together with 5G upgrades for its entry-level and midrange lineups, produced a 19% year-on-year increase in average selling price for 2021 at $268 per device.

The 5G handset market in 2021 nearly doubled in size year over year in terms of units shipped, with an estimated 536.5 million units shipped in 2021. The share of 5G handsets as a percentage of total units shipped ballooned to 39.6% in 2021 as manufacturers stepped up production: an estimated 79.4% of Apple's total smartphone shipments, for example, were 5G-capable. This is equivalent to an estimated 181.5 million units and comprises an estimated 33.8% of total 5G smartphones shipped, making Apple the biggest 5G smartphone vendor by volume in 2021.

Kagan's quarterly worldwide smartphone updates estimate the shipments, smartphone revenue and market shares of select vendors based on business unit revenues, supply chain information and proprietary shipment and market share tracking models. MI clients can access our full report that breaks out smartphone shipments by vendor along with our analysis on the North American market and the growing demand for 5G handsets.