Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Apr, 2022

By Jason Sappor

Highlights

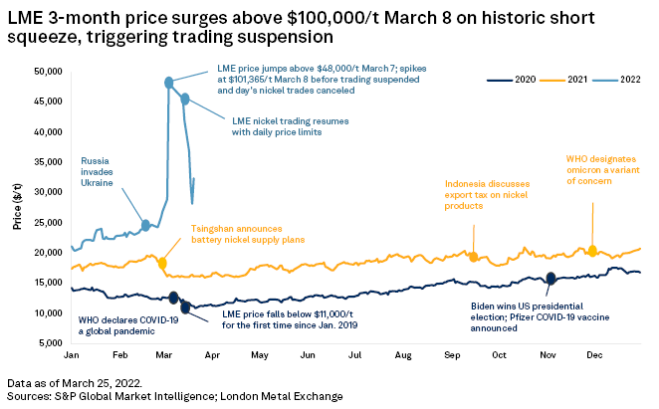

The London Metal Exchange three-month, or LME 3M, nickel price jumped 250.5% over two days to $101,365/t in trading March 8, after heightened concerns over Russian nickel exports activated a vicious short squeeze.

Learn how you can stay ahead with our metals market analysis and price forecasts.

A historic short squeeze propelled the London Metal Exchange three-month nickel price above $100,000 per tonne in trading March 8, precipitating an unprecedented series of events that severely disrupted nickel trading on the London Metal Exchange.

If you are a subscriber to S&P Capital IQ Pro Metals & Mining solution, you can access the Nickel Commodity Briefing Service March 2022 Full report and Databook.

* The London Metal Exchange three-month, or LME 3M, nickel price jumped 250.5% over two days to $101,365/t in trading March 8, after heightened concerns over Russian nickel exports activated a vicious short squeeze.

* The short squeeze gathered momentum as China's Tsingshan Holding Group Co. Ltd. attempted to cover its massive short position, which is reportedly equivalent to between 100,000 tonnes and 200,000 tonnes of metal.

* The acute price surge pushed the LME to cancel all nickel trades made March 8 and to suspend trading for 6 working days.

* LME nickel trading restarted March 16, with the price falling to $35,491/t on March 25 amid extreme volatility.

* There is a risk that another short squeeze could hit the LME nickel price in the near term, given the presence of both a dominant warrant-holding position on available LME stocks and Tsingshan's short position.

* Our global primary nickel market surplus forecast for 2022 has widened to 46,000 tonnes from 34,000 tonnes previously, on expectations that the macroeconomic impact of the Russia-Ukraine conflict will dent global primary consumption.

* This will lower the LME 3M nickel price from its recent high levels to an average of $32,868/t for 2022, according to our expectations.

Webinar

Blog

Location

Products & Offerings