Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsEU economic recovery fund provides opportunities and risks for Central Europe

What is NextGenerationEU and Recovery and Resilience Facility?

The “NextGenerationEU” (NGEU) is a joint fiscal response to the COVID-19 virus pandemic initiated by the European Union (EU) heads of state in 2020 to kickstart Europe’s post-pandemic economic recovery and break through the recession crisis happening in Europe. The Recovery and Resilience Facility (RRF) is the core component of the NGEU stimulus package.

The total amount of the NGEU recovery program is amounting to EUR750 billion, which is 5.5% of the EU27’s GDP in year 2019, seemingly to be the largest investment program and stimulus plan in the Europe since the US’s Marshall Plan. The RRF which is playing the main role in the NGEU stimulus package accounts for EUR672.5 billion in total. Within the RRF, the loans make up EUR360 billion and grants EUR312.5 billion, which is altogether 90% of the total NGEU recovery funds.

In April 2021, the European Commission should have received the “recovery and resilience plans” which entails reform and investment objectives in detail from all the EU’s member-state governments. After that, the European Commission took two months to assess all the submitted country plans based on multiple goals, with particular emphasis on supporting the green and digital transformation.

Enough said of context and with country plans are now available, let us assess the funding priorities and their potential impact of growth and public finances, as well as some of the associated risks and deficiencies that would reduce the positive impacts of the RFF on the European Union’s 11 members states from Central and Eastern Europe (CEE; EU-11).

Where do the EU-11 countries in Central and Eastern Europe currently stand on key RRF objectives?

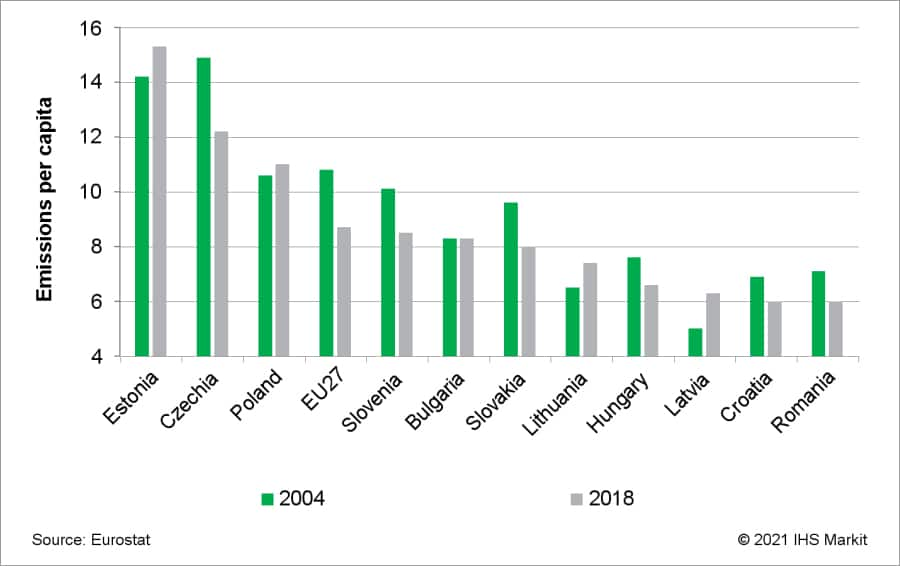

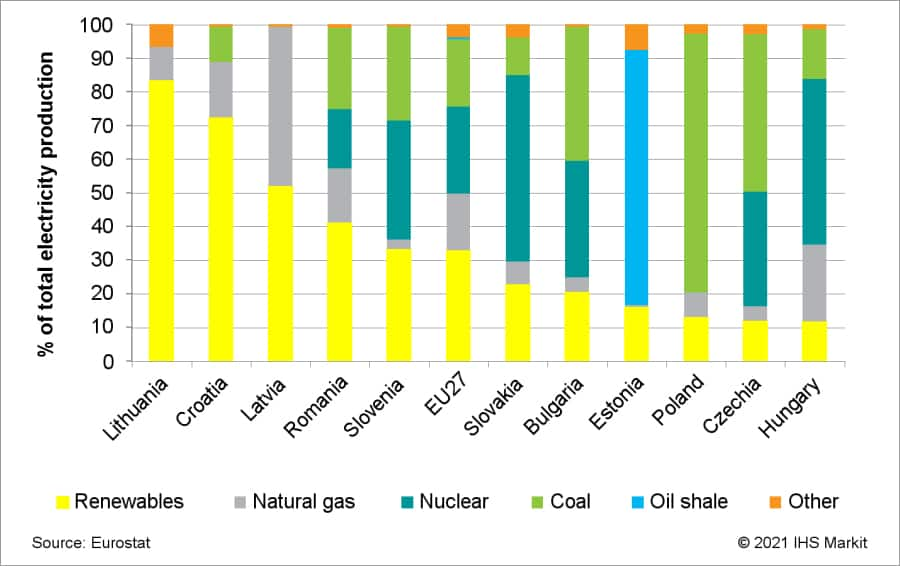

The EU-11 countries currently present a mixed picture in terms of progress towards digitalization, the green economy, and innovation. Romania, Croatia, and Latvia had the lowest per-capita emissions of greenhouse gas in the region in 2018 (see Chart 1). In contrast, three countries were above the EU average: Estonia, Czechia, and Poland. The poor emissions results for Estonia, Czechia, and Poland stem partly from the three countries’ energy mix, which is highly dependent on either coal (Poland and Czechia) or oil shale (Estonia). These three countries are among the region’s worst performers in terms of renewables as a share of total electricity production (see Chart 2). On the other hand, Lithuania and Croatia have comparatively high shares of renewables production, stemming mainly from hydro in the Croatian case and a mix of sources in Lithuania’s case. In absolute terms, Romania produces the most electricity from renewable sources among EU-11 countries, primarily hydro, with smaller shares of wind and solar.

Geothermal production is almost non-existent in EU-11 countries, signalling a potential source of growth. Hungary does currently have limited capacity and plans to develop further. Meanwhile, Slovakia is building its first geothermal power plant in Žiar nad Hronom, with the aim of bringing clean and sustainable electricity and residual heat to about 50,000 households, scheduled to begin operations in early 2026.

Looking at progress from 2009 to 2018 in EU-11 countries, the green energy transition had been broad-based in Bulgaria and Romania, with renewables growth stemming from a combination of solar, hydro, and wind. Elsewhere, growth has been driven either by solar (Czechia, Slovakia, and Slovenia), wind (Estonia, Lithuania, and Croatia), or a combination of the two (Hungary and Poland). In Latvia, renewables production has stagnated since 2009.

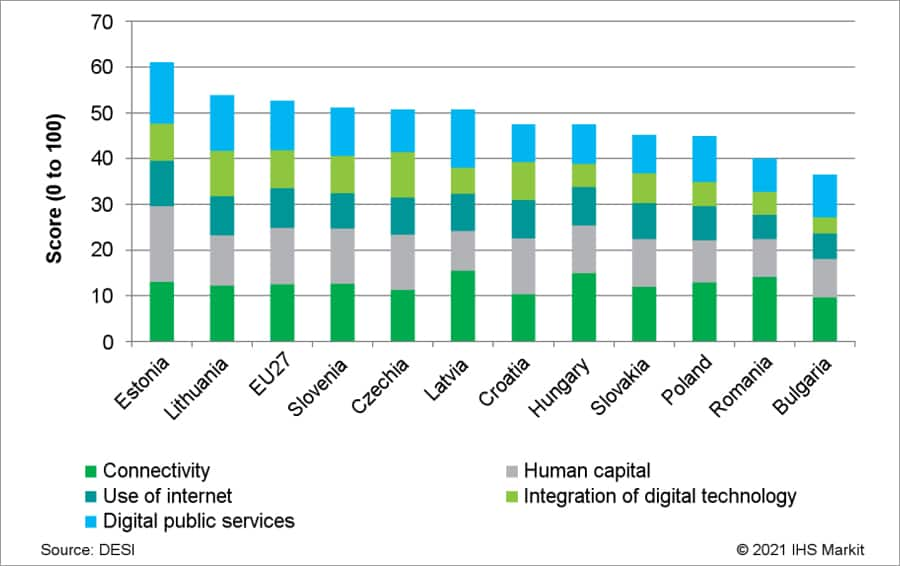

In terms of digitalisation, the EU’s Digital Economy and Society Index (DESI) indicates that Estonia and Lithuania are in the best position, ranking above the EU average. In contrast, Bulgaria and Romania are lagging behind (see Chart 3).

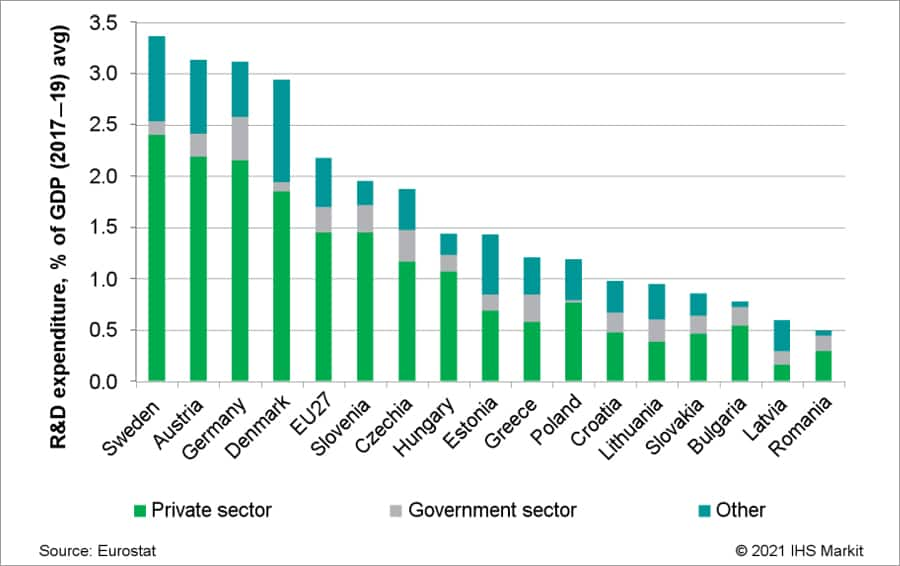

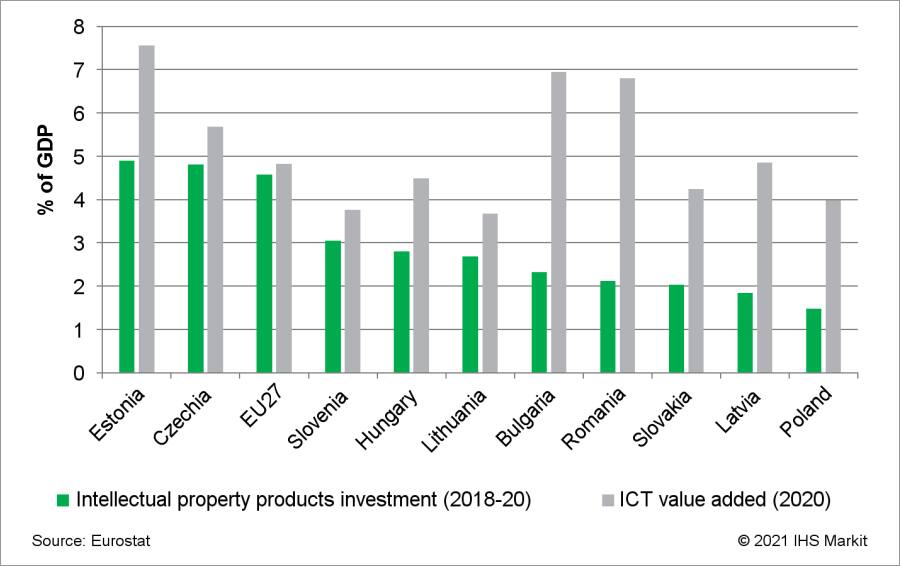

On the innovation front, EU-11 countries continue to perform poorly relative to more advanced EU countries, and all 11 stood below the EU average in terms of research and development (R&D) spending in 2017–19 (see Chart 4). Slovenia, Czechia, and Hungary were the leaders, while Romania and Latvia ranked lowest. Estonia ranks top in the region in terms of both investment in intellectual property products as well as the share of information and communications in GDP (see Chart 5). With regards to automation, Slovakia, Czechia, and Slovenia currently lead the region in the number of robots per manufacturing employee; however, the pandemic slowed the progress in 2020.

Potential impact of the RFF recovery program on growth for Central Europe

The Recovery and Resilience Facility (RRF) presents immense opportunities for Central Europe, improving the region’s prospects for long-term growth and environmental sustainability while helping to shift away from the low-wage development model of the last 30 years as well as avoid the middle-income trap. The information and communications technology (ICT) and renewable energy sectors are expected to serve as springboards, triggering further economic convergence with the wealthier EU countries. The RRF could also trigger more substantial inflows of foreign direct investment (FDI) in those high value-added creating sectors as a result of sizeable projects or created infrastructure that countries currently lack.

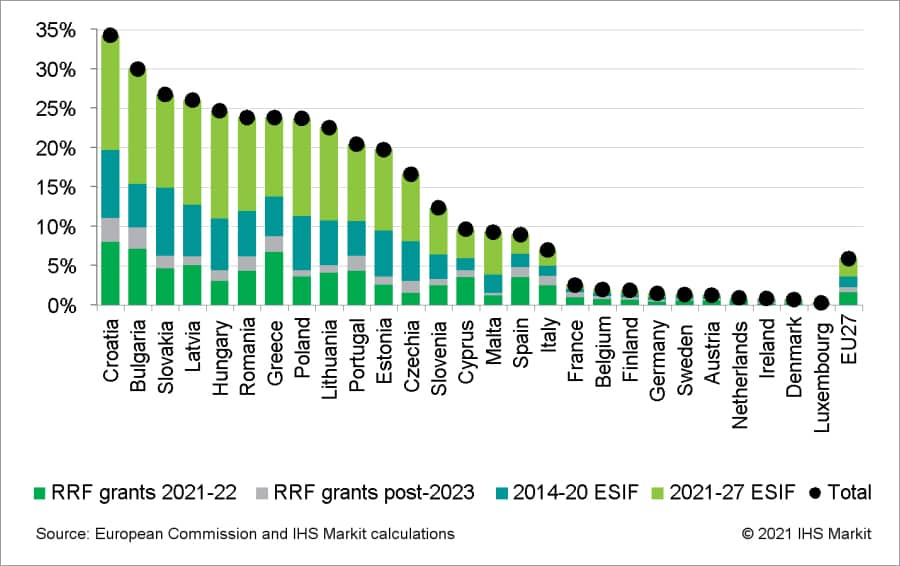

While the impact of the RRF will be fairly limited in 2021, it is important to keep in mind that the NGEU stimulus package’s funds are coming on top of the EU’s normal seven-year budget for 2021–2027 (at EUR1.2 trillion), in addition to the unused funds from the 2014–2020 budget (see Chart 6). The RRF grants are projected to significantly boost investment and productivity from 2022 onwards, speeding up the post-COVID-19 economic recovery, reducing income inequality, and ensuring more sustainable development going forward. These efforts are expected to better prepare EU countries for the next potential crisis (e.g., another pandemic). Education reforms will also be crucial, as the new economy will create demand for different types of jobs with special skills, including programmers and automation and robotics technicians. In order to ensure that labour supply meets demand for such professions, governments must ensure that the countries’ education systems are well-equipped through adequate vocational education and training.

Gauging the impact of the RRF from 2021 through to 2027, S&P Global’s May 2021 forecast assumes that 2027 GDP growth will be significantly higher than it had expected a year earlier, thanks to a better-than-expected performance since mid-2020, combined with the RRF. Nevertheless, our 2027 projection is in most cases still lower than we had anticipated in February 2020, owing to lost output in the services sector that will not be regained.

Challenges in automobiles and energy sector of Central Europe

For Central Europe, the automotive and energy sectors present key challenges that deserve further analysis. In the former’s case, the four Visegrad countries, Romania, and Slovenia are important producers of cars and car parts. While several electric and hybrid car models are produced in the region, all six of these countries are more focused on vehicles with combustion engines. If Central European countries fail to establish themselves in the electric vehicle (EV) ecosystem, the automotive sector (including many components producers) will be threatened as emissions standards are tightened, forcing a shift towards electric cars.

On a positive note, Central European countries have gained importance in electric battery production in recent years, with more capacity planned. In addition to Poland’s LG plant, the region also hosts battery factories in Hungary (SK Innovation). Moreover, Slovakia’s InoBat Auto is building a homegrown battery plant in conjunction with Wildcat Discovery Technologies of the US, with a scheduled launch in 2022. Finally, Poland, Czechia, and Slovakia are competing as a location for one of Volkswagen’s new gigafactories, corresponding with the European Commission’s plans to nearshore battery production. In this respect, Czechia benefits from having Europe’s largest deposits of lithium at Cínovec, situated next to the German border.

Another key challenge comes on the energy front. The costs related to the energy transition will be enormous, particularly in the case of Poland, which still relies on coal for more than 70% of electricity production. Poland’s ruling Law and Justice (Prawo i Sprawiedliwość: PiS) party has been reluctant to make plans to phase out coal production, given the potential impact on employment and energy security. Currently the only EU member that has not committed to climate neutrality by 2050, Poland is not planning to close its last coal plant until 2049.

Aside from coal, Polish electricity is derived from a variety of sources, including natural gas, onshore wind, and hydro and solar power; however, the share of renewables stands well below the EU average. Poland has recently taken steps to increase investments in renewable energy. Installed capacity in solar power has soared in recent years, thanks to government subsidies that encourage households to install solar panels on roofs. The number of households with solar panels rose to over 450,000 by December 2020 from 4,000 in 2015. Although Poland currently has no offshore wind farms, the National Energy and Climate Plan (NECP) singled out offshore wind as a key technology. A new Offshore Wind Act took effect in February 2021, with the aim of installing the first turbines by 2025. Poland is viewed as having enormous potential in offshore wind, a development that would help revitalise port cities such as Szczecin, Gdańsk, and Gdynia. Other Central Europe countries also face challenges related to the energy transition, particularly given the need to reduce emissions to net zero by 2050.

Will Central and Eastern Europe (CEE) countries emerge with stronger public finances?

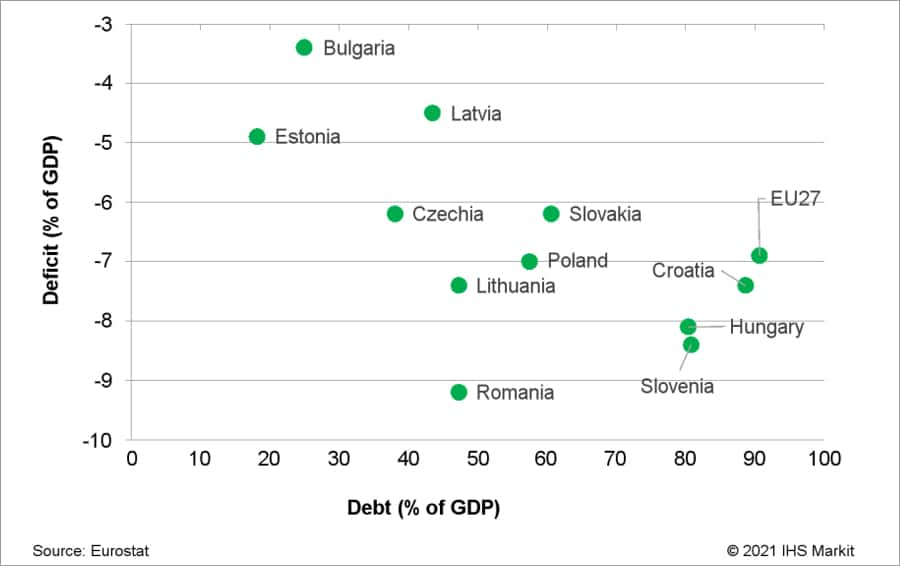

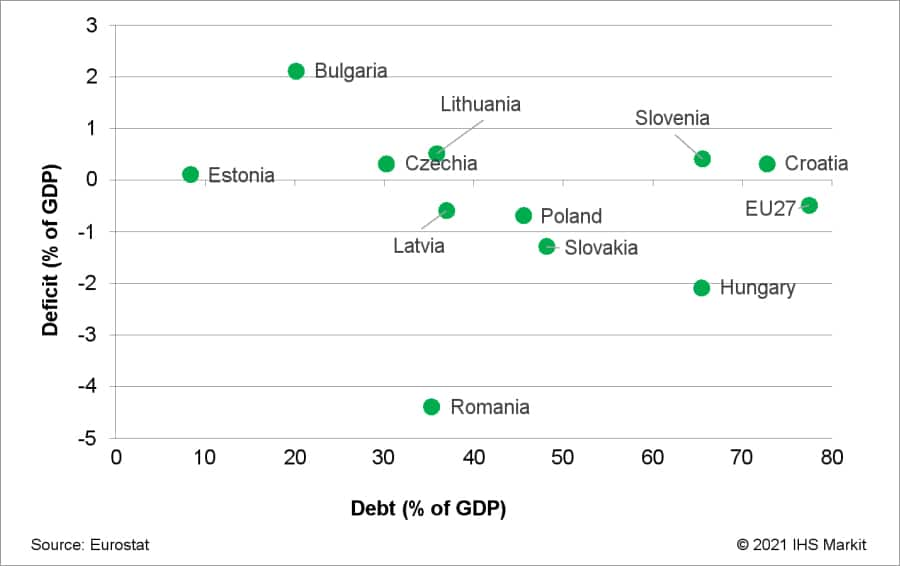

If investments ensure higher potential growth and resilience, the RRF would boost fiscal sustainability and decrease the debt burden in EU-11 countries. The RRF has arrived at an opportune time for Central Europe, which reported a steep deterioration of fiscal deficit ratios in 2020 because of falling GDP and a surge in anti-crisis expenditures. In 2019, all EU-11 countries, except for Romania, had budget deficits below 3% of GDP, and many countries achieved fiscal surpluses; however, by 2020 the region’s fiscal imbalances ranged from 3.4% of GDP in Bulgaria to 9.2% in Romania (see Charts 7 and 8). Debt levels increased accordingly and are expected to rise further in most countries at least until 2022, while fiscal deficits are expected to gradually decline.

Encouragingly, RRF grants (which amount to 6.4% of 2019 GDP in Romania, or 4% net) are likely to ease pressure on the budget or at least enable the country to finance more productivity-enhancing projects than a stretched national budget would have allowed. For countries that manage to raise productivity and increase resilience to shocks, the investments can have a positive impact on the debt burden in the longer term owing to higher and more stable growth and less reliance on primary surpluses that could weaken growth.

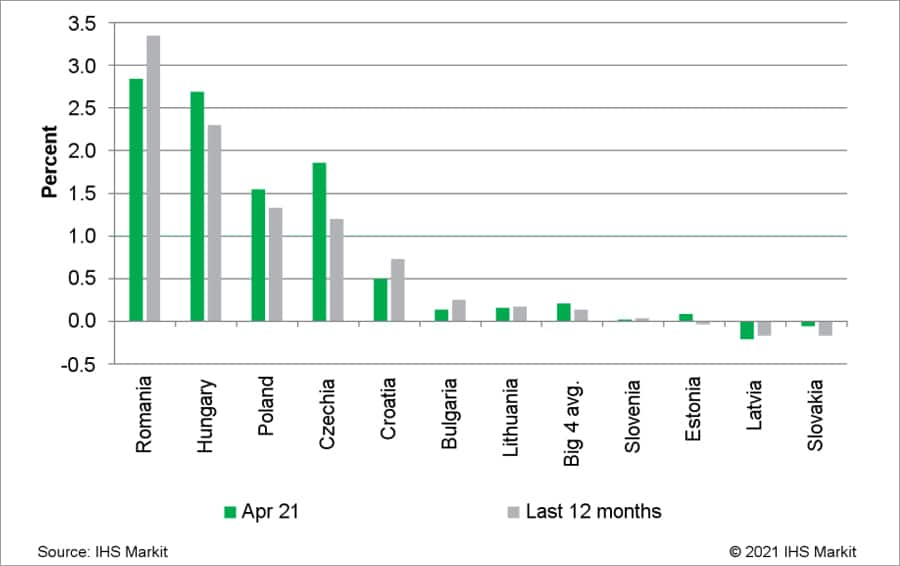

The Baltics, Slovenia, and Slovakia have less incentive to take loans from the RRF owing to low borrowing costs the countries enjoy as eurozone members (see Chart 9). In contrast, Romania and Hungary have high borrowing costs, which are close to 3% compared with close to 0% rates in the four biggest borrowers in the EU (Italy, France, Germany, and Spain). Hungary, however, has decided not to apply for RRF loans for now in order to limit growth in public debt (which jumped to 80% of GDP in 2020, versus less than 50% in Romania).

Negative impact of corruption, government instability, and social activism on EU recovery fund absorption

Corruption risks, particularly related to the EU subsidies, will represent a major obstacle in effective absorption of the RRF funds in some EU-11 member states. There is no EU legislation in place obliging EU member states to disclose the ultimate beneficiaries of EU subsidies. According to the European Anti-Fraud Office (OLAF), Hungary is the EU leader in terms of suspected irregularities, including suspected misuse of EU recovery funds. The irregularities allegedly involved 3.97% of total EU payments in 2019, a figure 10 times higher than the EU average (0.36%) and seven times higher than second-ranking Slovakia (0.53%).

Weak and instable governments, including lack of policy unity among coalition partners or interpersonal rifts among coalition partners, also risk causing delays to the strengthening of institutional capacity for EU recovery funds absorption, the fight against corruption, improved digitalisation, and changes in educational systems.

Social activism is also very likely contributing to delays to some aspects of RRF-related projects. This is particularly likely in terms of “green energy transition” in Poland, where the risk of strikes and protests affecting the mining sector remains elevated. The agreement reached between the government and trade unions representing coal miners is unlikely to reduce the risk of industrial action in the sector, with the potential to affect Poland’s objectives and pledges under the RRF, as the country plans to close its coal mines by 2049 as part of its commitment to phase out coal to reduce carbon emissions, in line with the EU’s Green Deal targets.

Bottom Line

Based on the above limitations and the history of weak absorption rates across Central Europe, S&P Global is somewhat sceptical about the region’s ability to fully benefit from the RRF. Indeed, devising and implementing effective reform programmes will take considerable effort, especially for countries that are further behind in terms of the green economy, digitalisation, and innovation. We will, however, consider upgrading our forecasts on a country-by-country basis during the coming months, as more details are made available about the RRF economic recovery plans and the response of the European Commission.

Chart 1: Estonia has the most challenges with greenhouse gas emissions

Chart 2: Among EU-11, Hungary has lowest share of electricity from renewables

Chart 3: Digitisation progress strongest in Estonia, Lithuania

Chart 4: Across EU-11, R&D spending stands below EU average

Chart 5: Estonia, Czechia have highest share of investment in intellectual property products

Chart 6: Funds to absorb in 2021-27, excl. RRF loans (% of 2019 GDP)

Chart 7: General government finances were broadly favourable in 2019

Don't want to miss out the latest update on the Europe's post COVID-19 economic recovery and prospect?

Experts

View AllEvents

4th Annual Understanding the 2028 Intelligence Vehicle: CO2 and Zero Direct Emissions

September 03 2021 | Europe & CIS As regulations cross the EU become ever more stringent, automakers need to balance efficiency and sustainability with strength and safety. Our...

{"slidesToScroll": 1,"dots": true,"arrows": true,"autoplay":false}

Connect anytime, anywhere

Acquire targeted insights from over 700 industry experts and thought leaders.

Wish to stay current with monthly curated content regarding Europe's economy exclusively for you?

{}

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2ftopic%2feu-economic-recovery-fund-for-central-europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2ftopic%2feu-economic-recovery-fund-for-central-europe.html&text=EU+Recovery+Fund%3a+Impact+%26+Risk+for+Central+Europe+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2ftopic%2feu-economic-recovery-fund-for-central-europe.html","enabled":true},{"name":"email","url":"?subject=EU Recovery Fund: Impact & Risk for Central Europe | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2ftopic%2feu-economic-recovery-fund-for-central-europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EU+Recovery+Fund%3a+Impact+%26+Risk+for+Central+Europe+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2ftopic%2feu-economic-recovery-fund-for-central-europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}