Understanding the country vulnerability ratings index

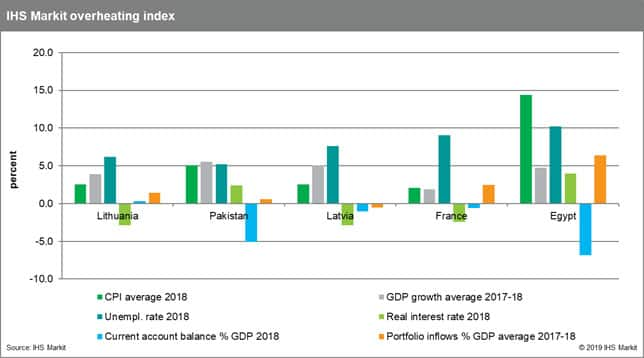

Although world GDP growth is projected to decelerate in 2019, there are still pockets of the global economy that continue to expand at high, and potentially unsustainable, rates. A country that is thought to be overheating is in danger of a sharp correction that will include a substantial deceleration of growth, if not a recession. We examined the classic signs of overheating – accelerating inflation, rapid GDP growth, credit expansion, rising real interest rates and tightening labor markets and included the impact from capital inflows and short-term debt. Using eight potential warning signs, we compiled an overall index that provides an early warning system for countries that are at risk of overheating. Each country was ranked from top to bottom based on its vulnerability in each individual criterion, with the final, headline index being an average of the country’s ranking across the criteria. While this index does not necessarily suggest that a country faces an imminent threat of crashing, it does show that there are signs that economic growth may be exceeding potential and a correction might occur in the near future.

Principal Economist Andrew Birch introduces index