Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 18, 2020

Weekly Pricing Pulse Vaccine news offers commodity demand hope

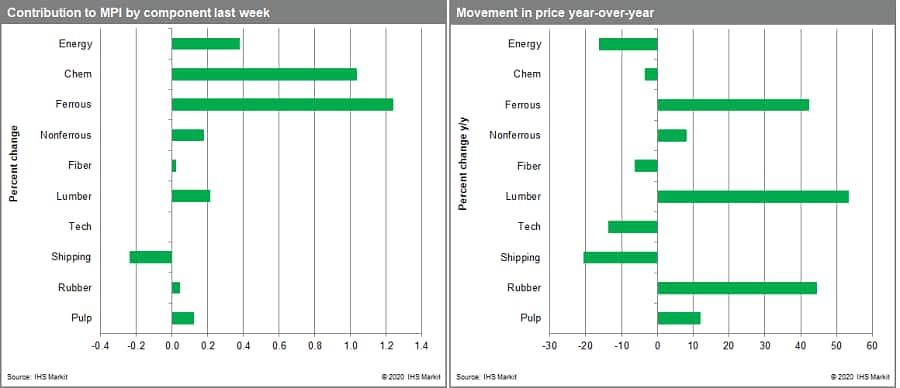

The announcement of a COVID-19 vaccine trial with a 90% success rate was well received by markets desperate for positive news in the face of rocketing COVID-19 case counts in Europe and the US. Commodity prices as measured by our materials price index rose 3.0% in a broad-based move, reversing the large, broad-based retreat of the previous week.

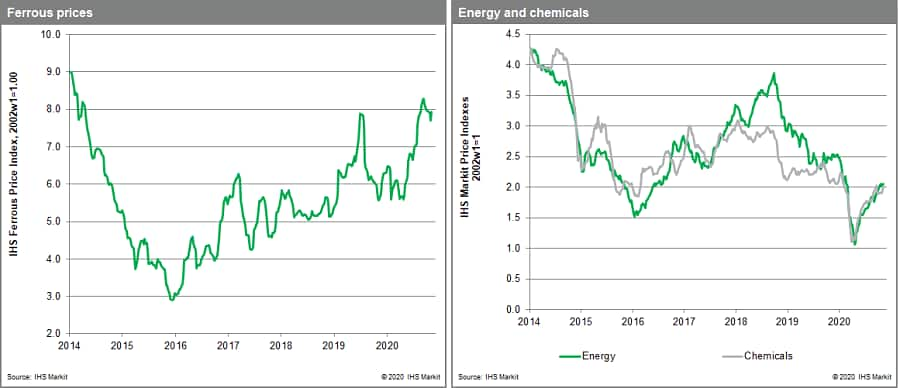

Chemicals price stood out, rising 6.2% with strong rises in ethylene (8.9%) and benzene (5.2%) with Asian prices particularly outperforming. Despite Chinese ethylene production increasing, South Korean spot demand remained firm. Steady buying coupled with rising feedstock costs, pushed prices higher. Energy prices jumped 3.4% as crude oil rose 9.4% on optimism surrounding the vaccine. Still, OPEC will now have to reconsider the 2.0 MMb/d production increase planned for January. Crude prices fell towards the week's end on data showing motorway traffic in some European countries down around 50% on pre-second lockdown levels. US vehicle miles have also declined. Steel raw materials prices also rose with iron ore jumped back to $124 /Mt on a surge in Chinese steel prices. Iron ore supply has been improving, but declining Chinese steel inventories have boosted finished steel prices by 10% since the end of October. Traders have been buying up volumes on the expectation that construction activity will extend well into December this winter. Non-ferrous metal prices also rose 1.9% on anticipation of a strong and prolonged construction season in mainland China. All six industrial base metals increased for the week with copper a stand-out, closing above $7,000 /Mt on Monday on a weaker US dollar and declining inventory on the Shanghai Futures Exchange (down by more than 20% since late August). Only Freight and DRAMs fell last week, declining 6.6% and 0.8%, respectively. Australian iron ore exports have dipped in the past couple of weeks whilst coking coal trade has also slowed, reducing capsize vessel demand.

The Pfizer vaccine news was well received across all markets last week, though optimism was later tempered as details around its production, distribution and actual performance became clear. IHS Markit's baseline assumption on a vaccine against COVID-19, is that it is likely there will be a fully approved, effective vaccine with access to large populations across several countries in the (northern hemisphere's) summer of 2021. This means that this winter presents a real challenge, as highlighted by our expectation that the Eurozone economy will now contract in the fourth quarter.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-vaccine-news-offers-commodity-demand-hope.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-vaccine-news-offers-commodity-demand-hope.html&text=Weekly+Pricing+Pulse+Vaccine+news+offers+commodity+demand+hope+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-vaccine-news-offers-commodity-demand-hope.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse Vaccine news offers commodity demand hope | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-vaccine-news-offers-commodity-demand-hope.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse+Vaccine+news+offers+commodity+demand+hope+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-vaccine-news-offers-commodity-demand-hope.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}