Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 13, 2018

Weekly Pricing Pulse: Trade developments and lackluster Chinese data weigh on commodity prices

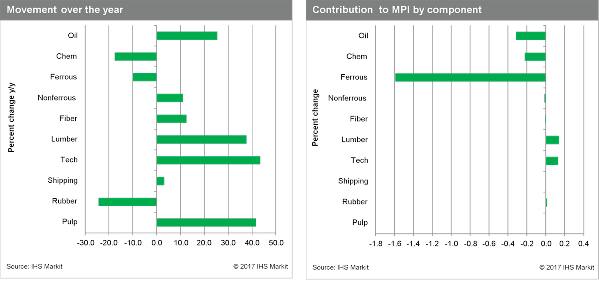

Our Materials Price Index (MPI) fell 1.9% last week, its ninth retreat in the last ten weeks. The decline was relatively narrow, however, with only five sub-indexes falling; another two were unchanged. It was largely a decline in ferrous metals, which retreated 6.4%, that continued the MPI's losing streak.

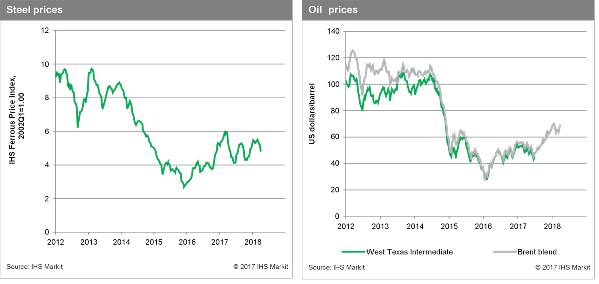

The driver behind the sharp drop in the ferrous index was falling iron ore prices./ Iron ore prices took off earlier this year, approaching $80 per metric ton on the expectation of further Chinese stimulus. With the hoped-for stimulus looking less likely, fundamentals are reasserting themselves. Chinese iron ore port stocks are relatively high, while ore shipments to China have begun to slow-both are signs of weaker demand, which is undercutting prices.

Signs of decelerating growth are also beginning to surface in Chinese macroeconomic data. The Caixin General Services PMI fell to 51.8, a decline of 1.5 from February, as new order activity fell. This follows the March Caixin PMI Manufacturing Index that also showed a slowdown in growth. Apart from somewhat disappointing Chinese data, markets are also having to deal with more inflammatory rhetoric and actions on the trade front. Tit-for-tat trade actions by the United States and China and additional US sanctions on Russia have continued to unsettle markets. Even though the March PMI manufacturing numbers in the United States and the Eurozone were solid, this good news was not enough to reassure markets that are growing increasingly nervous about a possible full-blown trade war. Indeed, commodity markets are signalling that trade developments may soon threaten the expansion.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-developments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-developments.html&text=Weekly+Pricing+Pulse%3a+Trade+developments+and+lackluster+Chinese+data+weigh+on+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-developments.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Trade developments and lackluster Chinese data weigh on commodity prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-developments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Trade+developments+and+lackluster+Chinese+data+weigh+on+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-developments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}