Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 28, 2019

Weekly Pricing Pulse: Trade actions create a more bearish outlook for commodities

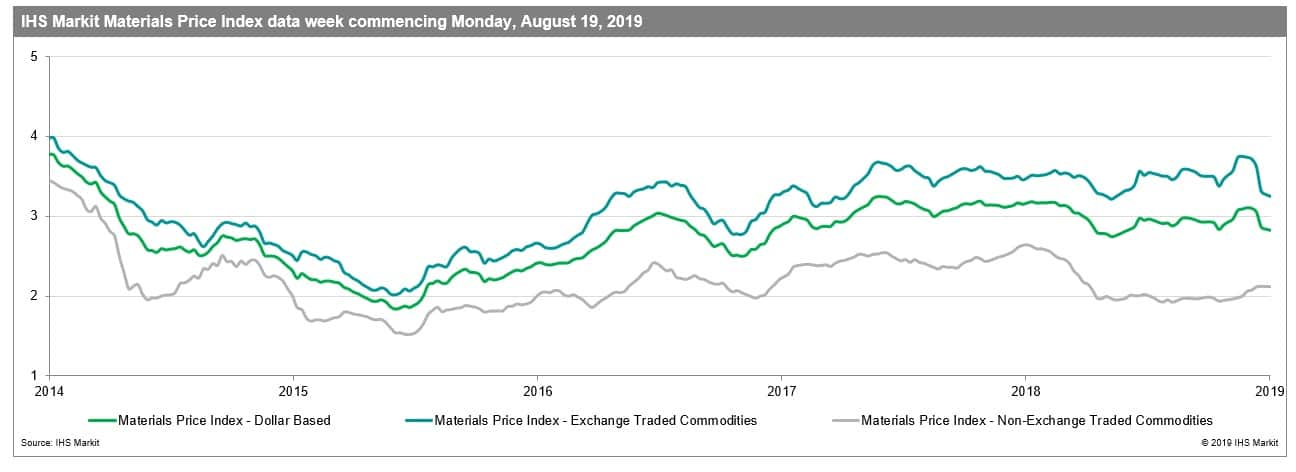

Commodity prices, as measured by our Materials Price Index (MPI), fell another 0.5% last week, their fifth consecutive weekly decline. While hints of additional monetary accommodation from the US Federal Reserve helped lift markets mid-week, any positives were again offset by US and Chinese trade actions at week's end. Highlighting the negative sentiment that now pervades markets, the MPI has fallen by almost 9.0% since mid-July, completely wiping out the early summer rally in prices.

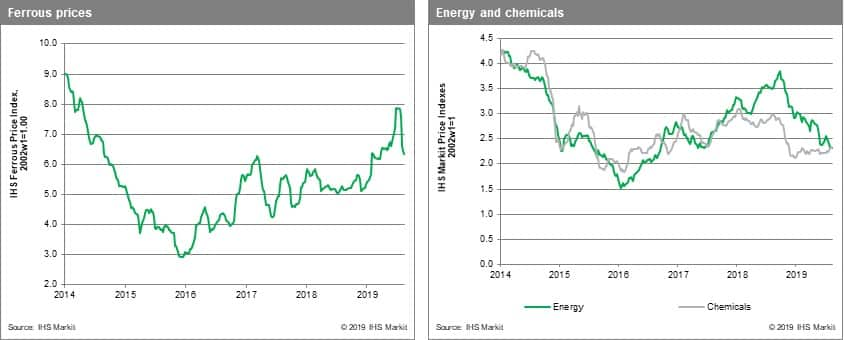

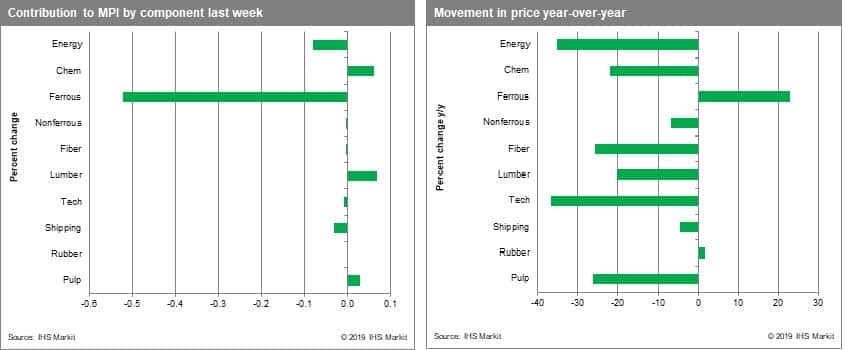

Oil prices rose 1.5% last week, partially on rumors that Iran's Foreign Minister might make an appearance at the G-7 talks, (which turned out to be true). However, the rest of the energy complex fell, nullifying oil's gain, with the MPI's energy sub-index falling 0.5%. The MPI's DRAM price index fell 1.5% for the week and is now down some 25% since January, not surprising given the 14.5% year on year drop in global semiconductor sales. Declining finished steel prices and production cuts helped lower iron ore prices, and pulled the ferrous sub index 1.4% lower. Freight prices fell 0.6% on both lower coal and iron ore prices. This said, gains in certain Australian time charter rates indicate an approaching bottom in ocean going freight rates.

Last weeks' volley of trade actions, coupled with the dialogue at the G-7 meeting over the weekend, only serve to increase uncertainty and feed the downbeat mood in markets and volatility in commodity markets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-create-more-bearish-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-create-more-bearish-outlook.html&text=Weekly+Pricing+Pulse%3a+Trade+actions+create+a+more+bearish+outlook+for+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-create-more-bearish-outlook.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Trade actions create a more bearish outlook for commodities | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-create-more-bearish-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Trade+actions+create+a+more+bearish+outlook+for+commodities+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-create-more-bearish-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}