Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 17, 2021

By Michael Dall

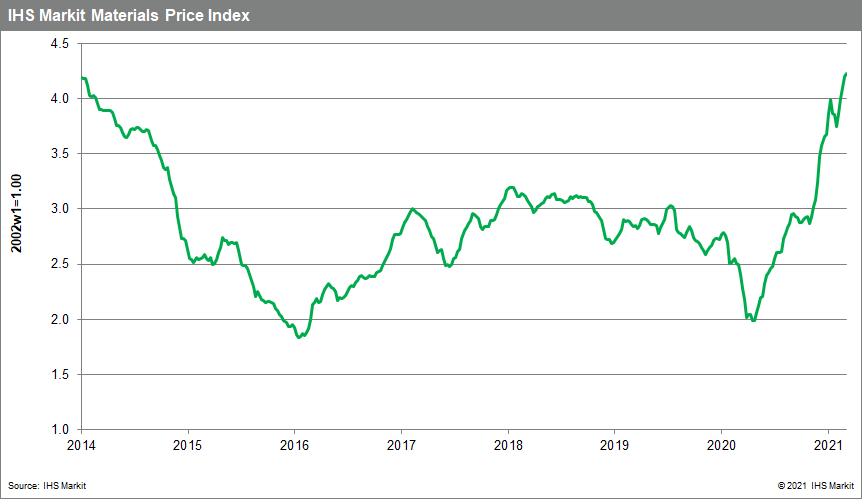

Our Materials Price Index (MPI) climbed 0.6% last week, its fifth consecutive weekly increase. This latest move sent the MPI to its highest level since December 2013. Commodity prices as measured by the MPI now stand 74% higher than mid-March 2020.

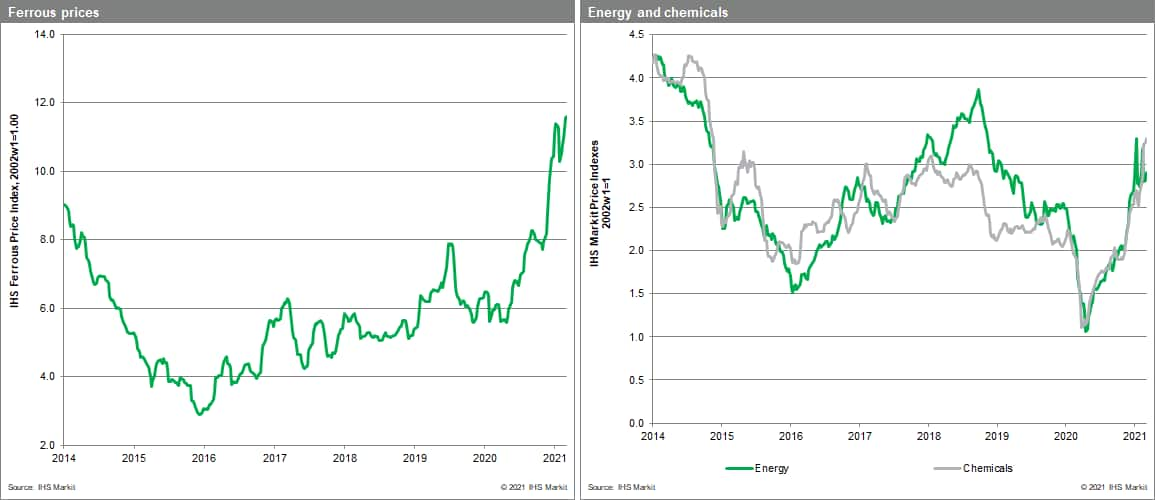

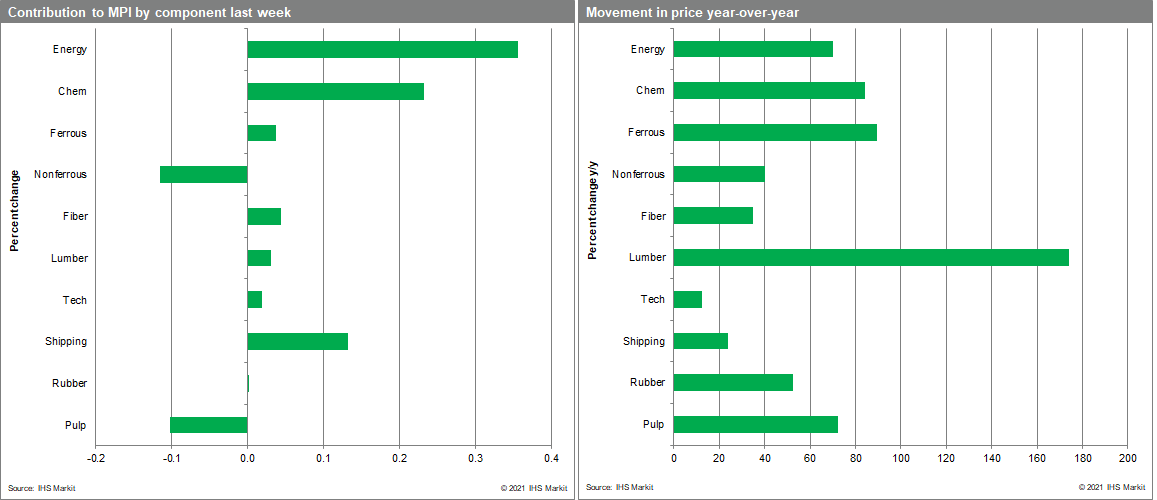

An upward move in the energy sub-index was the primary cause of last week's MPI increase. The index rose 3.3% as oil prices climbed higher. Brent crude oil broke the $70 per barrel mark for the first time since January 2020 as geopolitical tensions in the Gulf spooked oil markets. Two attacks targeting energy infrastructure in Saudi Arabia raised fears over future supply, but prices calmed once it was established that no damage was caused. However, it was a reminder of the sensitivity of oil prices to real or perceived supply disruption. Our chemicals index was another contributor to the MPI's upward move last week, increasing 1.2%. US ethylene prices continue to rise and have now jumped 77% in the last five weeks. The industry continues to reel from February's cold snap in Texas with 34% of US capacity still off-line as of last week. There is less pricing pressure in base metals with our nonferrous index down 1.5% for the week on a large correction in the nickel market. Nickel has pulled back from recent highs of $19,722 per metric ton in late February to $15,945 last week after the announcement of additional supply to the market. Stainless steel producer Tsingshan Holding Group said they would supply 100,000 metric tonnes of nickel matte suitable for battery production, easing fears that growing EV production will create a shortage.

The US treasuries sell-off continued last week as President Biden's stimulus bill received approval from the Senate, once again focusing investors on future growth prospects and the associated inflation risks. A shift in portfolio allocations into riskier asset classes like commodities, since last May has helped to add upward momentum to prices. Indeed, the surge in commodity prices over the past year now guarantees a burst in goods price inflation this summer. Whether or not commodity markets show the kind of prolonged strength last seen between 2010 and 2014 will depend how quickly supply-side bottlenecks are resolved this year. In most industries, available capacity looks sufficient to meet projected demand growth in 2021 and 2022 -- if operating rates improve.

Posted 17 March 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence