Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 15, 2019

Weekly Pricing Pulse: Negative sentiment increases as trade talks are derailed

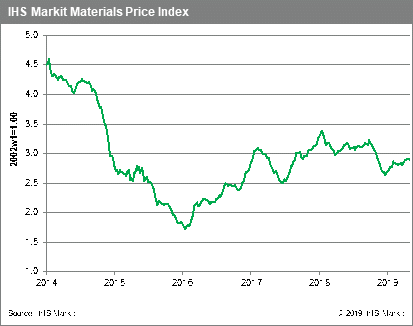

As the 11th round of US-China trade talks ended, markets reacted poorly to the absence of a deal and the threat of an increase in tariffs. Commodities followed equity and bond markets lower, with our Materials price index dropping 0.4% for the week.

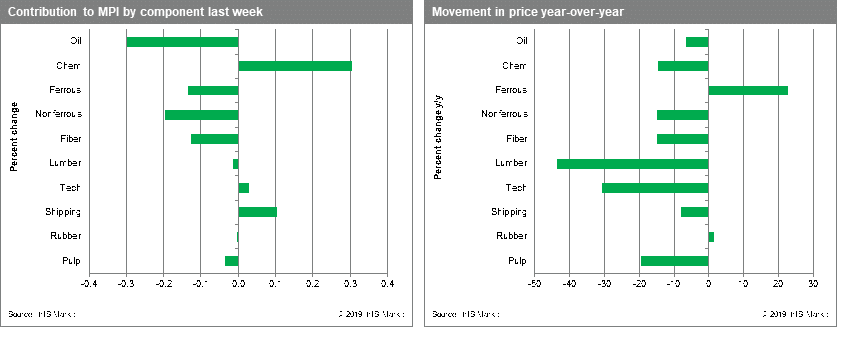

The fall in the MPI was broad based with seven of the MPI's ten

components retreating last week. Chemicals on the other hand moved

up for the fifth consecutive week by 1.7% as production capacity

remains shuttered in the US. Freight prices too showed a 3.4% gain

as bulk rates recover from the Q1 shock. Materials closely linked

to China suffered the most last week. Non-ferrous metals, for

example, fell 2.9%, their fifth consecutive weekly decline. Fiber

prices also lost ground, falling 2.1%. Chinese textile and fabric

imports are a particular target in the List 3 tariffs that will now

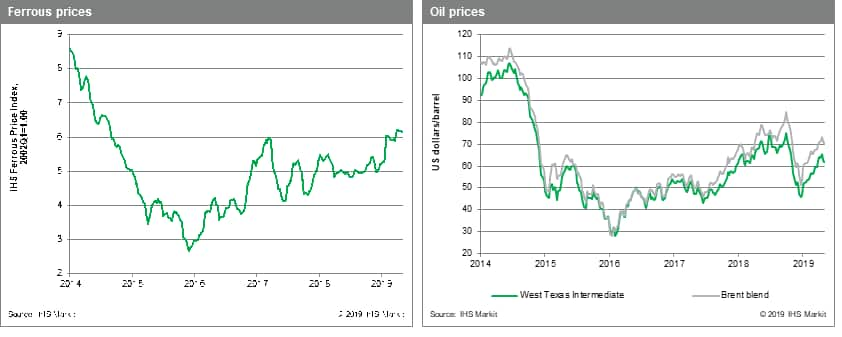

be increasing from 10% to 25%. Oil prices eased back again this

week by 1.6%, also because of trade related issues; however

supply-side issues effecting Iran and Venezuela are maintaining

pressure on crude and hence, we do not expect a sustained retreat

in prices until late 2019 or 2020.

The breakdown in US-China trade negotiations is forcing markets to

grapple with what could be a rupture in the world's largest and

most important trading relationship. The problem is complicated

because China is an important economic partner that has become

fully integrated into global supply chains. The danger now sending

a shudder through markets is that we may be looking at a process

that sees these two economies disengaging. Could conditions become

worse soon? A decision on 232 auto and auto parts tariffs is due

within a week.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-negative-sentiment-increases.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-negative-sentiment-increases.html&text=Weekly+Pricing+Pulse%3a+Negative+sentiment+increases+as+trade+talks+are+derailed+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-negative-sentiment-increases.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Negative sentiment increases as trade talks are derailed | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-negative-sentiment-increases.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Negative+sentiment+increases+as+trade+talks+are+derailed+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-negative-sentiment-increases.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}