Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 30, 2020

Weekly Pricing Pulse: More commodities roll over as uncertainty grows

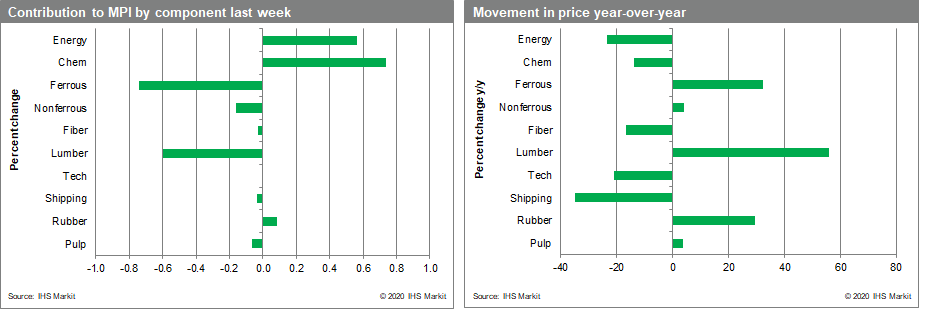

Commodity prices, as measured by our Materials Price Index (MPI), fell 0.2% last week. This was less than the fall in the previous week, but was broader based, with seven of the MPI's ten components falling. Growing COVID-19 case counts are stoking uncertainty around demand at the same time support measures, such as job retention schemes, are being phased out.

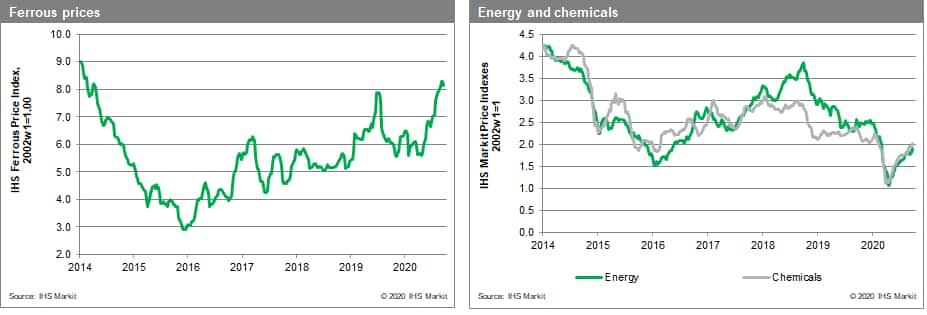

Lumber stood out again as a price mover for the week, falling another 14.4%. Prices now are down 40% from their record high of early September. Steel raw materials fell 1.7% as iron ore prices finally cracked after running above $120 /Mt since early August. Chinese steel mills have bid prices higher recently as they restock ahead of China's Golden Week holiday October 1st-7th. Non-ferrous metals prices fell 1.8% on weaker buying keyed to last week's rally in the US dollar. Nickel fared the worst falling 4.3%, with zinc and tin falling around 2.5% each. The non-ferrous market looks to be correcting, having enjoyed a boost recently from firm Chinese demand and strong sentiment around electrification and battery technology. Energy prices, still trading at low levels relative to the start of the recent crash jumped 5.7% last week powered by rises in LNG and thermal coal of 12.3% and 6.9%, respectively. European gas prices rose 20.9% on sharply colder weather in the region whilst thermal coal demand from India continues to strengthen, boosting Asian coal prices. Crude oil ticked up 1.4%. Chemicals feedstock prices rose 4.4% driven by gains in ethylene (6.8%), propylene (2.3%) and benzene (2.1%). US ethylene prices are being supported by strong demand and lower supply curtailed by planned and unplanned outages, some related to several recent hurricanes that have battered the Gulf Coast.

Commodity prices have enjoyed a strong run over the past five months, boosted by the rebound in manufacturing activity. The question is, is this bounce now beginning to fade? Concerns over growing COVID-19 case counts and the possibility of containment measures being re-imposed, plus the reduced government support are adding uncertainty to the fourth quarter outlook. Two additional known unknowns complicate the immediate outlook potentially creating added volatility: the possibility of a contested US election and the failure of the UK and EU to reach a trade agreement before the end of the withdrawal period. Our bottom-line is that we see the upward momentum exhibited recently in commodity markets, hard to maintain through year-end.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-commodities-roll-over-as-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-commodities-roll-over-as-uncertainty.html&text=Weekly+Pricing+Pulse%3a+More+commodities+roll+over+as+uncertainty+grows+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-commodities-roll-over-as-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: More commodities roll over as uncertainty grows | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-commodities-roll-over-as-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+More+commodities+roll+over+as+uncertainty+grows+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-more-commodities-roll-over-as-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}