Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 15, 2020

Weekly Pricing Pulse: How far can commodities keep rising?

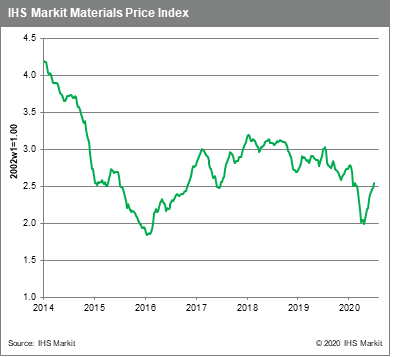

Commodity prices, as measured by our Materials Price Index (MPI), powered higher for a tenth-straight week, rising 2.7% in another broad-based move. Markets are shrugging off higher COVID-19 case counts and are instead focusing on production cuts, supply disruptions and improving demand to push prices higher. While the global economy has clearly turned a corner, our caution remains that the reaction in commodity markets seems "enthusiastic" given our near-term forecasts for physical consumption and the amount of capacity available.

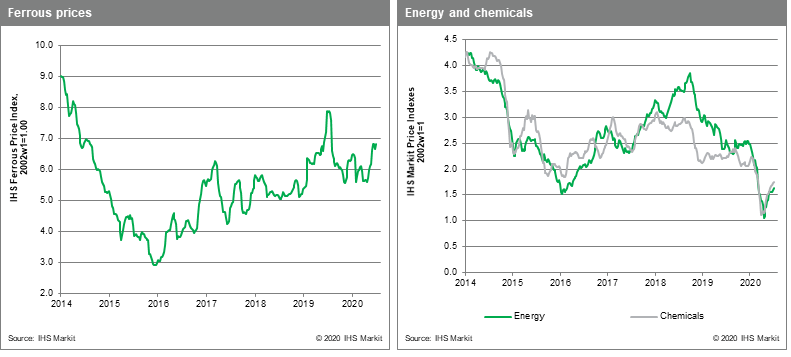

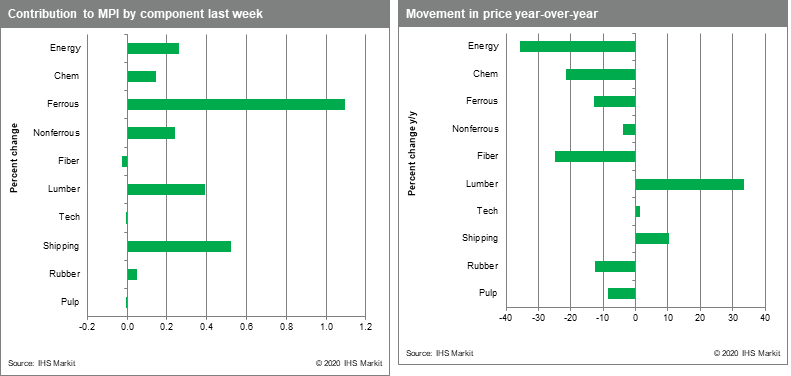

Ferrous prices led the MPI higher last week, rising 2.7%. Iron ore

CFR China rose 3.2% to $105/mt by week's end and continued in

Monday trading to $111/mt due to an uptick in Chinese rebar demand

and in spite of record iron ore exports from Australia. The MPI's

energy index rose strong 2.6%, mainly due to a 4.5% rise in crude

oil prices driven by a 6.3% rise in OPEC crude prices which have

been playing catch-up with Brent, the spread between the two

markers having reached as wide as $5 /bbl in May. The non-ferrous

sub-index increased 2.5% and is now up 17.9% from its first quarter

low. Copper again showed strength rising 3.1% on the threat of

strikes in Chile. Nickel rose 3.9%, benefiting from Chinese buying,

a factor supporting the entire base metals complex. Lumber rose

12.3% as exceptionally strong demand in Canada outpaced supply,

cleaning suppliers out in some cases. Lumber prices are now up

24.3% year-to-date, which, along with freight, are the only prices

in the index up from the start of the year. Finally, bulk freight

rose another 11.0%. The rally in ocean going bulk charter rates has

run out of steam as volumes from Brazil cooled slightly.

With materials demand still well down from pre-COVID-19 levels,

notable upward weekly price moves are coming from commodity groups

impacted by production cuts and disruptions related capacity

restrictions e.g. crude oil, base metals, freight and lumber. Some

producers not constrained by COVID-19 safety restrictions do seem

to have been caught out by the strength of the current rally. With

capacity utilization in many sectors low, however, this raises the

risk that supply will start to creep back in production,

incentivised by higher prices. Given the underlying softness in

demand, this could expose markets to a correction. The "V" shaped

recovery now being priced-in to many markets seems increasingly at

odds with this underlying fundamental.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-how-far-can-commodities-keep-rising.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-how-far-can-commodities-keep-rising.html&text=Weekly+Pricing+Pulse%3a+How+far+can+commodities+keep+rising%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-how-far-can-commodities-keep-rising.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: How far can commodities keep rising? | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-how-far-can-commodities-keep-rising.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+How+far+can+commodities+keep+rising%3f+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-how-far-can-commodities-keep-rising.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}