Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 22, 2018

Weekly Pricing Pulse: Good oil and chemical supplies push down commodity prices

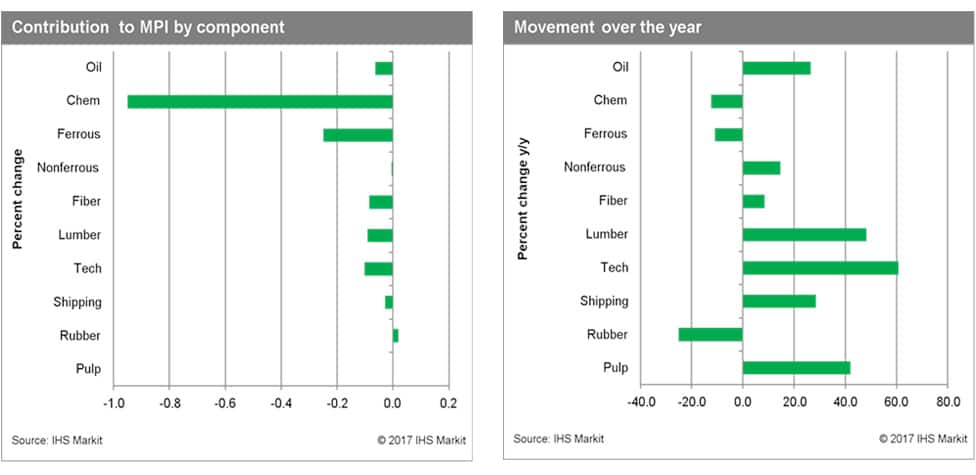

Our Materials Price Index (MPI) fell 1.6% last week, its sixth retreatin the past seven weeks. The decline was broadly based, with eight of the ten sub-indexes falling, while a ninth stayed flat. Chemical and lumber prices showed the largest declines, falling 4.2% and 3.2%, respectively. Crude oil also exhibited weakness for the second consecutive week, retreating 0.4%.

Ethylene prices tumbled last week; their 10.2% drop was the main driver pushing the chemical sub-index lower. An abundant supply of ethylene, coupled with weak demand from derivatives, has created a bearish mood in the market, with prices now falling for three consecutive weeks prices. Propylene markets also exhibited weakness, falling 1.7%, as US inventories rose on increasing dehydrogenation-unit operations. Upstream, US crude inventories registered a massive build of 5.0 MMbbl, helping push oil prices lower. Recent softness in oil prices has put downward pressure on benzene, which saw prices fall 0.7% last week.

While ample supplies in oil and chemical markets have helped check commodity prices, the global economy remains healthy; industrial production numbers released last week reaffirmed this. The highlight was the US number, which beat expectations, showing a 1.1% increase for February. This bump was driven by a jump in mining activity, but strength in business equipment also showed in the numbers. Despite strength in global manufacturing, the full-blown optimism that commodity markets started the year with has dissipated. Some of this change can be tied to political uncertainty created by the elections in Germany and Italy, along with the imposition of steel and aluminium tariffs in the United States. Technicals are also becoming unfavourable-spot prices for several commodities are now below their 200-day moving averages, which may trigger additional program selling. Fundamentally, however, we still expect slower Chinese growth, while another interest-rate hike looms in the United States. Look for more volatility ahead as commodity markets grapple with this collection of headwinds.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-oil-and-chemical-supplies-push-down-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-oil-and-chemical-supplies-push-down-commodity-prices.html&text=Weekly+Pricing+Pulse%3a+Good+oil+and+chemical+supplies+push+down+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-oil-and-chemical-supplies-push-down-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Good oil and chemical supplies push down commodity prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-oil-and-chemical-supplies-push-down-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Good+oil+and+chemical+supplies+push+down+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-oil-and-chemical-supplies-push-down-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}