Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 17, 2018

Weekly Pricing Pulse: Geopolitical turbulence drives up crude oil prices

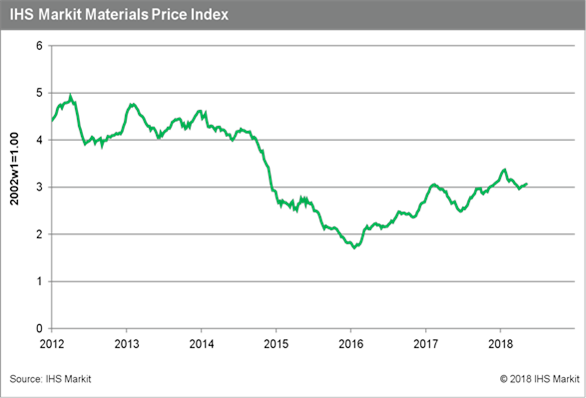

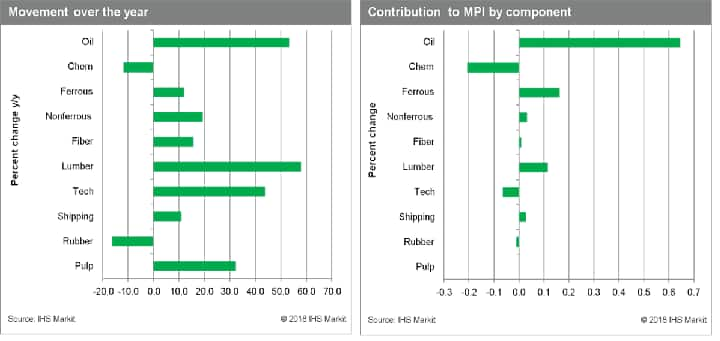

Our Materials Price Index (MPI) rose 0.7% last week, its fourth gain in five weeks. Increases in the MPI's subcomponents were broader than in recent weeks, with six increasing and another flat. Two commodities, oil and lumber, were the major drivers, both rising 3.5%.

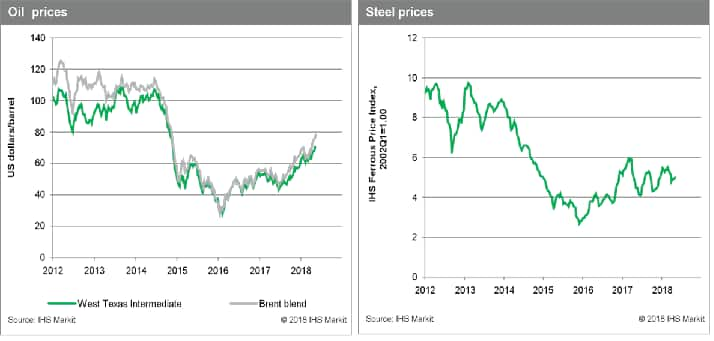

Geopolitics sent oil prices soaring last week, reinforcing the bullish sentiment that has prevailed in energy markets for the last month. Prices had rallied on expectations that President Trump would decertify the JCPOA and reimpose US sanctions on Iran; an expectation that prove to be correct on Tuesday. Adding to the market's concern is collapsing oil production in Venezuela, were economic conditions continue to worsen. ConocoPhillips seized PdVSA refining facilities critical for preparing Venezuelan heavy crude for export this past weekend, putting at risk as much as 500,000 barrels/day of exports. Fundamentals were also supportive of the upward move in oil markets last week; a rebound in US gasoline production and strong distillate exports caused US inventories to tighten across the board. In lumber markets, Canadian rail bottlenecks increased delivery times last week and backed up orders, causing a strong upward move in lumber prices for the second consecutive week.

A relatively light data week was highlighted by April CPI/PPI releases in the United States and China. The inflation reports were modest in the United States, with the CPI and PPI increasing by 0.2% m/m and 0.1% m/m, respectively. Increases in steel and aluminum prices put upward pressure on the PPI; however, the topline index remained subdued. In China, both the CPI and PPI fell by 0.2% m/m, while year-on-year money supply growth slowed in April; each of these indicators raise concerns about demand conditions in China. Commodity markets have had a good run over the past month, stabilizing and then rebounding slightly after their first quarter correction. The question is whether they can maintain their recent momentum in the face of a June US interest rate increase and clearer signs of a slowing Chinese economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-turbulence-drives-up-crude-oil-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-turbulence-drives-up-crude-oil-prices.html&text=Weekly+Pricing+Pulse%3a+Geopolitical+turbulence+drives+up+crude+oil+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-turbulence-drives-up-crude-oil-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Geopolitical turbulence drives up crude oil prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-turbulence-drives-up-crude-oil-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Geopolitical+turbulence+drives+up+crude+oil+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-turbulence-drives-up-crude-oil-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}