Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 19, 2018

Weekly Pricing Pulse: Geopolitical risks push up commodity prices

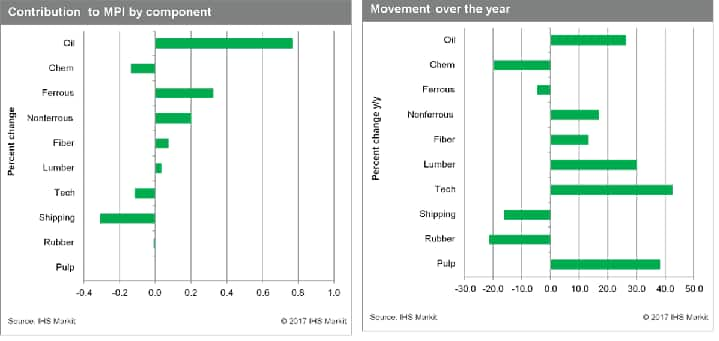

Our Materials Price Index (MPI) increased 0.8% last week, marking its second gain in the last 11 weeks. The rally was relatively narrow, with only five sub-indexes rising; another stayed flat. Oil and nonferrous prices were the biggest drivers lifting the MPI, increasing 4.4% and 2.8%, respectively.

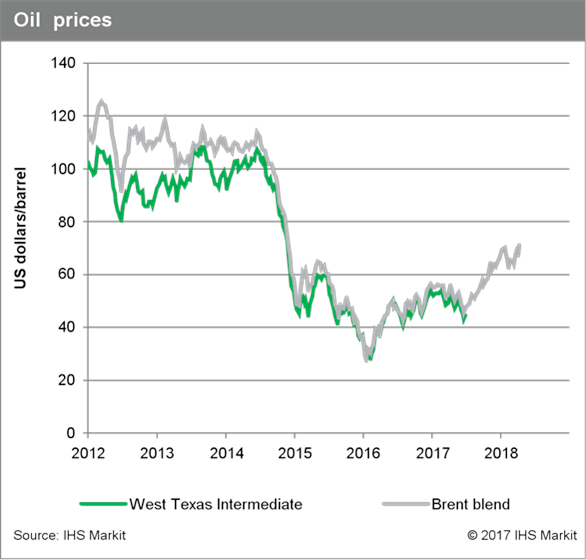

Heightened geopolitical risks pushed up oil prices last week as tensions rose in the Middle East. The prospect of renewed sanctions on Iran grew as new, more hawkish foreign policy advisors to President Donald Trump settled in at the White House. Furthermore, oil markets were anxious about possible military strikes in Syria-a fear that was realized Friday night. Fundamentally, the International Energy Agency increased its outlook for global oil demand to growth of 1.5 million barrels per day in 2018, bolstering bullish sentiment in oil markets. Geopolitics pushed up nonferrous metal prices as well, as the United States imposed sanctions on RUSAL, the giant Russian aluminum company. London Metal Exchange aluminum prices jumped 12% as a result, their largest weekly gain in 30 years.

Data releases last week continued to show a global growth still on track, though perhaps with growth at or near a peak. Industrial production in the Eurozone was unexpectedly low, marking the third consecutive month in which production has slowed. In the United States, Federal Open Market Committee members indicated they intend to maintain plans to increase interest rates. Meanwhile, in China, measures of money supply growth were weaker in March, indicating tighter credit conditions; this is a key reason we see decelerating growth ahead in China. Indeed, tightening monetary conditions and slowing growth in China are main reasons we see a range-bound outlook ahead for commodity prices. Heightened risks have led to a temporary boost in some commodity prices; however, fundamentals point to a change in conditions that will make sustained commodity price increases more difficult.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-risks-push-up-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-risks-push-up-commodity-prices.html&text=Weekly+Pricing+Pulse%3a+Geopolitical+risks+push+up+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-risks-push-up-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Geopolitical risks push up commodity prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-risks-push-up-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Geopolitical+risks+push+up+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-geopolitical-risks-push-up-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}