Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 19, 2022

By Michael Dall

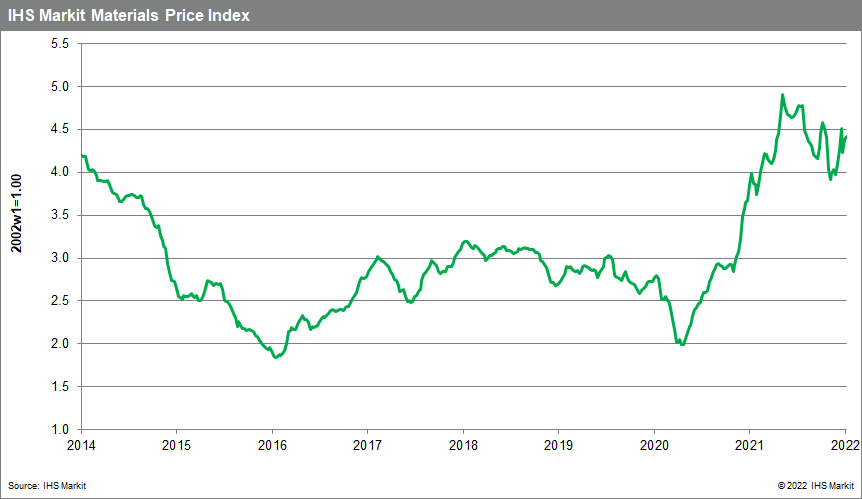

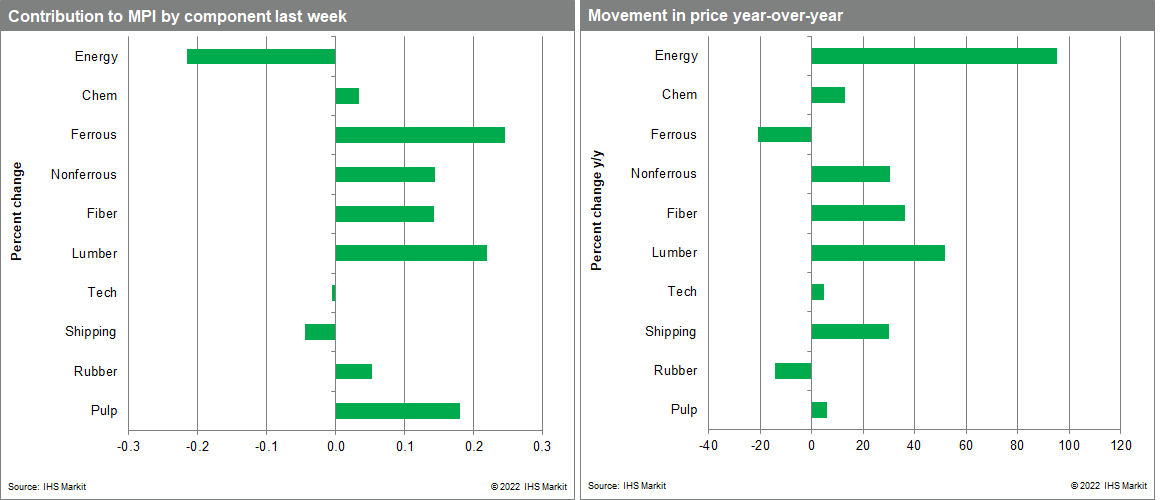

Our Materials Price Index (MPI) increased 0.8% last week, continuing a strong start to the year. Since the end of November, commodity markets have seen extraordinary volatility while rising a cumulative 11%. Even so, the MPI remains 10% below its May 2021 peak with year-over-year escalation continuing to decelerate.

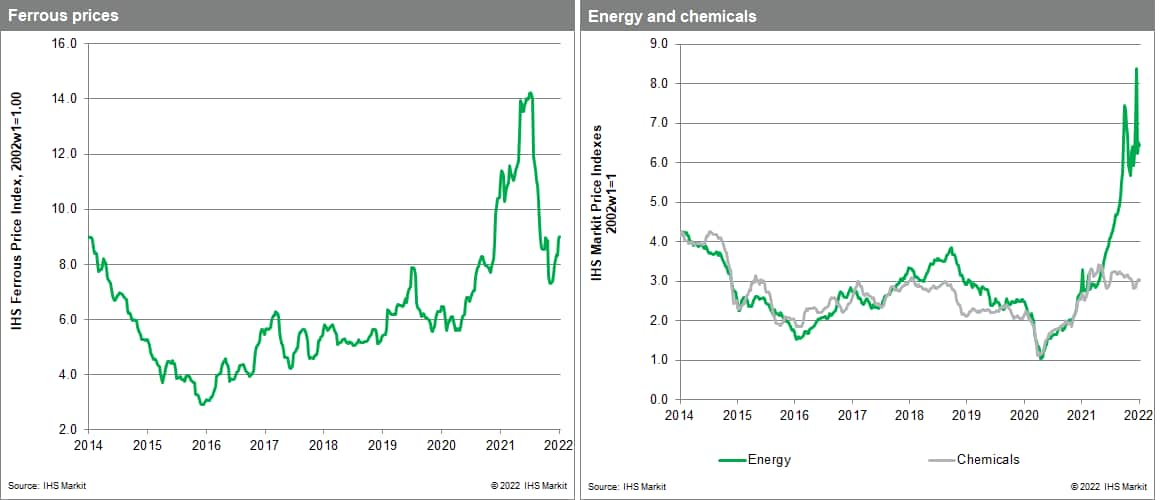

A rebound in industrial metals prices was the main reason for last week's increase. Our nonferrous metals sub-index was up 1.6%, with five of the six base metals tracked in the index increasing. Nickel prices were the biggest mover, reaching a ten-year high of $22,845/tonne, up 6% in one week. Declining exchange inventories and mandated production cuts in mainland China are providing price support. In addition to the supply crunch, nickel is also benefiting from optimism over growing electric vehicle production with battery chemistries that currently use nickel extensively. Stainless steel remains nickel's dominant end-market, however. It will be interesting to see if softening conditions in mainland China's steel and construction sectors will check some of nickel's momentum in the months ahead. In addition to industrial metals, lumber prices continue to show strength with our sub-index recording a 4.5% gain last week. Prices have more than doubled since mid-November, though they remain 27% below their May 2021 record high. Mudslides in British Columbia, (which provides 14% of total US lumber), have blocked deliveries, and the Biden Administration's doubling of tariffs on Canadian imports are supporting price increases in North America.

Last week's increase in the MPI chimes with continued market nervousness over rising price inflation in many economies, highlighted by December's US Consumer Price Index report, which showed US inflation reaching 7% year over year, its highest rate in four decades. More worrisome, the 12-month change in the core CPI, which excludes food and energy prices, rose to 5.5%, its highest rate in more than 30 years. Financial markets now anticipate an earlier lift-off in policy interest rates as a response to higher inflation, a view shared by IHS Markit. Notwithstanding their recent strength, tighter conditions in financial markets coupled with slower growth, especially in key markets such as China, suggest that commodity prices will head lower not higher in 2022.

Posted 19 January 2022 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence