Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 23, 2019

Weekly Pricing Pulse: Commodity prices tick quietly up

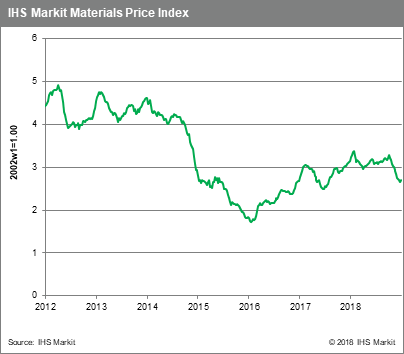

Global markets, starved of good news, are responding well to positive rumors emerging from US-China trade talks, despite the backdrop of a US government shutdown, weak Chinese data and Brexit confusion. Last week, reflecting this better tone in markets, commodity prices rose 0.9% as measured by our Materials Price Index (MPI).

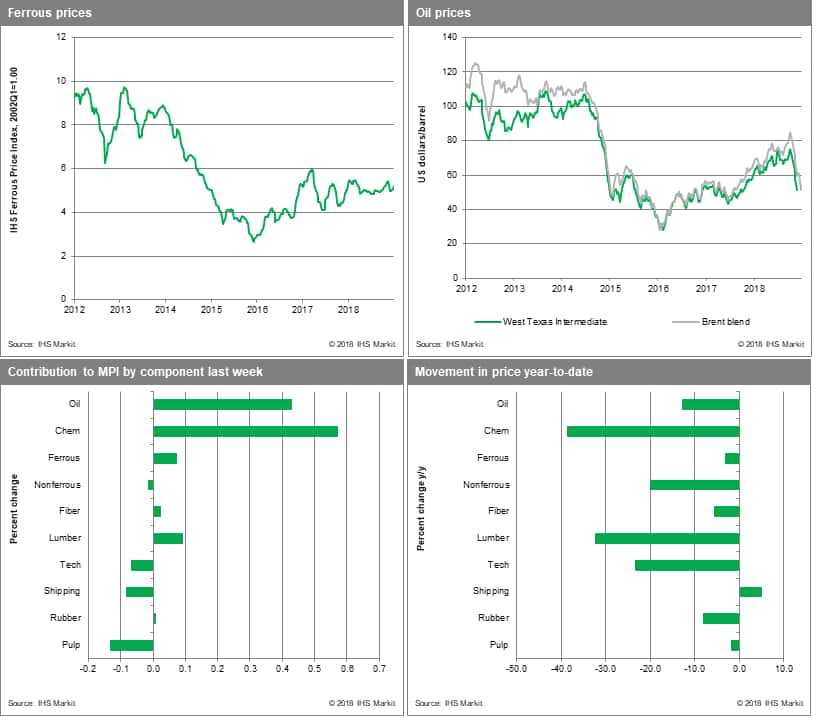

Oil prices increased 2.6% last week as the market felt its way back to something close to equilibrium. However, the prospect of slowing global demand and the unrelenting expansion in US output should prevent oil bull runs in 2019. Chemicals prices also enjoyed a good week with the market appearing to find a bottom; they were up a firm 2.9% w/w. Lumber prices were the big mover last week rising 4.6%, their largest weekly gain since early November. Lumber was helped by a modest m/m rise in the US Housing Market Index. Ferrous prices nudged up 0.4% again last week as a fire at a Rio Tinto port resulted in a force majeure declaration on some iron ore shipments, which helped ore prices to counteract scrap price losses. The fire also affected shipping rates last week as demand for dry bulk capacity fell, dropping charter prices 2.2% w/w. Pulp prices were unable to stay above water, falling 2.2% as US pulp mills that typically export to China, found a lack of demand.

The US government shutdown, now the longest in history, is moving from a blip to a real concern. The effects are rippling across the US economy, impacting everything from airport staffing to oil permitting, and is denting confidence among companies and consumers. Estimates suggest that each week of shutdown will shave 0.08 percentage point off US annualized real GDP growth. On the other side of the pond, Prime Minister May's Brexit deal was voted down by an historic margin, though she survived a key no-confidence vote shortly after. Another milestone has passed and yet no conclusive exit route from the European Union is visible for the UK. In China, another week brought another weak data point. China posted the slowest annual growth rate since 1990 at 6.6%, after recording a relatively weak 6.4% fourth quarter GDP growth rate tied to the US trade war and policy decisions that have undercut consumer confidence and capital spending. Although commodity markets have recently found some footing, real challenges remain with headwinds present in each major region worldwide.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tick-quietly-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tick-quietly-up.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+tick+quietly+up+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tick-quietly-up.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices tick quietly up | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tick-quietly-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+tick+quietly+up+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-tick-quietly-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}