Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 05, 2018

Weekly Pricing Pulse commodity prices slip again even as the global economy continues to expand

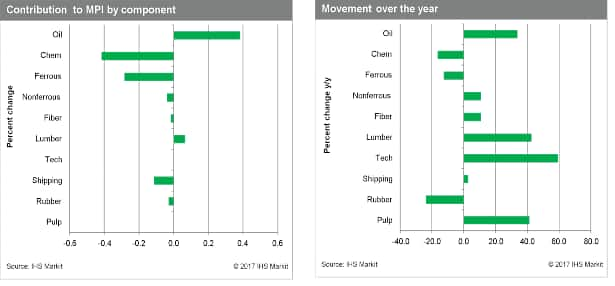

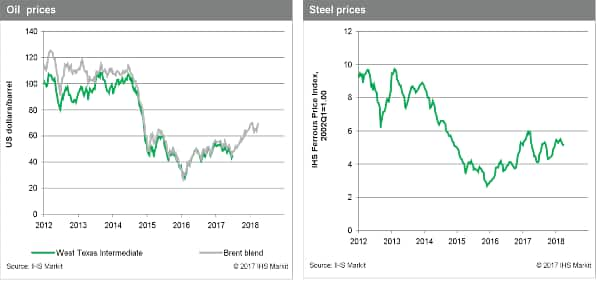

Our Materials Price Index (MPI) fell 0.4% last week, itseighth retreat in the last nine weeks. The decline was once again broadly based, with six of the MPI's ten sub-components falling, while two more stayed flat. Freight rates and chemicals drove the decline in commodity prices, falling 3.7% and 2.0%, respectively.

Freight rates fell last week as iron ore prices continued to

exhibit weakness, dropping for the fourth consecutive week.

Softness in iron ore prices reflects fundamentals reasserting

themselves; prices had reached unsustainable levels on the

expectation of stronger Chinese demand, but are now retreating

because fresh stimulus from the Chinese government looks less

likely. Chemical prices have fallen for five consecutive weeks,

with oversupply and bearish sentiment continuing to weigh on the

market.

Data releases reflect a trend that we have seen emerge over the last two months: good supplies and policy uncertainty are creating volatility even though global economic growth remains healthy. US GDP growth for the fourth quarter was revised up to a 2.9% annualized rate, beating consensus expectations. GDP releases were also positive in Europe, as was the March Flash Eurozone PMI. In Asia, the Caixin Manufacturing PMI for China fell to a four-month low of 51, but still signaled a slow expansion. The question going forward is whether increasing policy uncertainties will begin to affect growth. We do not believe so in a meaningful way, but it has certainly undercut the optimism with which commodity markets started the year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slip-again-even-as-the-global-economy-continues-to-expand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slip-again-even-as-the-global-economy-continues-to-expand.html&text=Weekly+Pricing+Pulse+commodity+prices+slip+again+even+as+the+global+economy+continues+to+expand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slip-again-even-as-the-global-economy-continues-to-expand.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse commodity prices slip again even as the global economy continues to expand | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slip-again-even-as-the-global-economy-continues-to-expand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse+commodity+prices+slip+again+even+as+the+global+economy+continues+to+expand+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slip-again-even-as-the-global-economy-continues-to-expand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}