Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 10, 2019

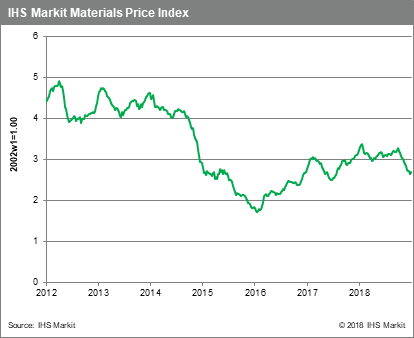

Weekly Pricing Pulse: Commodity prices rise – but volatility remains

After declining for 12 consecutive weeks, Our Materials Price Index, a broad measure of commodity prices, rose 1.5% w/w. Oil price volatility once again drove the index, with the market reacting strongly to reports of a reduction in Saudi Arabian production ahead of planned cuts. Commodity markets also reacted to hopes of progress in US-China trade talks.

Oil prices rebounded 4.4% w/w along with six of the other MPI components. Most moves were muted as has been the case in recent weeks. Ferrous prices however, surged 3.1% this week for two reasons. Firstly, this is a seasonal strong point for iron ore buying as Chinese mills restock ahead of Chinese New Year and higher steel production in the coming months. Secondly a combination of monetary and fiscal stimulus in China suggested a less-bearish outlook for steel demand in 2019. Conversely, non-ferrous prices dipped 1.6% w/w, as markets reacted badly to Apple's earnings guidance based on weak Chinese sales. The cross currents in ferrous and non-ferrous prices nicely illustrates the uncertainty in markets at the moment; normally the announcement of stimulus in China would be generally bullish for commodity prices.

After suffering aggressive selling early last week, sentiment improved late in the week on news of China's latest stimulus (more infrastructure spending and a drop in bank reserve requirements) and by the strong US employment report. A softening in the US dollar and a dovish statement by Federal Reserve Chairman Powell suggesting flexibility in the Fed's approach to policy decisions (IHS Markit now assumes only two interest rate increases in 2019) added upward momentum to markets at week's end. Challenges for the commodity complex remain. Next up is the Brexit vote in Parliament. And still unresolved is the US budget battle and government shutdown, while looming at the end of February is the Trump's administration's truce deadline for raising section 301 tariffs on Chinese imports. Expect more volatility immediately ahead.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-volatility.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+%e2%80%93+but+volatility+remains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-volatility.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rise – but volatility remains | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+%e2%80%93+but+volatility+remains+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}