Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 11, 2018

Weekly Pricing Pulse: Commodity prices rally on strength in lumber and iron ore markets

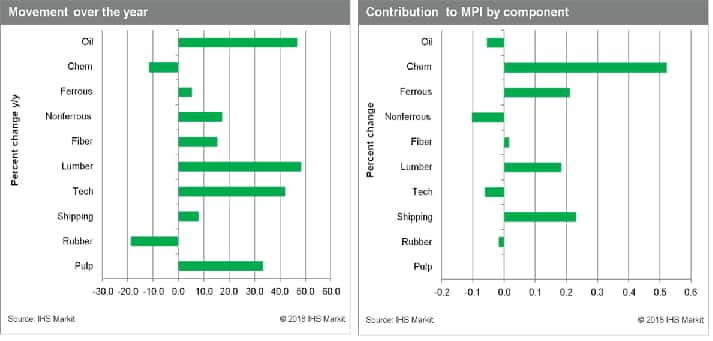

Our Materials Price Index (MPI) rose 0.9% last week, the third gain in the last four weeks. The increase was relatively narrow, with five sub-indexes rising, another flat and four falling. Freight rates and lumber were the main drivers behind the MPI's rise, increasing 7.8% and 5.8%, respectively.

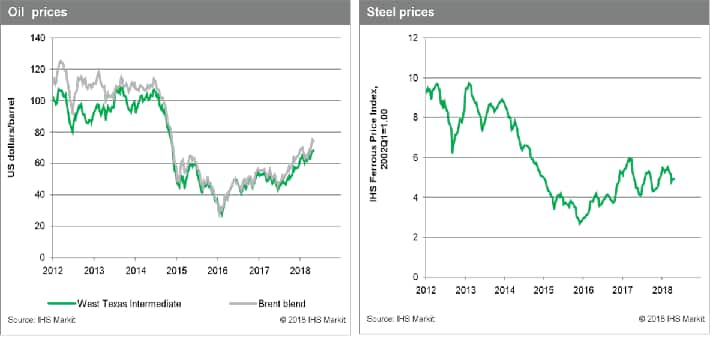

Increases in freight rates and ferrous metals both stemmed from strength in iron ore markets - signs of improving steel demand and falling inventories in China bolstered prices. Trading in Dalian iron ore futures was also opened to foreigners last week, which may have helped drive volume and prices. Despite the strength coming from China, we still see growth there slowing, leading to questions about whether the gain in iron ore markets can be sustained. Lumber prices rallied on both demand and supply factors; new home construction hit a ten-year high last week, pulling up prices, while tariffs on Canadian imports and wildfires in the Pacific Northwest pushed up lumber costs. Chemical markets also saw strength last week on improving demand, shaking off recent bearishness - prices are expected to see further strength given the recent rise in oil prices.

News released was mixed last week. Global markets continue to show strength, though some data points to growth peaking. The Pending Home Sales index in the United States for March saw a slight increase, highlighting the demand helping to lift lumber prices. The US unemployment rate fell below 4% for the first time since 2000, indicating tight labor conditions. Overseas, the Caixin Manufacturing PMI headline index for China advanced to 51.1 in April, a small gain of 0.1, though conditions are still weaker than they were at the beginning of the year. In the Eurozone, the PMI Manufacturing Index fell to 56.2 in April, though its reading still indicates strong growth. Conditions in the commodity complex have held up well over past month, but headwinds remain. Watch US dollar moves in the weeks running up to an anticipated June interest rate increase in the US. Commodity prices will be hard pressed to push against any further appreciation in the US dollar.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rally-on-strength-in-lumber-and-iron-ore-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rally-on-strength-in-lumber-and-iron-ore-markets.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rally+on+strength+in+lumber+and+iron+ore+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rally-on-strength-in-lumber-and-iron-ore-markets.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rally on strength in lumber and iron ore markets | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rally-on-strength-in-lumber-and-iron-ore-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rally+on+strength+in+lumber+and+iron+ore+markets+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rally-on-strength-in-lumber-and-iron-ore-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}