Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 11, 2020

Weekly Pricing Pulse: Commodity prices eke out a slight gain as central banks provide support

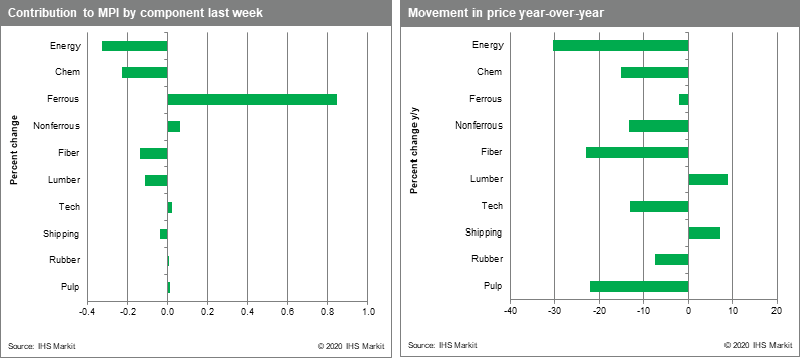

Markets temporarily took comfort from the Fed's March 3rd decision to cut interest rates and rallied on the news, with our Materials Price Index (MPI) increasing 0.1% last week. This said, the growing number of COVID-19 cases outside of China and the breakdown in negotiations among oil producers spooked investors on Friday. US 10-year treasury yields have since fallen to an all-time low with oil prices plunging, setting up a large retreat in the MPI this week.

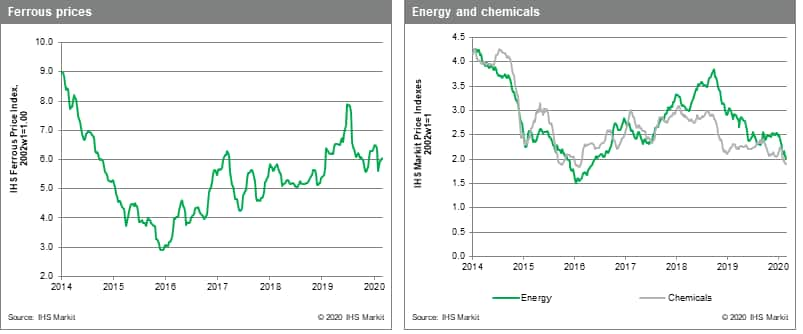

A 2.3% rise in the ferrous price index pulled the MPI higher last week as Chinese buyers of iron ore continued to take comfort from stimulus commitments by Chinese authorities, despite Chinese steel inventory rising to an all-time high of 25 million metric tons. Iron ore port stocks did drop last week amidst stronger buying activity and tepid inflows. Non-ferrous prices also rose, but by a smaller 0.6%, also on the promise of stimulus and the hope that Chinese authorities would intervene directly in markets by adding to base metal strategic stockpiles. Exchange inventory of non-ferrous metals continues to rise, however. DRAMs rose a strong 3.3% even in the face of sluggish smart-phone demand. The index has benefitted from the partial resumption of work at server manufacturing facilities in China. In stark contrast to other markets, DRAMs are now up 14.0% since the start of 2020. The energy index fell 2.4% last week due to a 4.7% drop in crude oil prices, offsetting a rare 3.8% rise in natural gas prices. Oil prices cratered over the weekend after OPEC and Russia failed to reach an agreement on additional production cuts. Instead, Saudi Arabia will raise production above 10 Mbbl/d in April and offer deep 20% discounts in certain markets. Prices began falling late over the weekend, with Monday's market open at just $31/bbl, a four and a half year low, setting up what promises to be another volatile week in commodity and equity markets.

The Covid-19 pandemic is proving to be both a demand-side (with damage to travel, tourism, and any activities involving large crowds) and a supply-side shock (with major disruptions to supply chains). Moreover, because it appears that the peak impact will not now occur until late in Q2 or in Q3, IHS Markit assumes a U-shaped rather than a V-shaped cycle, with a sharp reduction in 2020 global growth. The Eurozone and Japan will now see recessions this year, with growth in China significantly reduced (below 5%). US growth is also lower and will be less than 2.0% this year. Commodity markets have already seen a large 17% correction since last July. However, the MPI is still some 25% above its January 2016 low, the last time markets experienced a combination of falling oil prices, a sharp slowdown in Chinese manufacturing activity and an ad hoc response by policymakers.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-eke-out-slight-gain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-eke-out-slight-gain.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+eke+out+a+slight+gain+as+central+banks+provide+support+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-eke-out-slight-gain.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices eke out a slight gain as central banks provide support | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-eke-out-slight-gain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+eke+out+a+slight+gain+as+central+banks+provide+support+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-eke-out-slight-gain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}