Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 21, 2020

Weekly Pricing Pulse: Commodity markets revive after China-led hiatus

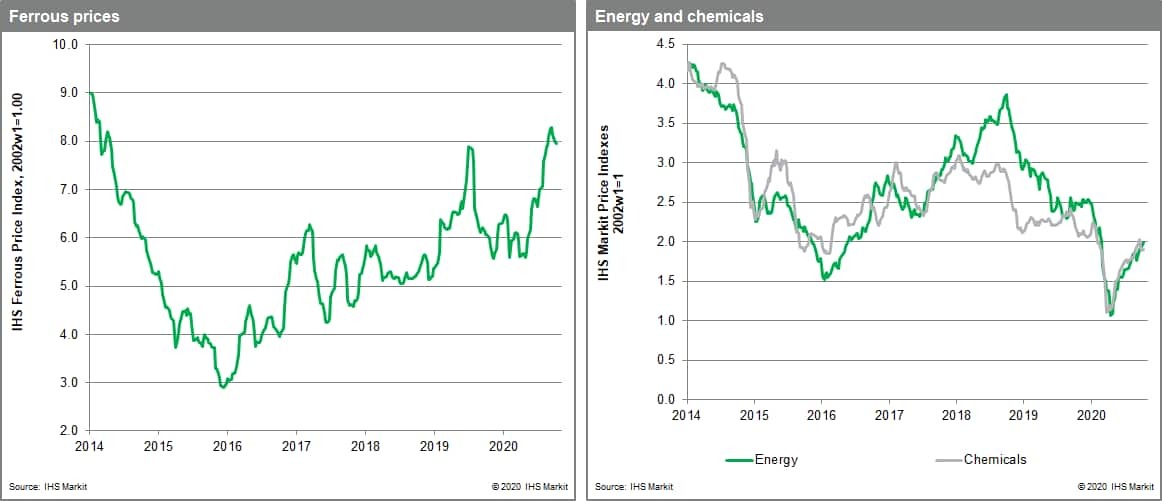

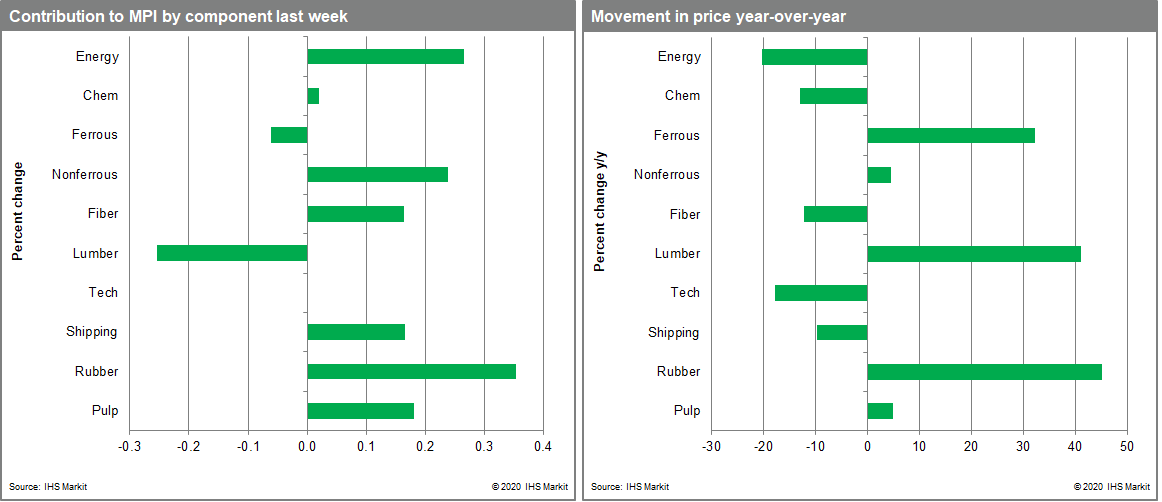

Commodity prices, as measured by our Materials Price Index (MPI), rose 1.1% last week, as Chinese buyers returned to the markets after the Golden Week holiday. A strong third quarter for Chinese industrial activity, aided by effective COVID-19 containment measures, means that mainland China will continue to set the tone for commodity prices in the fourth quarter.

In a busy week, it was a rise in energy and nonferrous metals prices that sent the MPI higher. Natural gas and oil both rose, with gas standing out, rising 18%, due to huge jumps in both US and European prices. Gas prices reacted positively to the prospect of colder weather on the horizon. Initial fears of widespread Hurricane Delta damage added to upward pressure in the US market. Nonferrous metals, particularly nickel and aluminum, provided further support to the headline MPI number this week. Nickel rose 4.3%, with aluminum up 4.1% to an 18-month high. Both metals are benefiting from good data from mainland China's auto sector, where new vehicle sales rose 17% in September. Nickel is being given an added boost by the start-up of a large new battery plant designed to produce BYD's new blade battery, which the company claims is resistant to thermal runaway and increases energy density by as much as 30%. The new factory is one of four planned and focused attention on the promise that EV demand holds for nickel consumption. Chinese auto sales were also behind a 9.7% jump in rubber prices, the biggest mover in the MPI last week.

Mainland China continues to underpin the rise in commodity prices. Third quarter Chinese GDP increased by 4.9% year on year, an increase from 3.2% in the second quarter, confirming the turnaround after the sharp first quarter contraction. Industrial production is back at pre COVID-19 levels and retail sales have also turned positive after two consecutive quarterly declines. This quick rebound is fueling hope that mainland China will be able to lift global commodity markets by itself, much like it did in the aftermath of the Great Recession. Given the softness still present outside mainland China, and given Chinese policymakers desire to rein in debt, especially in the highly leverage real estate sector, this seems a bit too optimistic. With COVID-19 case counts rising rapidly in Europe and North America, the fourth quarter will provide an answer.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-revive-after-chinaled-h.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-revive-after-chinaled-h.html&text=Weekly+Pricing+Pulse%3a+Commodity+markets+revive+after+China-led+hiatus+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-revive-after-chinaled-h.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity markets revive after China-led hiatus | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-revive-after-chinaled-h.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+markets+revive+after+China-led+hiatus+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-revive-after-chinaled-h.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}