Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 05, 2020

Weekly Pricing Pulse: Commodities sustain further loses on heavy selling

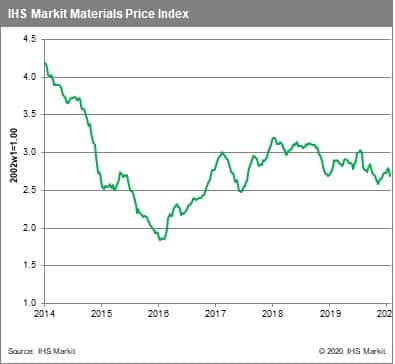

Our Materials Price Index (MPI) fell 2.5% last week, declining broadly once again as fears of the spreading coronavirus and its potential impact on the Chinese economy triggered selling across markets. The MPI is down roughly 3.5% in the past two weeks, with commodity prices as measured by the index now lower than a year ago.

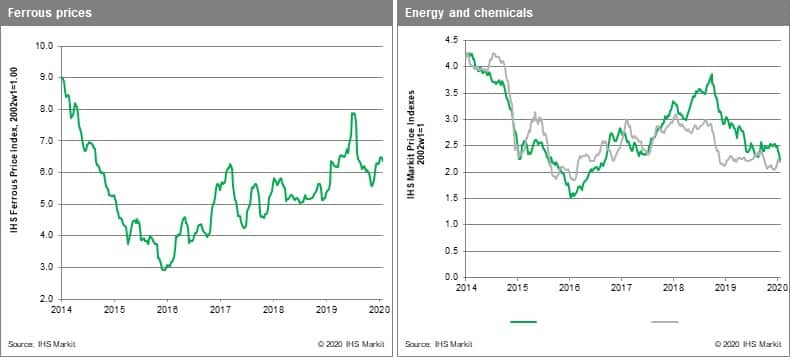

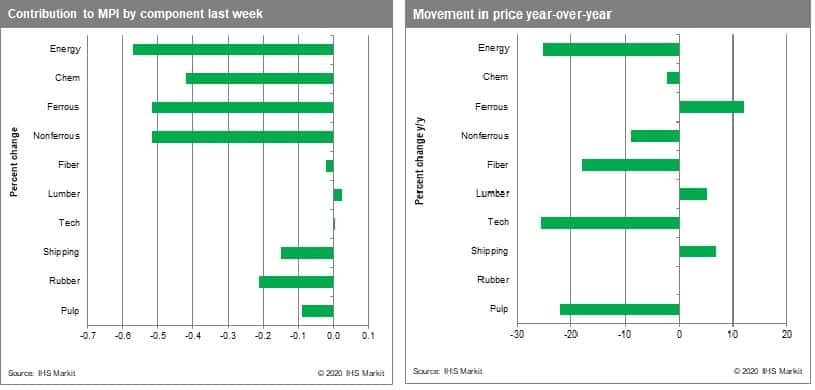

Although Chinese markets were closed last week for the normal Lunar New Year celebration, global exchanges continued to trade, with oil and base metals seeing heavy selling. Copper's 7.0% plunge caused the MPI's non-ferrous metals index to end the week down 5.6%. More importantly, it suggests a sharp drop in manufacturing activity. The MPI's energy index fell 4.2% mainly from a large decline in crude oil prices. Brent fell 5.8% last week to $58.7 /bbl. on estimates that Chinese demand may fall as much as 0.5 Mbbl/d while travel bans remain in place. Brent prices are now down 13.7% since the first week of January. Rubber prices retreated 6.3% last week despite the current supply crunch in South-east Asia and the Chinese auto industry showing some growth in December. Freight and ferrous prices also fell 3.7% and 1.4%, respectively. Ocean going freight rates are now absorbing news that both inbound and outbound cargoes are likely be affected by disruptions to Chinese production.

With the effects of the coronavirus now carrying past the traditional New Year holiday week in China, damage to the Chinese economy becomes an order of magnitude greater. Commodity markets are pricing in a sizeable reduction in aggregate Chinese demand with an impact on global markets greater than during the SARS outbreak 15 years ago. The questions now are how long do Chinese factories remain idle and, on the demand side, how much consumer spending is lost?

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sustain-further-loses-selling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sustain-further-loses-selling.html&text=Weekly+Pricing+Pulse%3a+Commodities+sustain+further+loses+on+heavy+selling+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sustain-further-loses-selling.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities sustain further loses on heavy selling | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sustain-further-loses-selling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+sustain+further+loses+on+heavy+selling+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sustain-further-loses-selling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}