Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 17, 2020

Weekly Pricing Pulse: Commodities rise strongly again

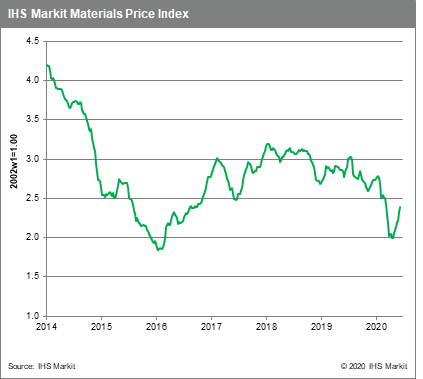

Our Materials Price Index (MPI) rose another 3.0% last week, the fourth time in the past five weeks that it has posted a gain of three percent or more. Since hitting a low at the end of April the MPI has risen 20%, though it is still down 14.2% in the year to date. The easing of more restrictions in Western economies has been accompanied by some improvement in demand and caused commodity markets to become more optimistic about prospects for the second half of 2020. Still, new infections in Beijing and fears about rising infections in several US states were enough to trigger a fresh bout of volatility in both equity and commodity markets at week's end.

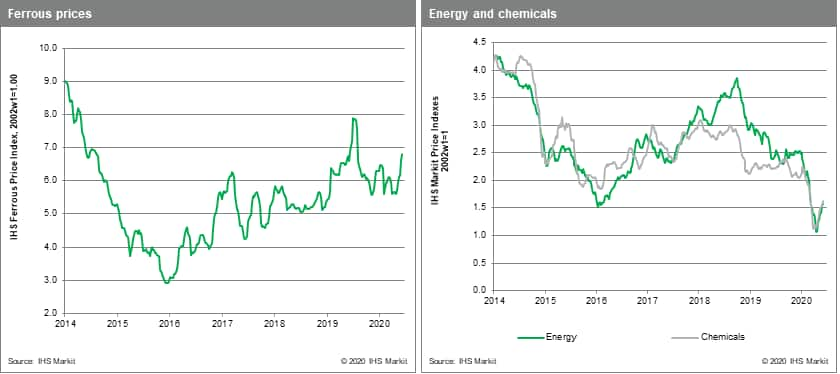

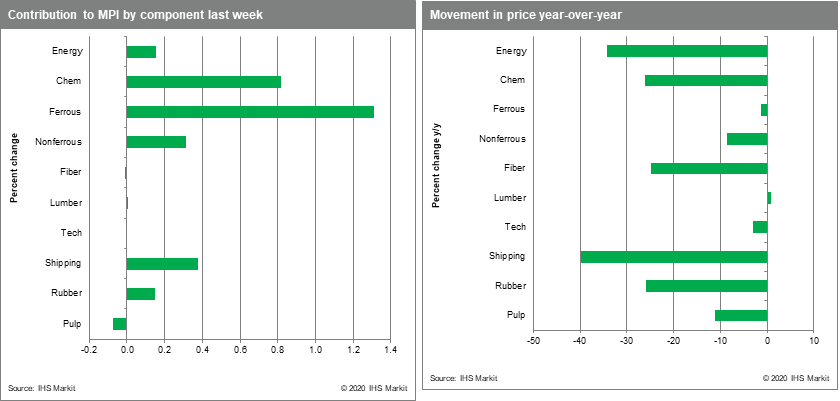

Chemicals prices pulled the MPI higher last week, rising 4.9%. Ethylene and benzene prices rose 6.3% and 9.9%, respectively. Chemicals prices are reflecting higher oil prices, which rose another 4.3% last week. Non-ferrous metals prices increased 3.3% for the week. The risk-on trade in copper and other base metals has seen a greater than usual divergence between paper and physical trading. Markets have been responding to COVID-19 related supply-side disruptions, especially in South America. But investors and traders also seem to be playing a role, adding momentum to the recent rise in metals prices. New COVID-19 restrictions in Brazil are clearly behind the recent rally in iron ore prices, which rose another 3.3% last week. Ocean going freight prices also posted a noteworthy gain last week, continuing a rebound from April's four-year low. Capesize rates rose 15.9% partly driven by Australian iron ore producers shipping an all-time record weekly volume to close out the Australian fiscal year. Finally, rubber prices appear to have turned a corner as auto production worldwide begins to recover; spot prices rose 4.6%, another nice gain after seeing weakness extend into late-May.

Judging from the recent strength in commodities and US equities, many market participants appear to anticipate a rapid recovery in the second half of this year. IHS Markit's view of fundamentals, however, suggests a different picture of the near future. In the case of US equities, earnings forecasts appear optimistic, and for commodities, anticipated growth in physical consumption too strong. Policymakers worldwide have provided extraordinary amounts of stimulus to support growth. Even so, the profound shock to both aggregate supply and demand caused by the global pandemic means that the recovery in global value chains will not be rapid. Consumer spending and business investment are unlikely to return to 'normal' until a vaccine becomes widely available, which we assume is not until the second half of 2021. This view of the real economy translates into physical consumption levels that do not return to late 2019 levels until sometime in 2022, which seems at odds with the strong rebound in commodity prices over the past six weeks.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-strongly-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-strongly-again.html&text=Weekly+Pricing+Pulse%3a+Commodities+rise+strongly+again+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-strongly-again.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities rise strongly again | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-strongly-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+rise+strongly+again+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-strongly-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}