Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2019

Weekly Pricing Pulse: Commodities rise but without conviction

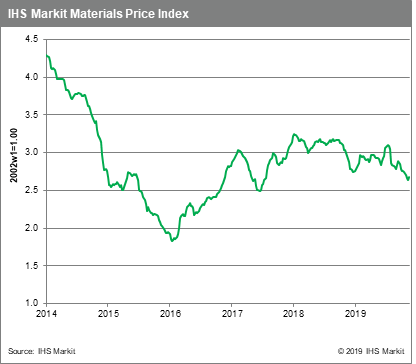

Commodity prices, as measured by our Materials Price index (MPI), rose 1.4% last week, their first increase since mid-September. Sentiment in commodity markets does seem to be shifting ever so slightly, though the caution is that a one week move hardly constitutes a rally.

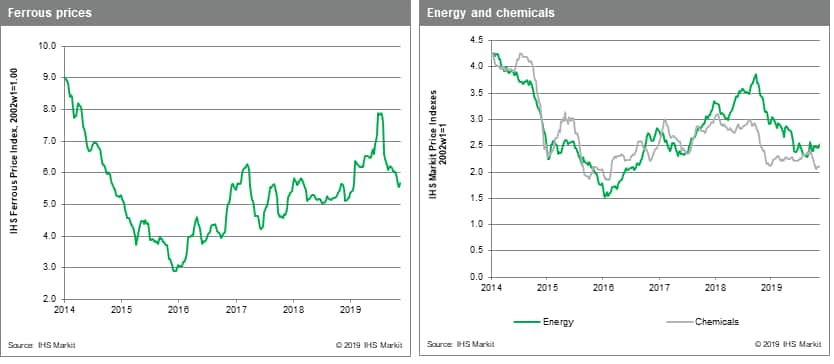

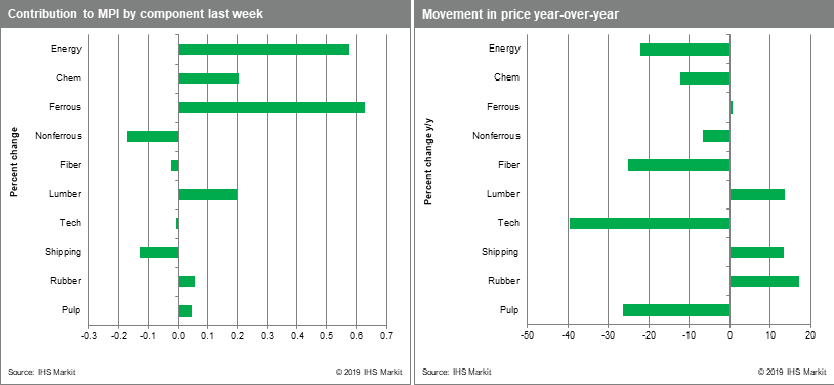

Energy prices led the MPI higher, rising 3.1% on strong showings from natural gas, up 5.2%, and coal, up 5.8%. The oil market, in contrast, remained calmed ahead of the upcoming OPEC meeting. The ferrous sub-index increased 1.8% amidst strengthening steel prices and the cut in a key interest rate in China. Lumber prices jumped 9.0% last week on strong US housing market data - lower mortgage rates lifted housing starts 3.8% in October and building permits hit a 12-year high. Non-ferrous prices fell 2.0% last week with all prices bar copper falling. Nickel prices again fell sharply and have now dropped more than 20% since early September as supply concerns around Indonesia's export ban ease.

We have been touting the upside potential in commodity prices for several weeks given the improvement in equity and bond markets and hints that manufacturing activity may be stabilizing. Still, commodity markets will require solid evidence that conditions in manufacturing are in fact improving and that tangible progress is being made in the US-China trade war before any rally in prices can be sustained.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-but-without-conviction.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-but-without-conviction.html&text=Weekly+Pricing+Pulse%3a+Commodities+rise+but+without+conviction+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-but-without-conviction.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities rise but without conviction | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-but-without-conviction.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+rise+but+without+conviction+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-but-without-conviction.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}