Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 27, 2020

Weekly Pricing Pulse: Commodities' rebound continues as eyes turn to China

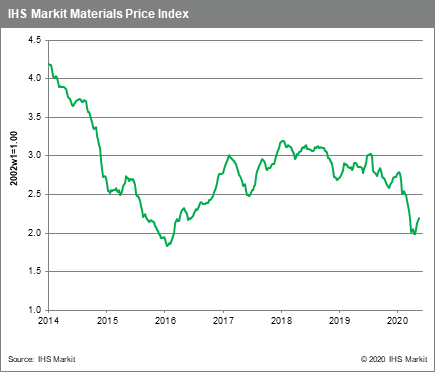

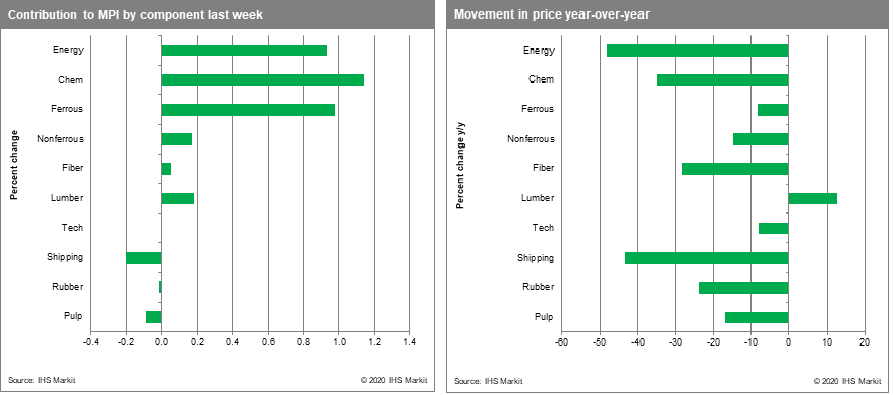

Strong moves in crude oil, chemicals and iron ore prices last week helped commodity prices to rise 3.2% last week as measured by the IHS Markit Materials Price Index (MPI). This takes the recent commodity price rally to 10.4% from the late-April low, though prices are still down 20.7% year-to-date.

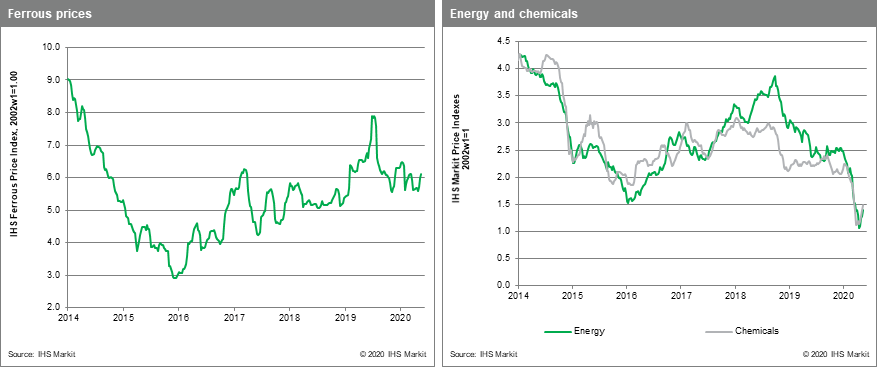

Brent crude hit a high of $36 /bbl last week as oil notched another strong gain supported by growing supply-cuts and improving demand. The increase sent the MPI's oil sub-index rose 21.3% for the week. Thermal coal prices also rallied 5.6%, due to a 7.1% rise in Asian coal prices on hopes that Indian demand will soon rebound. Together, these moves in oil and coal propelled the MPI's energy index 9.7% higher. Chemicals rose 6.9% on 10.5% and 6.6% increases in ethylene and benzene respectively, due to crude price gains. Iron ore prices rose 2.3% to an eight-month high on supply concerns from Brazil. COVID-19 has been spreading rapidly through the state of Para, home to 33% of Brazil's iron ore supply. Meanwhile Chinese steel mills came close to a daily production record, setting up a demand pull, supply push scenario for iron ore prices, which now threaten to top $100 /t again. Lumber continued its recent tear, rising another 6.5% last week. Prices are now up 32.4% from the end-March low on hopes that the building season may be salvaged in the US and elsewhere.

Commodities and equity markets around the world are taking comfort from the growing list of countries that have, in some way, eased lockdown restrictions. The "return to normal", however, is being hampered by the growing acrimony between the US and China, which threatens trade relations at a time when global trade is already contracting. Markets also seem to be pinning hopes on a strong stimulus led rebound in China even though proposals put forward during the National People's Congress suggest relatively modest efforts to support growth. Hence, while there is a clear sense that the worst of the pandemic may have passed, markets may be viewing the near future a bit too optimistically.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rebound-continues-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rebound-continues-china.html&text=Weekly+Pricing+Pulse%3a+Commodities%27+rebound+continues+as+eyes+turn+to+China+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rebound-continues-china.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities' rebound continues as eyes turn to China | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rebound-continues-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities%27+rebound+continues+as+eyes+turn+to+China+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rebound-continues-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}