Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 05, 2020

Weekly Pricing Pulse: Commodities push higher, but with less gusto

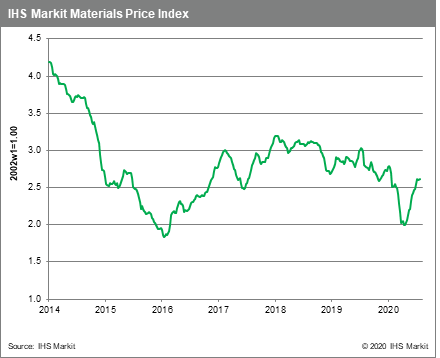

Commodity prices, as measured by our Materials Price Index (MPI), rose 0.4% last week supported by small gains in several major commodities groups. In comparison to previous weeks, price moves were lacklustre, a sign that the three-month rally in commodities may be ebbing.

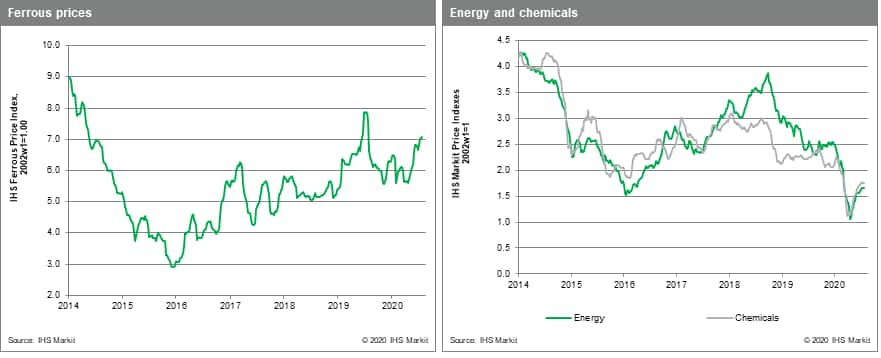

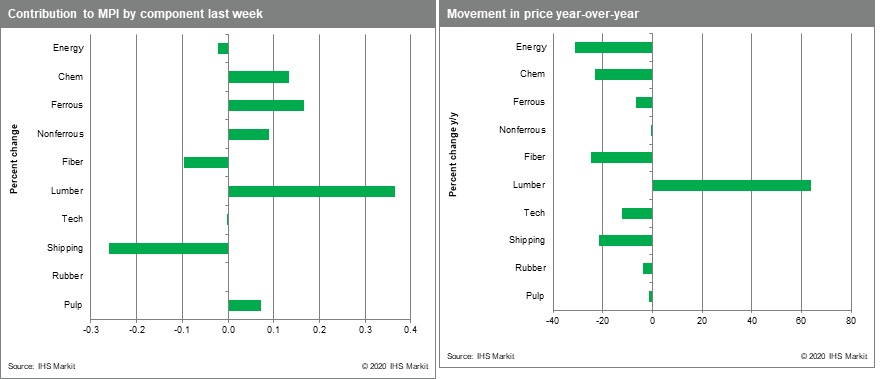

Lumber prices steered the MPI higher last week rising 10.2%, adding to its impressive 118% post-sell off bounce. Inventories continue to be scarce with some contractors in the US struggling to source lumber to keep work going on projects. Sawmills cut production early in 2020 anticipating a fall in building products demand, only to see housing construction bounce back quickly because of low mortgage rates and the home improvement market take off. Ferrous prices rose 0.4% driven mainly by strength in steel scrap prices, which rose 1.6%. Scrap prices have found strength due to weak collections and surprisingly strong Turkish demand since early July. Non-ferrous prices rose 0.9%, on the weaker US dollar and continued optimism over rising Chinese manufacturing activity. All base metals rose, save copper, which fell 0.6%. Nickel outperformed, rising 2.8%. Energy prices fell 0.2% due to the first weekly retreat in crude oil (-1.3%) since its second quarter low. With OPEC+ production cuts being relaxed starting in August, the third quarter will see supply begin to improve, which should cap further crude price increases. Freight prices fell 5.5% as iron ore exports dropped in July. According to data from our Maritime and Trade team, Commodities at Sea service, Australian shipments fell 12% month-on-month (m/m) in July as ports underwent maintenance. Brazilian exports also fell 8% m/m in July after a 25% m/m surge in June.

Commodity prices have been taking support from a combination of factors -- production cuts or supply disruptions, a weaker US dollar, better China demand, even hopes for a vaccine late in 2020. Notwithstanding their three-month rally, we do not see the recent momentum in commodity markets being sustained across the second half of the year. The rise in prices does indicate the worst is over. But the continuing increase in COVID-19 case counts globally, and the re-imposition of containment measures even in regions that had seemingly beat-back the pandemic, highlights what is likely to be the start-stop pattern to growth and a slow return to normal. This will not be a "V" shaped recovery.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-push-higher-with-less-gusto.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-push-higher-with-less-gusto.html&text=Weekly+Pricing+Pulse%3a+Commodities+push+higher%2c+but+with+less+gusto+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-push-higher-with-less-gusto.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities push higher, but with less gusto | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-push-higher-with-less-gusto.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+push+higher%2c+but+with+less+gusto+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-push-higher-with-less-gusto.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}