Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 12, 2020

Weekly Pricing Pulse: Commodities price gains find a new gear, rising strongly across sectors

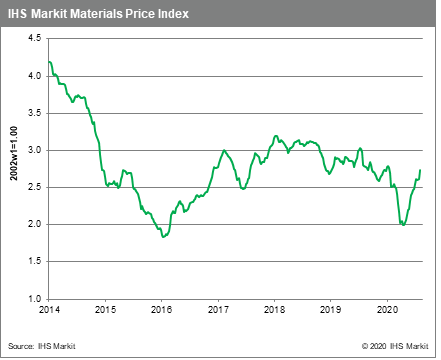

Commodity prices, as measured by our Materials Price Index (MPI), rose 4.4% last week in one of the largest gains in the 24-year history of our index. Massive moves in iron ore and natural gas led the index higher, although large increases were seen in a wide range of commodities last week - nine of the MPI's ten major subcomponents rose. With last week's increase, the MPI is now essentially flat for the year, having now erased all of the first quarter's plunge over the last four months.

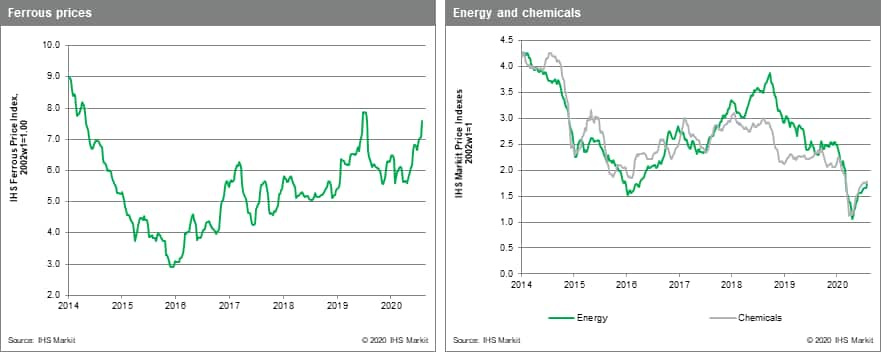

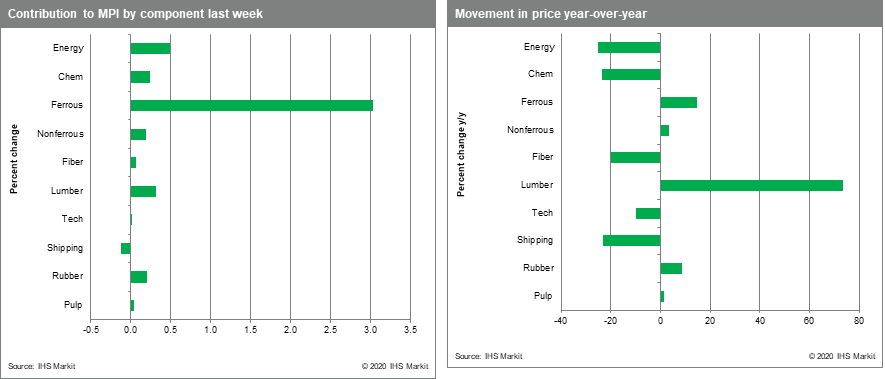

Ferrous prices lead the MPI higher last week rising 7.3% due to an 8.1% rise in iron ore prices, which hit $121 per metric ton. For context, prices were under $83/metric ton in early April with a post-Vale dam disaster price peak of $125 per metric ton in 2019. Record Chinese steel production and multi-year-low iron ore inventories in China have sparked ore prices. The MPI's energy sub-index rose 4.9% last week, driven by a 22.3% jump in natural gas prices. Oil and coal also showed sizeable gains, increasing 3.2% and 4.9%, respectively. With LNG prices near historic lows, volatility should be expected, which explains the 32.6% rise European natural gas. Demand in Europe and the US is firming, with buyers continuing to seize upon cheap cargoes on price dips. Rubber prices jumped 6.2%, a large move on a 4% dip in Shanghai rubber inventories. Lumber also continued to climb strongly, increasing another 8.1%. Even though sawmills are lifting production, rebounding new home construction and a booming home improvement market in the US are keeping supplies tight.

Commodity prices are reacting to more signs of rebounding demand, last week bringing the July Purchasing Manager Index reports, which recorded a widespread improvement in manufacturing activity. Our caution is that the recent rebound does not foretell a full recovery in 2020, the damage to labor markets worldwide has been too great. Most worrisome, however, is the continuing deterioration in US-China relations and the re-imposition of tariffs by the US on Canadian aluminium imports, even though the new USMCA trade agreement recently came into force. With a global pandemic still raging, a ratcheting up in trade tensions does not need to be added to the challenges facing the global economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-price-gains-find-a-new-gear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-price-gains-find-a-new-gear.html&text=Weekly+Pricing+Pulse%3a+Commodities+price+gains+find+a+new+gear%2c+rising+strongly+across+sectors+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-price-gains-find-a-new-gear.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities price gains find a new gear, rising strongly across sectors | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-price-gains-find-a-new-gear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+price+gains+find+a+new+gear%2c+rising+strongly+across+sectors+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-price-gains-find-a-new-gear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}