Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 02, 2018

Weekly Pricing Pulse: Chemical and oil price volatility reverses recent losses

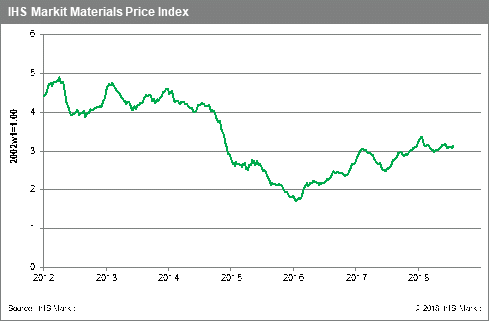

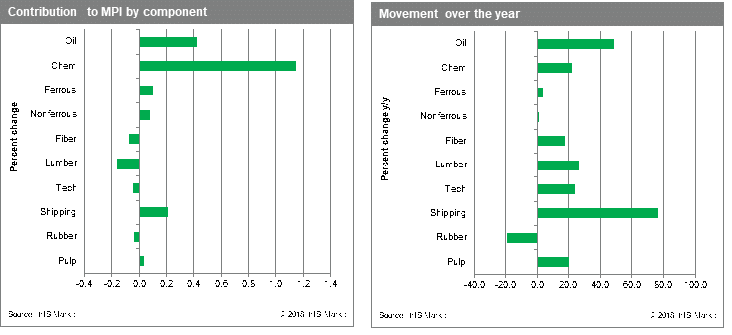

Our Materials Price Index (MPI) jumped 1.8% last week, erasing the previous week's correction, though commodity prices remain lower than in early June and are still down 3.4% since the start of the year. Six of the MPI's ten sub-components rose, with the chemical and freight indexes posting the largest gains, increasing 5.1% and 6.3%, respectively. Having lead the downward correction last week, oil has rebounded supporting increases in chemicals and freight.

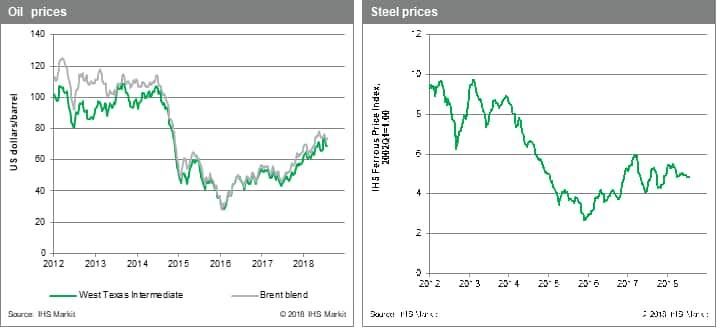

Freight prices have risen in 14 of the past 16 weeks. Shipping volumes of key bulk materials have been running at record levels since the start of Q2 which, combined with strong bunker fuel prices, have helped drive charter rates higher. A strong 9.7% increase in US polypropylene price drove the MPI chemical index higher. Both Asian and US polypropylene prices are reflecting the setting of higher monthly contract prices. Chemical price increases are being supported by the lift in oil prices over the past two weeks. Oil's rally has come about despite OPEC output reaching a 2018 high; key outages and growing anxiety about future Venezuelan and Irian production continue to weigh on the market.

Macroeconomic conditions continue to point to soft commodity prices. Growth in China's manufacturing sector slipped again m/m, in July with the Chinese Manufacturing headline PMI posting a score of 51.3, down 0.3 points from June. Export PMI from China also declined for a third month in June, price pressures intensified and factory optimism slipped to 22-month low. Chinese authorities did announce a modest stimulus package last week, which helped buoy markets, but the broader picture still shows growth slowing over the near-term. Staying with PMIs, July's flash composite PMI in the Eurozone declined by around half a point to 54.3, continuing the downward trend year to date. This said, US second quarter growth came in at a strong 4.1%, which though slightly below expectations, will help stabilize commodity markets moving through Q3.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-chemical-oil-reverse-8218.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-chemical-oil-reverse-8218.html&text=Weekly+Pricing+Pulse%3a+Chemical+and+oil+price+volatility+reverses+recent+losses+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-chemical-oil-reverse-8218.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Chemical and oil price volatility reverses recent losses | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-chemical-oil-reverse-8218.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Chemical+and+oil+price+volatility+reverses+recent+losses+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-chemical-oil-reverse-8218.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}