Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2020

Weekly Pricing Pulse: Accelerating case count fails to dent commodities

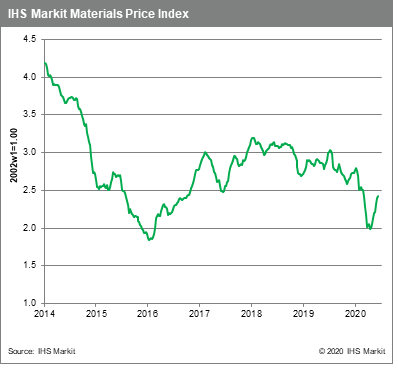

Our Materials Price Index (MPI) rose 1.3% last week, its seventh consecutive weekly gain. Since late April the MPI has rallied broadly, rising by more than 21.0%. While the MPI is still down 11.1% year-to-date, sentiment has become more optimistic, even brushing off the volatility that crept into equity markets last week because of increasing COVID-19 case counts in the US, South America and India.

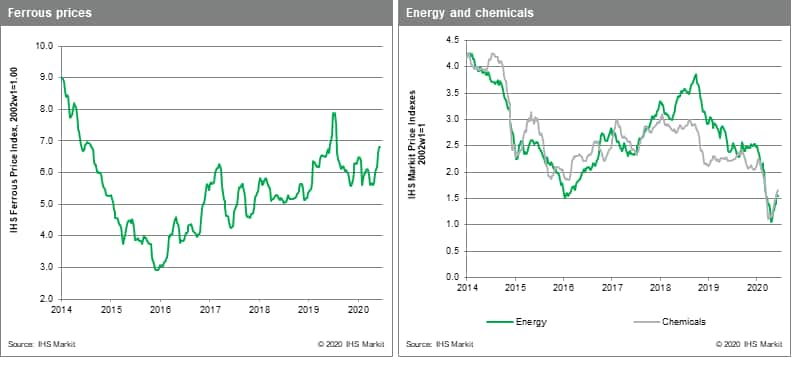

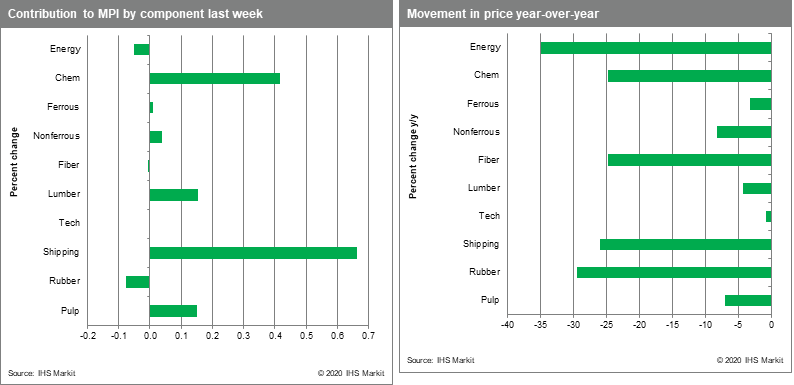

A large gain in bulk freight prices took the MPI higher last week and was driven by tighter Capesize availability for July due to economic strength in China and rising Brazilian iron ore exports. Chemicals prices rose 2.4% on gains in ethylene and propylene prices. Ethylene rose 3.8% as production losses from planned and unplanned outages in the US hit supply. The propylene market remains strong globally because of good demand in China and production outages in the US. Lumber prices rose 5.7% on double digit increases in both single and multi-family housing building permits in the US during May. Energy prices fell for the first time in eight weeks due to continuing softness in coal demand, particularly in India. Markedly stronger freight rates discouraged buyers of thermal coal further, which fell 3.8%, offsetting minor gains in oil (1.5%) and gas (1.7%). US, Henry Hub gas prices, however, fell 5.8%, to hit a 21-year low of $1.38 /MMbtu, on rising supply and weak demand.

The continuing strength in commodity markets seems at odds with the growing COVID-19 case counts in the western hemisphere, India, and renewed outbreaks in China. It also seems at odds with the relative strength still seen in a safe haven asset class like precious metals or the lack of a real lift in US bond yields. All of this suggests some sort of reckoning in commodity markets ahead. Perhaps not an outright correction, but at least an end to the sustained increases seen over the past ten weeks.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-accelerating-case-fails-dent-commodities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-accelerating-case-fails-dent-commodities.html&text=Weekly+Pricing+Pulse%3a+Accelerating+case+count+fails+to+dent+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-accelerating-case-fails-dent-commodities.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Accelerating case count fails to dent commodities | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-accelerating-case-fails-dent-commodities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Accelerating+case+count+fails+to+dent+commodities+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-accelerating-case-fails-dent-commodities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}