Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 14, 2020

Weekly Pricing Pulse: A quiet week in commodity markets

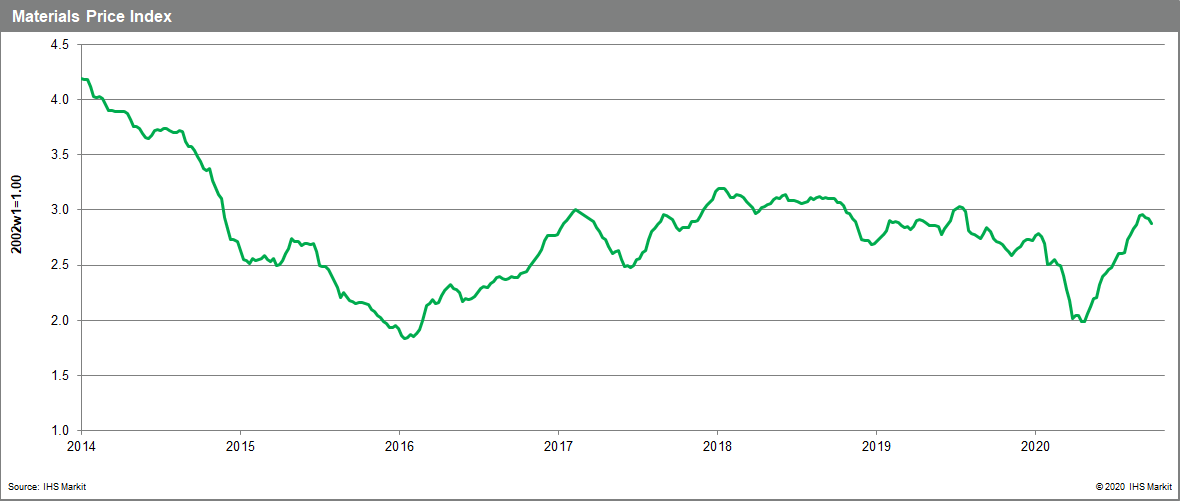

Commodity prices, as measured by our Materials Price Index (MPI), rose 0.1% last week, tracking sideways with Chinese buyers largely absent from markets because of the Golden Week holiday. Growing COVID-19 case counts globally and reduced government support in North American and Europe mean mainland China will help dictate the direction of commodity prices in the fourth quarter.

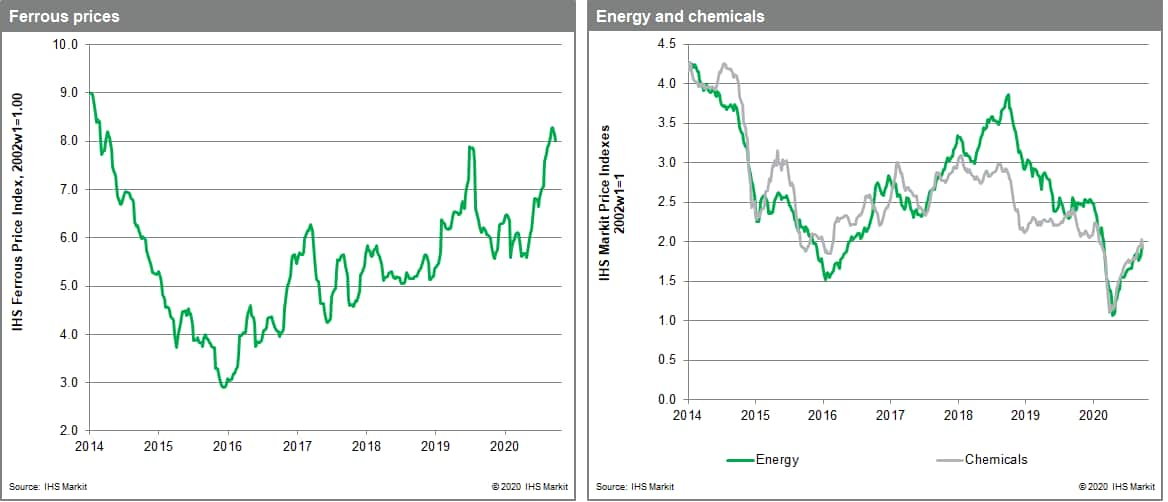

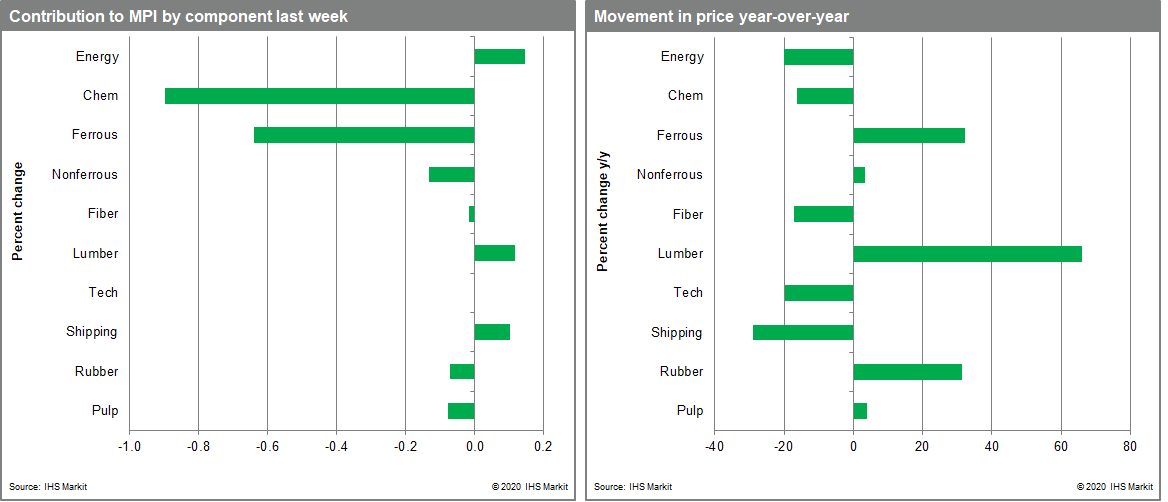

In a generally quiet week, it was a 3.3% rise in energy prices that kept the MPI from registering its fourth consecutive decline. Coal, oil and gas all rose, with gas standing out, rising 7.7%, mainly due to a huge 42.7% jump in US prices. US gas prices have firmed as more capacity exits the market. Benchmark Brent and WTI crude rose 5.4% and 3.4%, respectively, on the threat of Hurricane Delta, which prompted evacuation of 42% of platforms in the US gulf. Bulk freight prices rose sharply, increasing 11.3% last week. A shortage of Capesize vessels in the Atlantic and firm demand at Brazilian ports were behind the increase. Non-ferrous metals, fiber and rubber prices, all closely linked to Chinese demand, ticked up again after falling the previous week. Lumber fell 4.0%, continuing its correction from all-time highs in September. Production and sawmill capacity utilisation continued to improve. Chemicals prices declined 1.8% as US markets re-balance after disruptions tied to hurricane Laura. Ethylene, which was most affected by the hurricane, fell 4.2%. Steel raw materials prices also fell, due to a small decline in iron ore prices and falling scrap steel prices in Turkey.

Currency moves, which have shown volatility throughout 2020, have influenced commodity markets repeatedly this year and promise to do so again in the fourth quarter. The US dollar stood out as a safe haven early in 2020, with a strong dollar helping to reinforce the crash in prices during the first quarter. The heavy economic impact of COVID-19 on the US economy, the expectation of markets that the Fed will provide more stimulus than other central banks and the near elimination of interest rate differentials between US and other sovereign debt has since weakened the US dollar. Demand for Chinese assets has also improved with mainland China's strong recovery with the Yuan appreciating steadily since mid-May. This appreciation gives Chinese buyers additional purchasing power and therefore gives commodity markets an additional boost as the fourth quarter opens. Whether this will offset continuing weakness outside of mainland China remains to be seen.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-quiet-week-in-commodity-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-quiet-week-in-commodity-markets.html&text=Weekly+Pricing+Pulse%3a+A+quiet+week+in+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-quiet-week-in-commodity-markets.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A quiet week in commodity markets | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-quiet-week-in-commodity-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+quiet+week+in+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-quiet-week-in-commodity-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}