Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 06, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The European Central Bank convenes in a new week which also sees a barrage of official economic data releases. The latter includes US, mainland China and India inflation figures, while the UK updates its monthly GDP and labour market data. Additionally, S&P Global's Investment Manager Index and the GEP Supply Chain Volatility Index will offer valuable insights into key topics tracked by the market.

The ECB is in the spotlight amid high expectations of another rate cut. While softening price pressures have induced the market to price in two more rate cuts before the end of year, including 25 basis points for September, ambiguity over the rate path thereafter persists given the uncertainty over the inflation trajectory and recession risks. The August HCOB Flash Eurozone PMI, which offer early insights into the CPI trend, showed easing input cost growth. While output growth ticked higher, this was in part a temporary lift from the Paris Olympics, hinting at a weak underlying trend led by a deep manufacturing downturn. As such, the ECB's rhetoric regarding the outlook will be scrutinised closely.

Meanwhile a series of key official data will be updated in the week with US CPI especially closely watched ahead of the Fed meeting on September 17-18. Early PMI releases have pointed to an easing inflationary trend, and confirmation of inflation falling sustainably to target will be important to corroborate market speculation of FOMC rate cuts. Mainland China's inflation, industrial production and retail sales numbers will also be eagerly assessed to gauge the need for economic policy support.

Over in the UK, we will also be watching for July's monthly GDP figures, coming after positive growth prints were observed from PMI numbers for both July and August. Faster growth in employment was also noted for the UK since July, and wage data will be keenly assessed by the Bank of England to gauge second round inflationary pressures as UK policymakers remain cautious about further rate cuts.

Finally, we will look to the S&P Global Investment Manager Index for insights into equity market risk sentiment and views regarding market drivers. The September survey will also shed light on expectations regarding economic growth, Fed fund rates, US dollar and S&P 500 index outlooks.

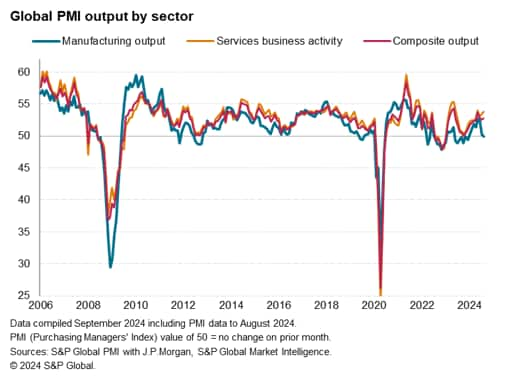

The recent weakness of manufacturing has come under the spotlight amid concerns that the goods-producing sector's decline could be a precursor to broader economic malaise.

Although only accounting for around one-tenth of GDP in most developed economies, the manufacturing sector's health carries overweight importance because of its leading indicator properties. As our chart of PMI survey output data demonstrates, a deteriorating manufacturing performance tends to be followed by a noticeable weakening of the service sector within the next six months.

Hence news of the global manufacturing PMI showing a renewed fall in manufacturing output in August raises worries about spillover effects to the service sector, which is now the main driver of global economic growth.

A broader economic slowdown is by no means certain: the manufacturing downturn may prove to be a short-lived blip as anticipated interest rate cuts help drive a revival of demand, investment, and business activity. Could this time also be different, as economies grow less reliant on manufacturing? Business trends over the summer months can also be volatile. Hence September's PMI data will be crucial in determining the near-term global growth trajectory, and especially in monitoring this interplay between goods and services.

Monday 9 Sep

Japan GDP (Q2, final)

Japan Current Account (Jul)

China (Mainland) CPI, PPI (Aug)

Taiwan Trade (Aug)

Mexico Inflation (Aug)

United Kingdom Regional Growth Tracker* (Aug)

Tuesday 10 Sep

Australia Westpac Consumer Confidence (Sep)

Malaysia Industrial Production (Jul)

Germany Inflation (Aug, final)

United Kingdom Labour Market Report (Jul)

Spain Industrial Production (Jul)

Turkey Industrial Production (Jul)

Italy Industrial Production (Jul)

Brazil Inflation (Aug)

Global GEP Supply Chain Volatility Index* (Aug)

S&P Global Investment Manager Index* (Sep)

Wednesday 11 Sep

South Korea Unemployment (Aug)

China (Mainland) M2, New Yuan Loans, Loan Growth (Aug)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Jul)

United States CPI (Aug)

Thursday 12 Sep

Australia NAB Business Confidence (Aug)

Spain Inflation (Aug, final)

Brazil Retail Sales (Jul)

India Industrial Production (Jul)

Eurozone ECB Interest Rate Decision

United States PPI (Aug)

United States Monthly Budget Statement (Aug)

Friday 13 Sep

Japan Reuters Tankan Index

Singapore Unemployment Rate (Q2, final)

Japan Industrial Production (Jul, final)

France Inflation (Aug, final)

Eurozone Industrial Production (Jul)

United States Export and Import Prices (Aug)

United States UoM Sentiment (Sep, prelim)

Saturday 14 Sep

Japan Machinery Orders (Jul)

China (Mainland) Industrial Production (Aug)

China (Mainland) Retail Sales (Aug)

China (Mainland) Unemployment Rate (Aug)

China (Mainland) Fixed Asset Investment (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: US CPI, PPI, UoM sentiment and Brazil, Mexico inflation

US CPI and PPI data for August will be released on Wednesday and Thursday respectively for a check of how official inflation data evolved ahead of the upcoming Fed meeting on 17-18 September. Softening price pressures have been outlined by the latest S&P Global Flash US PMI, which showed average prices charged for goods and services rising at the slowest rate since January 2020. The latest development is supportive of a rate cut at the September FOMC meeting and we will seek to confirm the trend with the CPI update.

Inflation updates will also be released in Brazil and Mexico.

EMEA: ECB meeting; UK GDP and labour market data; Eurozone industrial production; Germany and France inflation; Turkey industrial production

The European Central Bank (ECB) convenes for their September meeting with another rate cut on the table. This is set against a backdrop of easing inflationary pressures in the past couple of months and with the latest HCOB Flash Eurozone PMI prices data further outlining only a modest rise in average prices charged in August. While near-term rate cuts have largely been priced in, the uncertainty lies with the central bank's views regarding the inflation outlook and the terminal rate, which will be in focus in the upcoming meeting.

The UK meanwhile releases GDP data for July, in addition to employment figures. Faster expansions were observed in both the manufacturing and service sectors in July according to the S&P Global UK PMI, with more up-to-date August data further showing improvements amid solid expansions in both sectors.

APAC: China inflation, industrial production, retail sales data; Japan GDP; India inflation, industrial production

In APAC, a busy economic calendar sees the release of mainland China's inflation figures, in addition to other monthly activity data. Final Q2 GDP from Japan will also be due, while India's inflation and industrial production figures will be further highlights in the week.

Investment Manager Index and Supply Chain Volatility Index

September's S&P Global Investment Manager Index will be released on Tuesday for insights into changes in risk sentiment, expected returns and sector preferences among money managers.

Separately, the GEP Global Supply Chain Volatility Index, derived from S&P Global PMI surveys, will also be released and watched amidst recent updates of elevated shipping prices.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.