Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2023

Week Ahead Economic Preview: Week of 30 January 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy week ahead sees eagerly anticipated central bank meetings in the US, UK and eurozone accompanied by some of the most important monthly economic data releases. The latter include US labour market and eurozone inflation data as well as worldwide manufacturing and services PMIs, all of which will help assess growth and inflation conditions around the globe at the start of 2023. The week also sees updates to Q4 GDP from Germany and inflation figures from Germany, South Korea and Indonesia.

The start to 2023 had been positive so far for US equity investors with the three most widely followed indices in the US - the S&P 500, Dow Jones Industrial Average and the Nasdaq Composite - in green (as of January 25) despite lukewarm earnings performance in the early part of the earnings season. With that said, a series of economic events may test the market in the coming week, namely in the form of the first Fed meeting of 2023, the January jobs report and worldwide manufacturing and services PMI readings.

To a large extent, hopes for a more dovish Fed amid the recent softening of inflation pressures and weak business survey data have fuelled positive risk sentiment in the market. Whether this positivity can be sustained will depend to a large extent on the tone adopted in the upcoming FOMC meeting and post-meeting press conference. A 25-basis point rise in fully priced in by the markets, but more important is what comes next. Markets are pricing in the possibility of Fed rate cuts in late 2023, but the Fed has so far clearly sought to dismiss these hopes.

The Bank of England and European Central Bank are meanwhile both expected to raise rates by 50 basis points. Despite falling demand plaguing growth for both economies, still elevated inflation rates continue to force the hand of central bankers, with the hawks encouraged further by diminished recession risks, as suggested by PMI data in the eurozone and, to a lesser degree, the UK.

Finally, worldwide manufacturing and services figures will provide a comprehensive overview of economic conditions in January, especially in Asia and notably mainland China, where COVID-restrictions have been recently eased. All of which will carry event risks in the coming week.

Flash PMIs signal reduced recession risks

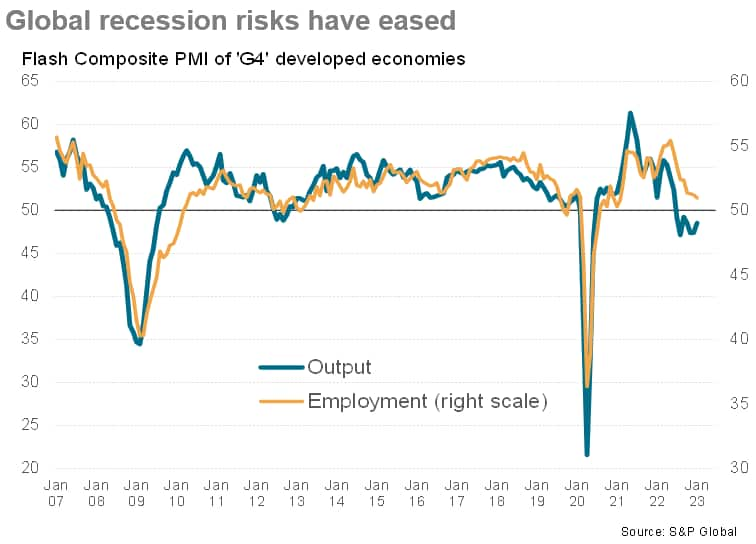

Ahead of the publication of final worldwide PMI data for manufacturing and services in the week ahead, some encouragement came from the flash PMI numbers. Across the four major developed economies, output continued to contract on average (see chart) but at a slower rate than in December. The eurozone even staged a marginal return to growth. Forward looking indicators such as new orders and business expectations were on the whole even more encouraging.

Recession risks have therefore eased considerably since the dark days of the autumn, when soaring gas prices threatened to hit consumption in Europe while mainland China remained heavily locked down by COVID-19 restrictions and inflation rates were continuing to rise. In the UK, a botched fiscal budget had added to market stress. Since then, all of these factors have reversed, helping buoy markets and stem the downturns in global demand and economic activity.

Also encouraging is the fact that, despite the drop in output recorded by the flash PMIs, employment continues to rise, albeit at a much-reduced rate compared to a year earlier, as firms continue to seek staff to fill long-held vacancies. The big question is the extent to which this labour market resilience persists and helps sustains strong wage growth in spite of slower economic growth, which will of course be hawkish from a central bank perspective.

Key diary events

Monday 30 January

New Zealand Trade (Dec)

Germany GDP (Q4, flash)

United Kingdom Nationwide House Price (Jan)

Tuesday 31 January

South Korea Industrial Output and Retail Sales (Dec)

Japan Unemployment Rate (Dec)

Japan Industrial Output and Retail Sales (Dec)

Australia Retail Sales (Dec)

China (Mainland) NBS Manufacturing PMI (Jan)

Thailand Manufacturing Production (Dec)

Germany Import Prices (Dec)

Germany Retail Sales (Dec)

Thailand Current Account (Dec)

Switzerland Retail Sales (Dec)

Taiwan Export Orders (Dec)

United Kingdom Mortgage Lending and Approvals (Dec)

Eurozone GDP (Q4, flash)

Germany HICP (Jan, flash)

Canada GDP (Nov)

United States Consumer Confidence (Jan)

Wednesday 1 February

Malaysia Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jan)

New Zealand Labour Cost Index (Q4)

Taiwan Industrial Output (Dec)

Eurozone HICP (Jan, flash)

Eurozone Unemployment Rate (Dec)

United States ADP National Employment (Jan)

United States ISM Manufacturing PMI (Jan)

United States JOLTS Job Openings (Dec)

Indonesia Inflation (Jan)

United Kingdom Halifax House Prices* (Jan)

United States Fed Funds Target Rate (1 Feb)

Thursday 2 February

South Korea CPI (Jan)

Australia Building Approvals (Dec)

Germany Trade Balance (Dec)

United Kingdom BOE Bank Rate (Jan)

Eurozone ECB Deposit Rate (Feb)

United States Initial Jobless Claims

United States Factory Orders (Dec)

Friday 3 February

Worldwide Services, Composite PMIs, inc. global PMI* (Jan)

Hong Kong Retail Sale (Dec)

Norway Unemployment (Jan)

Eurozone Producer Prices (Dec)

United States Non-Farm Payrolls, Unemployment Rate, Average Earnings (Jan)

United States ISM Non-manufacturing PMI (Jan)

United Kingdom Reserve Assets (Jan)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Worldwide manufacturing and services PMI data

Worldwide manufacturing and services PMI data due next week will provide the first look into global economic conditions at the start of 2023. This follows the flash figures from major developed economies including the US and eurozone which saw diverging indications whereby the eurozone found recession risks to be fading while the US saw added recession signals. UK flash PMI data likewise pointed to steeper declines at the start of year.

Meanwhile Japan saw its private sector return to growth at the start of 2023 while demand growth was renewed in Australia, suggesting better conditions in APAC which we will be studying with the full set of PMI data from the region at the start of February. Mainland China PMI data will be the most anticipated after shallower declines were observed in December with the easing of restrictions.

Americas: Fed FOMC meeting, US January jobs report, Canada GDP

The US Federal Open Market Committee (FOMC) meets amid the consensus pointing to a 25 basis points (bps) hike. Post-meeting comments from Fed chair Jerome Powell will be the highlight, however, eyed for further guidance on the Fed's path in 2023. Meanwhile January's non-farm payrolls, unemployment rate and wage growth figures will be due for insights into the labour market which have been the Fed's focus amid concerns over wage growth's contribution to overall inflation. Indications from the S&P Global Flash US Composite PMI suggested that the labour market remains tight in the US, though the pace of jobs growth has slowed.

Europe: BoE, ECB meetings, Germany Q4 GDP, CPI, eurozone CPI

The Bank of England and European Central Bank meet to set monetary policy rates with both central banks expected to lift rates by 50 bps according to consensus.

On the data front, besides PMI data, Germany's Q4 GDP will be released while inflation figures from both Germany and the eurozone are keenly anticipated.

Asia-Pacific: South Korea and Indonesia CPI

In APAC, we will be seeing inflation figures updated from South Korea and Indonesia. That said, the focus is expected to be with the January PMI data from mainland China and rest of Asia after China's easing of COVID-19 restrictions.

Special reports:

US January's Flash PMI Data Add to Recession Signals - Chris Williamson

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-january-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-january-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+30+January+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-january-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 30 January 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-january-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+30+January+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-january-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}