Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2023

Global factory downturn shows signs of easing as China re-opens

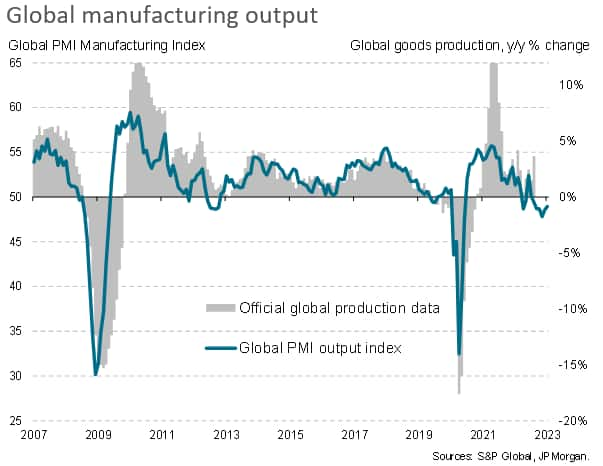

Global manufacturing output fell for a sixth successive month in January, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, but the rate of decline showed welcome signs of moderating for a second successive month.

Encouraging signals were also sent via a cooling in the rate of loss of order books and a marked improvement in business confidence about prospects for the year ahead. Sentiment was buoyed in particular by the news of China relaxing its COVID-19 containment measures.

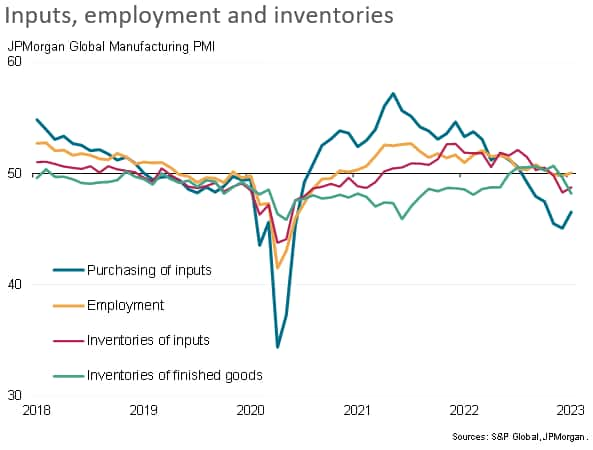

Producers nevertheless remained cautious about the outlook, keeping staffing levels largely unchanged and continuing to focus on inventory reduction policies in order to manage overheads, underscoring how the business environment remains challenging and that a resumption of robust growth is by no means assured.

Global factory output downturn moderates

The global manufacturing downturn showed signs of easing at the start of 2023, according to the latest PMI surveys compiled by S&P Global. At 49.1, the JPMorgan Global Manufacturing PMI remained below the 50.0 threshold which separates contraction from expansion, but by rising from 48.7 in December, the PMI registered a moderating rate of deterioration.

Moreover, the PMI survey's Output Index, which acts as an especially reliable advance indicator of actual worldwide factory production trends, signalled a second successive month of slower decline, moving up to its highest since last August to add to signs that the global manufacturing downturn peaked in November.

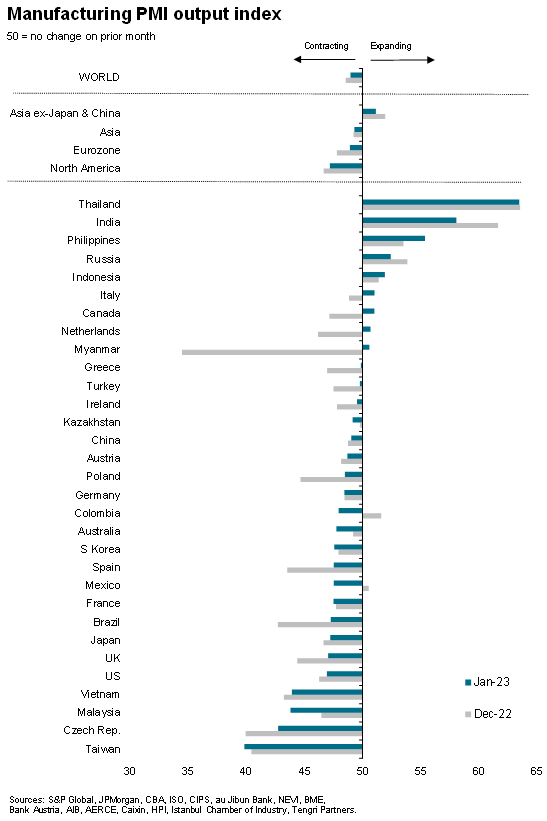

Any pockets of growth were largely confined to Asia, with Thailand, India and the Philippines leading the pack in January and with Indonesia also enjoying a solid expansion while Myanmar reported a small uptick. However, modest growth was also seen in Russia, Italy, Canada and the Netherlands.

Although, some of the steepest downturns were also recorded in Asia, with Taiwan leading the global contraction and Malaysia and Vietnam both also reporting especially steep contractions. Asia excluding mainland China and Japan was again the only major trading block to report manufacturing growth in January.

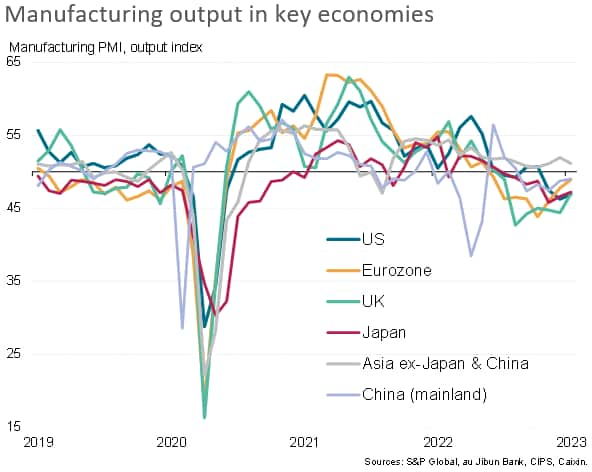

Encouragingly, however, downturns eased in the other major economies, including in the US, Eurozone, UK, Japan and mainland China to add to signs that the worst of the current manufacturing weakness has passed.

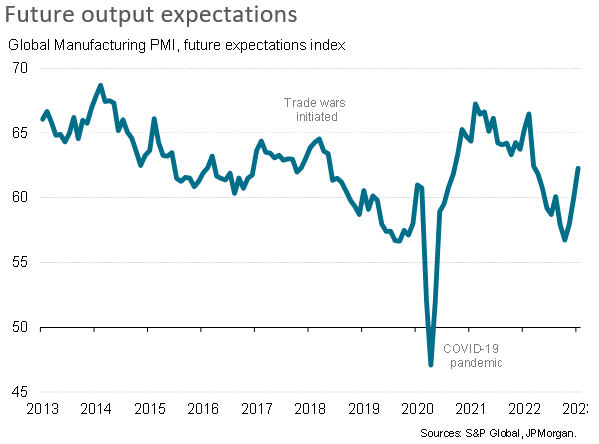

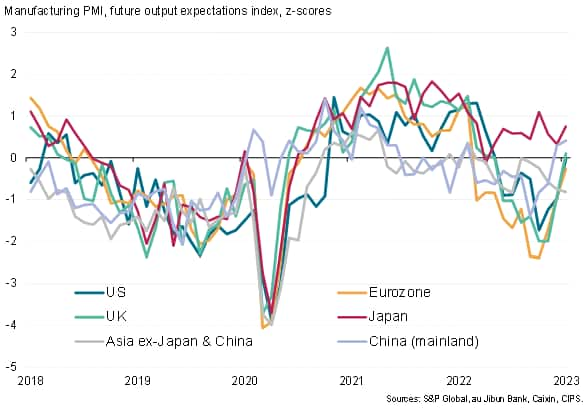

Future expectations hit 10-month high

Further evidence of a turning point was provided by the survey's subindices. In particular, new orders fell at the slowest rate since last August, reflecting a cooling of the pace at which demand for manufactured goods is falling.

However, even more encouraging was a third successive monthly improvement in business optimism about the year ahead. Confidence is consequently now running at its highest since March of last year.

Key to other improvement in business expectations about the year ahead was the reopening of China's economy. Not only did the removal of COIVID-19 restrictions lift optimism in the Chinese mainland's manufacturing sector to the highest since April 2021, but the surveys saw widespread reports of the re-opening of the Chinese economy to have lifted growth expectations in many other economies, including helping expectations hit an 11-month high in the eurozone, an eight-month high in the US, and a three-month high in Japan. Interestingly, sentiment slipped slightly in the rest of Asia, in part reflecting expectations of some possible loss of export business as trade from China revives.

Ongoing caution

Despite the slower rate of loss of new orders and improvement in business optimism, January saw signs of continued caution from manufacturers worldwide, notably in respect to a further steep drop in purchasing of inputs, ongoing inventory reduction policies, and a sustained reluctance to hire workers.

Any material change in this cautious stance observed across manufacturing will require demand conditions to further improve. While China's reopening is likely to provide a welcome boost to demand, reviving demand also needs to be seen in the developed world, notably in the US and Eurozone which, so far, remains subdued.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-downturn-shows-signs-of-easing-as-china-reopens-feb-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-downturn-shows-signs-of-easing-as-china-reopens-feb-2023.html&text=Global+factory+downturn+shows+signs+of+easing+as+China+re-opens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-downturn-shows-signs-of-easing-as-china-reopens-feb-2023.html","enabled":true},{"name":"email","url":"?subject=Global factory downturn shows signs of easing as China re-opens | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-downturn-shows-signs-of-easing-as-china-reopens-feb-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+downturn+shows+signs+of+easing+as+China+re-opens+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-downturn-shows-signs-of-easing-as-china-reopens-feb-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}