Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 30, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

August US labour market report will be the data highlight in the lead up to the September FOMC meeting, while the Bank of Canada may lower rates again ahead of the Fed meeting. Additionally, worldwide manufacturing and services PMI will shed light on growth, inflation and supply chain conditions following the flash PMI update.

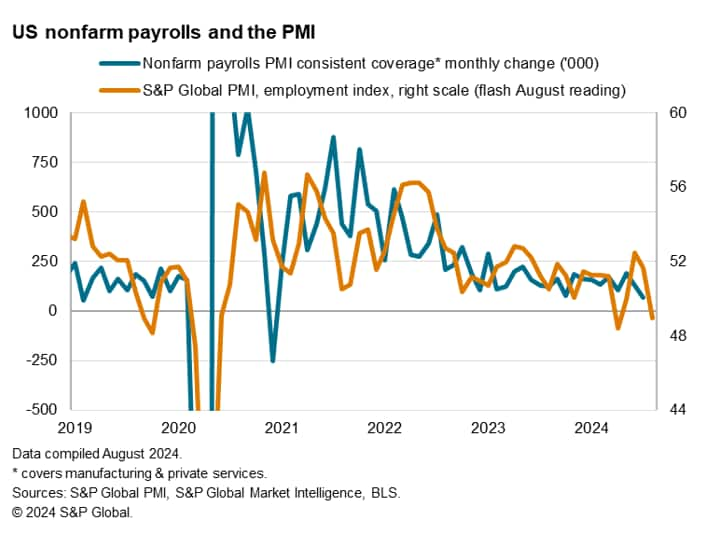

US employment market data for August will be eagerly anticipated at the start of September for clues regarding the interest rate path. The data follow Jackson Hole comments from Fed chair Jerome Powell that interest rates are expected to be lowered from September if the data come in as expected. With the Fed's focus on supporting the job market, any surprises on the downside may spur the market to speculate for a bigger September cut or extended rate reductions in the months to follow. As far as US flash PMI data have shown, a decline in the employment index in August hints at a lower reading for payrolls, while softening price pressures also suggest an absence of further wage pressures, which is in line with the latest estimates.

Meanwhile central bank monetary policy meetings are expected to unfold in Canada and Malaysia, with the Bank of Canada (BoC) expected to lower rates again in September as inflationary pressures eased. Furthermore, with the Fed looking set to commence their rate cut cycle in September, the BoC may well proceed with lessened risk of rates moving too far ahead of the US.

Worldwide releases of August manufacturing, services and detailed sector data will also be closely watched for insights into growth trends, assessing if the uneven sectoral growth pattern seen across developed nations in flash data extends to the rest of world. More importantly, inflation trends will be key to watch being the determinants of global interest rates. Additionally, supply chain conditions will be scrutinised amid sustained disruptions in the Red Sea, which contributed to a worsening of trade conditions earlier in July.

In APAC, besides tracking regional performance in August via the PMI data, key official data releases include Australia's Q2 GDP and mainland China's trade data over the weekend.

With markets eager to assess scope for the FOMC to cut US interest rates at its September meeting, the monthly nonfarm payroll report for August will provide a major clue. The Fed has clearly signalled a shift in its policy stance towards supporting the employment aspect of its remit, bringing heightened focus to the job market data.

This policy focus pivot is supported by the recent PMI data, which showed inflation pressures further abating. Most notably, barring only a blip lower in January, flash PMI data for August showed the slowest rise in prices charged by service providers since inflation picked up in the sector back in June 2020. Meanwhile, however, the flash PMI data showed employment falling across manufacturing and services for the third time in the past five months. This represents the weakest spell of jobs growth since the early pandemic months.

One word of caution: it's clear that weaker hiring in manufacturing reflected a reaction to sluggish sales, but employment fell in the service sector often due to labour shortages. The latter would reflect a tight labour market. Hence wage data will also be important to watch on Friday, and could temper the Fed's enthusiasm for aggressive rate cuts.

Monday 2 Sep

US, Canada, Vietnam Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (2-3 Sep)

Australia Building Permits (Jul, prelim)

Indonesia Inflation (Aug)

United Kingdom Nationwide Housing Prices (Aug)

Turkey GDP (Q2)

Italy GDP (Q2, final)

Tuesday 3 Sep

South Korea Inflation (Aug)

Switzerland Inflation (Aug)

Switzerland GDP (Q2)

Turkey Inflation (Aug)

South Africa GDP (Q2)

Brazil GDP (Q2)

United States ISM Manufacturing PMI (Jul)

Wednesday 4 Sep

Worldwide Services, Composite PMIs, inc. global PMI* (3-4 Sep)

Australia GDP (Q2)

Brazil Industrial Production (Jul)

Canada Trade (Jul)

US Trade (Jul)

Canada BoC Interest Rate Decision

United States JOLTs Job Openings (Jul)

United States Factory Orders (Jul)

United States Fed Beige Book

Thursday 5 Sep

South Korea GDP (Q2, final)

Philippines Inflation (Aug)

Australia Trade (Aug)

Thailand Inflation (Aug)

Germany Factory Orders (Jul)

Malaysia BNM Interest Rate Decision

Eurozone HCOB Construction PMI* (Aug)

United Kingdom S&P Global Construction PMI* (Aug)

Eurozone Retail Sales (Jul)

United States ADP Employment Change (Aug)

United States ISM Services PMI (Aug)

S&P Global Sector PMI* (Aug)

Friday 6 Sep

Brazil Trade (Aug)

Australia Home Loans (Jul)

Germany Trade and Industrial Production (Jul)

United Kingdom Halifax House Price Index* (Aug)

Eurozone GDP (Q2, 3rd est.)

Canada Unemployment Rate (Aug)

United States Non-Farm Payrolls, Unemployment Rate and Average Hourly Earnings (Aug)

Saturday 7 Sep

China (Mainland) Trade (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide manufacturing and services PMI releases

August PMI data, including manufacturing, services and composite figures, will be due across the globe at the start of September. Following indications of faster, but uneven, developed world expansion in August according to flash PMI, worldwide releases will be watched for detailed developments across all regions. Sector PMI data will also be updated, shedding light on which are the key growth industries midway through the third quarter of 2024.

Americas: US labour market report, ISM PMI data, BoC meeting, Canada trade and employment data

In the US, August non-farm payrolls, the unemployment rate and wage growth data will be released at the end of the week. This will be the final labour market report due prior to the September Fed meeting where Fed chair Jerome Powell has indicated interest rates will likely be cut. According to consensus, job additions are expected to lessen compared to July, with August flash US PMI data having alluded to a falling employment trend, which - alongside easing price pressures - is supportive of the Fed's upcoming move.

Additionally, we will also see the release of ISM PMI data and final S&P Global US PMI figures.

The Bank of Canada meanwhile convenes Wednesday with another rate cut on the table. Trade and employment data out of Canada are also anticipated in the week.

EMEA: Eurozone Q2 GDP, retail sales, Germany trade, Switzerland, Turkey GDP and CPI

Besides the detailed PMI data, releases to watch for Europe in the coming week include a third estimate of eurozone Q2 GDP, retail sales and German trade figures. The UK also updates housing prices data for August via the release of the Halifax and nationwide house price indices.

August HCOB Flash Eurozone PMI data revealed that the eurozone economy avoiding a downturn in August, though trade conditions remained subdued, including in Germany.

APAC: Australia, South Korea GDP, BNM meeting, China trade data, South Korea, Indonesia, Philippines inflation

In APAC, detailed PMI data will offer the earliest insights into growth conditions in the region. Official data to watch include GDP from Australia and South Korea. Meanwhile Malaysia's central bank, the Bank Negara Malaysia, updates monetary policy settings though no changes are expected as of yet.

Additionally, trade data from mainland China will be due over the weekend post the release of Caixin PMI in the week. Inflation numbers from South Korea, Indonesia and Philippines will also be updated.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.